How the 10 Biggest IPOs of 2019 Performed During COVID-19

How the 10 Biggest IPOs of 2019 Performed During COVID-19

In with a bang

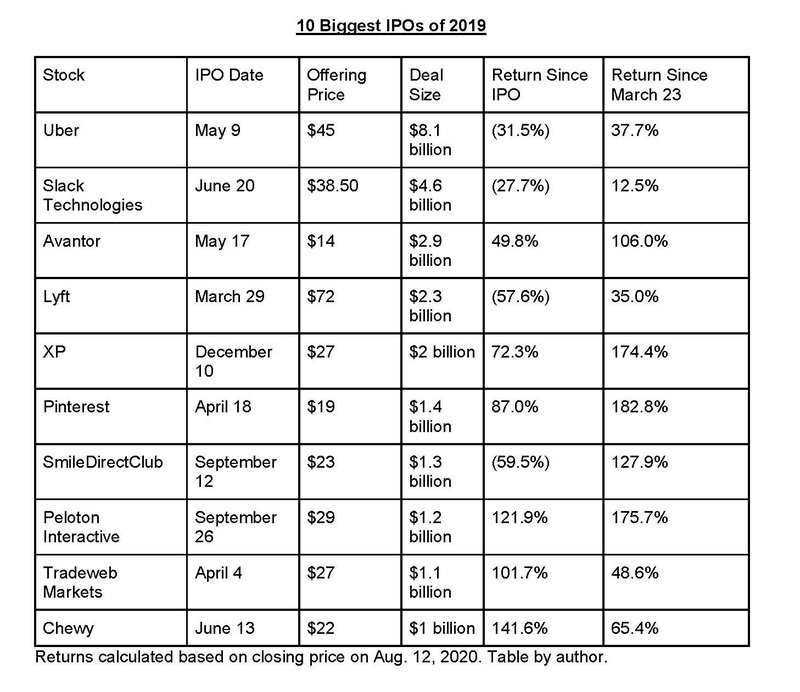

There were just 159 initial public offerings in 2019, the fewest since 2016, though the $46 billion they raised was even with what was produced the year before.

While the IPO market took some time to get going, it began to pick up speed in the second quarter until some high-profile flameouts happened and one of the most-anticipated IPOs, WeWork, fell apart.

Then there was Luckin Coffee, which did make it to market and even made a big splash on its debut, but it subsequently collapsed amid accusations of fraud and was eventually delisted -- all in less than a year.

There were nine IPOs that raised a billion dollars or more in 2019, and one that took the direct listing route. Here is how they've fared since the coronavirus pandemic sank the market in March.

5 Winning Stocks Under $49

We hear it over and over from investors, “I wish I had bought Amazon or Netflix when they were first recommended by the Motley Fool. I’d be sitting on a gold mine!” And it’s true. And while Amazon and Netflix have had a good run, we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Simply click here to learn how to get your copy of “5 Growth Stocks Under $49” for FREE for a limited time only.

Previous

Next

1. Uber Technologies

Ride-sharing app Uber Technologies (NYSE: UBER) was the biggest U.S. IPO of 2019, with a deal size worth $8.1 billion, but it soon ran into trouble as its growth potential seemed limited and more competition was entering the market.

It's failed to spark much enthusiasm since and though shares have jumped 38% since the market's low on March 23, it remains 32% below its $45 offer price back on May 10, 2019.

Previous

Next

2. Slack Technologies

Workplace communications and messaging platform Slack Technologies (NYSE: WORK) was the second-biggest debut of a company last year, with a $4.6 billion deal, but rather than a traditional IPO, it chose to go the direct listing route, which lets company insiders, employees, and early investors bypass financial institutions and sell their shares directly to the market.

Almost immediately, though, investors became concerned about competition from Microsoft's (Nasdaq: MSFT) competing Teams platform and it has not regained its $38.50 offer price, trading about 28% below that threshold. Its stock crashed along with the market back in March to around $15 a stub, but it has since regained 12.5% and now trades at around $28 per share.

Previous

Next

3. Avantor Inc

Avantor (NYSE: AVTR) is a company that specializes in medical and laboratory instruments, but it was another of the richly-priced IPOs that subsequently worried investors because of its history of generating losses.

It went public in May at $14 a share in a $2.9 billion offering and was on an up-and-down ride as the market tried to determine whether it would be viable or not. Like almost all other stocks, it cratered hard during the pandemic, falling below $7 a stub, before mounting a strong comeback. Avantar has more than doubled in value from those dark days, and is up 50% since its IPO.

Previous

Next

4. Lyft

Uber rival Lyft (Nasdaq: LYFT) was the first unicorn to go public in 2019, debuting in at the end of March at $72 a share and raising $2.3 billion. Yet like Uber, it remains plagued by concerns over competition, regulation, and whether it can effectively grow, so while it's stock is up 35% from its March lows, the stock is 58% below its IPO price.

Previous

Next

5. XP Inc.

Brazilian fintech XP (Nasdaq: XP) was the last unicorn to go public last year, raising $2 billion with a $27 share offering, but it wasn't long before it was running into trouble that had nothing to do with COVID-19.

An analyst alleged the company failed to notify investors before its IPO of financial improprieties. While XP refuted the claims, its stock was falling hard and fast before the coronavirus outbreak was declared a pandemic.

