If you're self-employed or own a very small business, then a SEP IRA can be a great way to save for retirement. SEP stands for simplified employee pension, and IRA stands for individual retirement account. A simplified employee pension plan confers many of the same benefits of a 401(k) plan but without nearly as much administrative hassle.

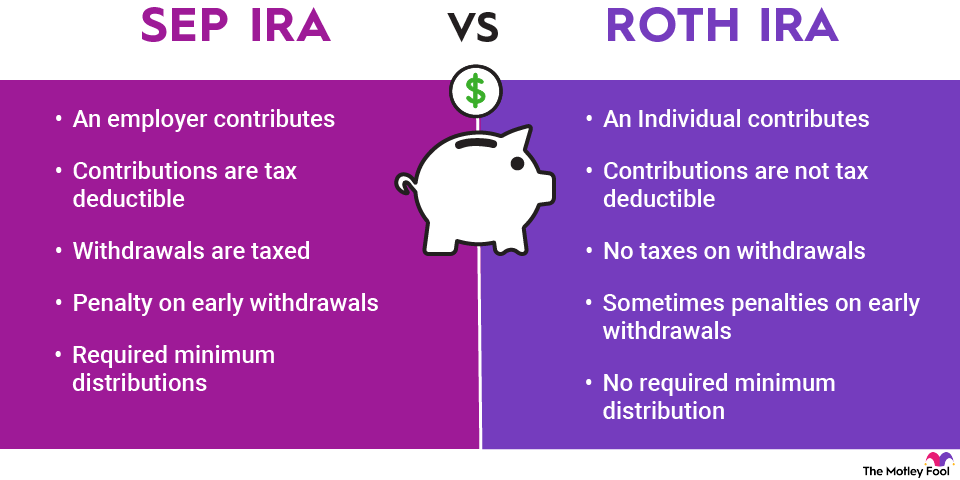

A SEP IRA is similar to a regular IRA in that it's a tax-deferred account. With a traditional SEP IRA, you are only taxed when you withdraw money, and for any withdrawals that occur before you reach age 59 1/2, you also pay a 10% penalty on the amount withdrawn. You can also choose a Roth SEP IRA that's funded with post-tax money and take tax-free withdrawals in retirement.

Only employers can establish SEP IRAs, so if you're funding a SEP IRA, then you're technically doing so as your own employer. SEP IRAs are best suited for the self-employed or for small businesses with very few employees since employers must contribute equally to their own SEP IRAs and those of their eligible employees.

SEP IRA contribution limits

Your maximum contribution limit for a SEP IRA is the lower of these two amounts:

- 25% of your salary

- $70,000 in 2025 and $72,000 in 2026

If you have employees who meet certain criteria, you must calculate the percentage of your salary you contribute to your own SEP IRA and contribute that same percentage of your employees' salaries to their SEP IRAs. Eligible employees are those who:

- Are age 21 or older

- Have worked for you for at least three of the past five years

- Have earnings of at least $750 in 2025 and 2026

- SEP IRA contribution limits for 2025 and 2026

Type | Minimum contribution | 2025 maximum contribution | 2026 maximum contribution |

|---|---|---|---|

Employees | $0 | $0 | $0 |

Employers | No dollar-amount minimum; percentage parity required between employer and employee contributions | Lesser of 25% of salary or $70,000 | Lesser of 25% of salary or $72,000 |

Self-employed | $0 | Usually the lower of ~20% of gross income or $70,000 | Usually the lower of ~20% of gross income or $72,000 |

S corporation | No dollar-amount minimum; percentage parity required between employer and employee contributions | Lesser of 25% of salary or $70,000 | Lesser of 25% of salary or $72,000 |

You can still contribute to a SEP IRA if you have a traditional or Roth IRA, but catch-up contributions -- which raise maximum contribution limits for older investors nearing retirement -- are not permitted. If your business sponsors another retirement plan, like a 401(k) or a profit-sharing plan, then your total contributions to all employer-sponsored investment accounts still can't exceed $70,000 in 2025, or $72,000 in 2026.

The maximum contribution limits for SEP IRAs are significantly higher than those associated with traditional IRAs and Roth IRAs, which makes them an attractive option for the self-employed.

How to calculate your SEP IRA contribution

If you pay yourself a salary using a IRS W-2 form, then calculating your maximum allowed SEP IRA contribution is easy. If you're self-employed or a freelancer and don't pay yourself a salary, then determining your maximum allowed SEP contribution is a bit more complicated, but it tends to equal a little less than 20% of your gross income.

Using a W-2 salary number, determine your maximum allowed contribution by multiplying your salary by 25%. For 2026, the contribution limit is the lesser of that number or $72,000. Remember that you must contribute the same amount on a percentage-of-salary basis to the SEP IRA of every eligible employee.

People who are self-employed and receive income on a contract basis can approximate their salaries by calculating their net income from self-employment. Your net self-employment income equals your gross income minus your business-related expenses, which include any costs of doing business and self-employment taxes. Multiply your net self-employment income by 25% to determine your maximum allowed SEP IRA contribution limit. In most cases, your maximum allowed contribution equates to slightly less than 20% of your gross income. Your contribution can't exceed $70,000 in 2024, or $72,000 in 2025.

Contribution percentages, provided that yours and your employees' match, are allowed to vary from year to year. If you're having a tough year, you can contribute 0%.

When is the SEP IRA contribution deadline?

The annual deadline for SEP IRA contributions is tax day, which is generally April 15. You have until April 15 every year to contribute up to the maximum permissible amount to your SEP IRA for the prior year.

The biggest drawback of a SEP IRA

The biggest drawback of a SEP IRA, for employers, is the requirement that percentage-of-salary contributions for employers match those of employees. Of course, if you don't have any employees, that disadvantage is irrelevant. It is also less problematic if you have very few employees, low-paid employees, or no employees who meet the eligibility requirements.

Is a SEP IRA right for you?

Whether a SEP IRA is right for you depends largely on the nature and size of your business. Assuming you don't have a large number of eligible employees, SEP IRAs can be attractive because they are simple and allow you to invest in a wide range of securities.

Unlike 401(k) plans, SEP IRAs are administratively easy to establish and maintain. Most financial institutions have streamlined procedures, which include completing IRS Form 5305-SEP, to open SEP IRA accounts. Once you create individual accounts for yourself and your employees, each person is responsible for managing their own account.

Furthermore, with a SEP IRA, you can buy and sell a range of investments typically much wider than what is offered by other employer-sponsored plans -- another benefit attractive to many investors.