If you've invested in a Roth 401(k) at work and are leaving your job, you may want to do a Roth 401(k) rollover. A Roth 401(k) rollover allows you to move your money from your current retirement account to a new retirement plan without any immediate tax consequences as long as you follow certain rules.

Because Roth 401(k) contributions are made with after-tax dollars, Roth 401(k)s must be rolled over to either a Roth IRA or a new employer's Roth 401(k) (if that employer offers one).

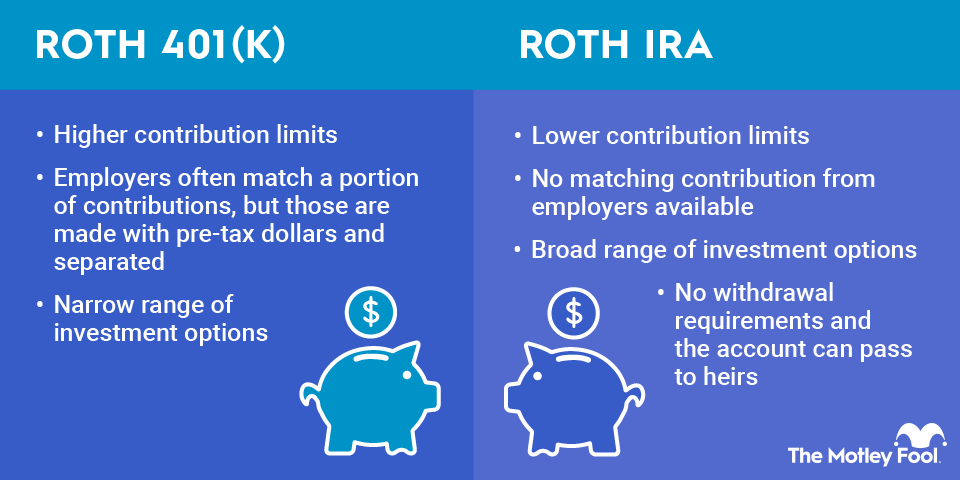

Rolling over your funds means you won't have to worry about managing an account held with an old employer. And, if you roll over into a Roth IRA, you will generally have more investment options than with a Roth 401(k) as well as more flexibility when you take money out of your retirement account later.

Rolling your Roth 401(k) over to a Roth IRA

Rolling over a Roth 401(k) to a Roth IRA is often the best option when you leave your job. This can be the right choice because:

- Roth 401(k) accounts aren't as common as traditional accounts, and your new employer may not offer a Roth 401(k) you can move your money into.

- You'll have your choice of brokerage firms, so you can open your Roth IRA wherever you're comfortable investing.

- You'll almost always have more investment options in a Roth IRA. Most Roth 401(k) accounts offer a limited choice of investments, but a Roth IRA allows you to invest in virtually any stock, bond, or fund.

Rolling over a Roth 401(k) to a Roth IRA enables you to retain the tax benefit these accounts provide, which is the ability to withdraw money tax-free as a retiree as long as you've followed certain rules. You also avoid any tax penalties that could result if you withdraw but don't roll over money from your Roth IRA when leaving your job before you are 59 1/2.

Note that neither account has required minimum distributions (RMDs). Prior to 2024, Roth 401(k)s had RMDs.

Fortunately, rolling over funds from a Roth 401(k) to a Roth IRA can be very simple. You'll need to open a Roth IRA with a brokerage of your choosing and contact your 401(k) plan administrator to arrange a transfer of funds to your new account. This is called a trustee-to-trustee transfer, and it reduces the potential for tax consequences.

If you don't do a trustee-to-trustee transfer but instead have the money from your Roth 401(k) sent to you, you'll need to redeposit it into your Roth IRA within 60 days to avoid early withdrawal penalties.

Rolling over from a traditional 401(k)

If you currently have a traditional 401(k) and want to convert it to a Roth 401(k), you also may have the option to do that. But it's important to understand the tax implications of this type of rollover.

You contribute to a traditional 401(k) with pre-tax funds and are taxed on withdrawals as ordinary income after age 59 1/2 (before then, you'll also incur a 10% early withdrawal penalty under most circumstances). However, when you contribute to a Roth 401(k), you contribute with after-tax dollars but can take tax-free withdrawals.

Because of the different tax rules, rolling over money from a traditional to a Roth 401(k) has tax consequences, with converted funds classified as taxable income. This can increase the amount of income taxes you owe the IRS in the year the conversion takes place.

However, while you may get a large IRS tax bill, this can make sense in some situations. You may wish to convert a traditional 401(k) to a Roth 401(k) under the following circumstances:

- You're in a lower tax bracket now than you expect to be in retirement: If this is the case, you'll owe less tax on the converted funds at your current low tax rate than you'd otherwise pay when taking taxable distributions from a traditional 401(k) as a retiree.

- You want to minimize taxes on Social Security: Distributions from a Roth 401(k) aren't considered "countable" income when you're determining if a portion of your Social Security benefits will be taxed.

Converting a traditional 401(k) to a Roth 401(k) is simple -- you'll just need to complete some paperwork to request the transfer of funds.

However, you'll want to make sure you have money available outside of your retirement account to pay the taxes due as a result of the conversion. Otherwise, you could be forced to make an early withdrawal, which may be subject to a 10% penalty.

Pros and cons of rolling over your 401(k)

Here are some of the biggest benefits of rolling over your Roth 401(k) to a Roth IRA:

- You can get access to more investment options than your workplace plan likely offers.

- You can preserve the tax benefits a Roth account offers.

- Converted amounts don't count toward annual Roth IRA contribution limits.

- You can consolidate with other Roth IRA accounts.

- You won't have to worry about your 401(k) getting lost if you leave it with an old employer or moving the money again if you switch to a new employer's account and then leave the new job.

Here are some of the biggest disadvantages:

- You'll usually have to sell your investments to roll over your account.

- If you're opening a new Roth IRA to roll the funds into, you may have to wait five years from the time you open the account to be able to take tax-free withdrawals.

Distribution rules

Because Roth 401(k)s are tax-advantaged accounts, they're subject to special rules for when money can be withdrawn. Unlike a Roth IRA, which always allows you to withdraw contributions tax and penalty-free, the rules are a bit different for Roth 401(k)s.

If you take early Roth 401(k) distributions, the amount you withdraw is prorated between after-tax contributions and taxable gains. The gains portion is subject to income taxes and a 10% penalty unless you're 59 1/2 and follow the five-year rule. The five-year rule mandates the first contribution to the account must occur five or more tax years prior to the first distribution to avoid penalties.

The five-year rule can sometimes get you into trouble when you're doing a rollover. If you had your Roth 401(k) open for long enough to fulfill the requirement but only recently opened the Roth IRA you rolled your funds into, you would not meet the five-year rule after moving your money over.

If you anticipate rolling over money from a Roth 401(k) to a Roth IRA, be sure to open the Roth IRA early and make a contribution to it so you are not subject to a long waiting period before you can take a penalty-free distribution after moving your 401(k) funds over.