They've recovered smartly since then as the market shrugged off concerns about irregularities at the business, and where XP now trades 72% above its IPO price, it stands more than 170% above the market's March nadir.

5 Winning Stocks Under $49

We hear it over and over from investors, “I wish I had bought Amazon or Netflix when they were first recommended by the Motley Fool. I’d be sitting on a gold mine!” And it’s true. And while Amazon and Netflix have had a good run, we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Simply click here to learn how to get your copy of “5 Growth Stocks Under $49” for FREE for a limited time only.

Previous

Next

6. Pinterest

Pinterest (NYSE: PINS) was among that class of IPOs that debuted during the second-quarter bloom, and while it was able to raise $1.4 billion by selling 75 million shares at $19 each, it did itself no favors by issuing its first earnings report as a publicly traded company that showed it lost three times more money than expected.

It traded below its IPO price for a good part of the year, then fell further in March. However, it has rebounded since then and shot up at the end of July following a blowout earnings report. Shares are trading 87% higher than its IPO, but it has become the best performer of the post-pandemic bottom with its stock up 183%.

Previous

Next

7. SmileDirectClub, Inc

If Pinterest was one of those stocks that debuted in the first flush of IPOs last year, SmileDirectClub (Nasdaq: SDC) was one that appeared after the summer lull. But it's still a ne'er-do-well as its stock is down 60% from its $23 per share offering.

The maker of discount clear dental aligners hasn't impressed the market with its sales, and its just-reported second quarter earnings show it has a difficult time in front of it dealing with reduced demand during a pandemic. While it had made gains from March with the stock doubling in value, it cratered once again after the financial report was released.

Previous

Next

8. Peloton Interactive

Home fitness leader Peloton (Nasdaq: PTON) went public just two weeks after SmileDirectClub, but its business has shown surprising resilience during the crisis. Turns out when people are forced to stay home with nothing to do, working on beach bodies was a fine way to take minds off the world's problems.

Peloton raised $1.2 billion offering 40 million shares at $29 a piece, and it has been one of the best performers of the 2019 class of IPOs returning 122% from its IPO as the market is excited about its new line of connected fitness equipment as well as its membership classes that don't require a user to buy a pricey stationary bike or treadmill. Shares are up 176% since March.

Previous

Next

9. Tradeweb Markets Inc

Tradeweb Markets (Nasdaq: TW) is an electronic securities exchange operator for banks, investment houses, hedge funds, and other institutions that is benefiting from the volatility the coronavirus pandemic is causing. Just like other exchanges and brokerages, the more people trade, the more money it makes.

It went public early last year at $27 a share, and while its stock tumbled just like everyone else in March, it never dipped below its IPO price. Shares have doubled since then, and they've climbed almost 50% from their recent lows.

Previous

Next

10. Chewy

Pet supplies retailer Chewy (NYSE: CHWY) was the smallest of the unicorns to go public last year, raising just over $1 billion in its summer doldrums offering. Spun off from PetSmart, it offered its shares at $22 a pop, and though initially there were concerns about its ability to compete on its own against Amazon.com (Nasdaq: AMZN) and its Wag.com site, it has since gone on to prove it can run with the big dogs.

Shares of Chewy are up over 140% from the original offering, and though its stock fells as low as $20 per share in March, it's gained 65% since then.

5 Winning Stocks Under $49

We hear it over and over from investors, “I wish I had bought Amazon or Netflix when they were first recommended by the Motley Fool. I’d be sitting on a gold mine!” And it’s true. And while Amazon and Netflix have had a good run, we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Simply click here to learn how to get your copy of “5 Growth Stocks Under $49” for FREE for a limited time only.

Previous

Next

Still a healthy bunch

Of the 10 stocks that raised over $1 billion from the public debut in 2019, six of them are recording gains for investors. Every one of them has gained since the market crash in March, but fully half of them have doubled in value since then.

If you were among those investors that didn't panic during the rout, but instead saw it as a buying opportunity, it's likely you're doing quite well for yourself at the moment.

John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Teresa Kersten, an employee of LinkedIn, a Microsoft subsidiary, is a member of The Motley Fool’s board of directors. Rich Duprey has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Amazon, Microsoft, Peloton Interactive, Pinterest, and Slack Technologies. The Motley Fool recommends Chewy, Inc. and Uber Technologies and recommends the following options: long January 2021 $85 calls on Microsoft, short January 2021 $115 calls on Microsoft, short January 2022 $1940 calls on Amazon, and long January 2022 $1920 calls on Amazon. The Motley Fool has a disclosure policy.

Previous

Next

Invest Smarter with The Motley Fool

Join Over Half a Million Premium Members Receiving…

- New Stock Picks Each Month

- Detailed Analysis of Companies

- Model Portfolios

- Live Streaming During Market Hours

- And Much More

READ MORE

HOW THE MOTLEY FOOL CAN HELP YOU

-

Premium Investing Guidance

Market beating stocks from our award-winning service

-

The Daily Upside Newsletter

Investment news and high-quality insights delivered straight to your inbox

-

Get Started Investing

You can do it. Successful investing in just a few steps

-

Win at Retirement

Secrets and strategies for the post-work life you want.

-

Find a Broker

Find the right brokerage account for you.

-

Listen to our Podcasts

Hear our experts take on stocks, the market, and how to invest.

Premium Investing Services

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services.