When it comes to paying for a child's college education, many families must weigh taking out student loans vs. parent loans. The decision will require taking into account several factors, including federal vs. private loans, the creditworthiness of the student and parents, whether the loans will qualify for government subsidies, and the plans to pay off the loan after graduation. This article will take you through important variables to help you make a better decision.

Federal student loans

Federal direct student loans are those made by the federal government. They're taken out in the student's name, which means they're directly responsible for repaying the debt.

There are several enticing benefits to federal student loans:

- Flexible repayment options.

- Few qualifications for approval.

- Potential government subsidies.

That said, students are limited to the amount they can borrow each year.

Year | Dependent Students | Independent Students |

|---|---|---|

First-year undergraduate | $5,500 (no more than $3,500 subsidized) | $9,500 (no more than $3,500 subsidized) |

Second-year undergraduate | $6,500 (no more than $4,500 subsidized) | $10,500 (no more than $4,500 subsidized) |

Third-year and beyond undergraduate | $7,500 (no more than $5,500 subsidized) | $12,500 (no more than $5,500 subsidized) |

Graduate and professional students | N/A | $20,500 (unsubsidized only) |

Total loan limit | $31,000 (no more than $23,000 subsidized) | $57,500 for undergraduates (no more than $23,000 subsidized)$138,500 for graduate or professional students (no more than $65,500 subsidized) |

You're considered an independent student if you're 24 or older, married, a graduate or professional student, a veteran or a member of the armed forces, an orphan or ward of the court, caring for dependents of your own, an emancipated minor, homeless, or at risk of being homeless. Students whose parents don't qualify for a Parent PLUS loan may qualify for the same level of unsubsidized loans available to independent students.

You may qualify for subsidized loans if you have financial need. Financial need is determined through the same form used to apply for financial aid, the Free Application for Federal Student Aid (FAFSA).

If you're eligible for a subsidized loan, the government will pay the interest due on the subsidized amount while repayment is deferred. So, while you're a student and not making payments, your loan won't accrue additional interest.

There are several different ways to repay federal student loans, giving borrowers a lot of flexibility on their monthly payments.

Fixed payment plans:

- Standard repayment: Pay a fixed amount every month for 10 years.

- Extended repayment: Pay a fixed amount every month for 25 years (minimum $30,000 in loans)

- Graduated repayment: Pay a monthly amount that increases every two years for 10 years.

Income-based repayment plans:

- Revised Pay as You Earn (REPAYE): Pay a monthly amount equal to 10% of your discretionary income. Discretionary income is defined as the difference between your income and 150% of the poverty guideline for your state and family size. A loan is forgiven after 20 years for undergraduate loans and after 25 years for graduate or professional loans.

- Pay as You Earn (PAYE): Pay a monthly amount equal to 10% of your discretionary income or the standard repayment rate, whichever is less. Loans are forgiven after 20 years of payments.

- Income-Based repayment (IBR): Pay a monthly amount equal to 10% of your discretionary income (15% if you took out your loan before July 1, 2014) or the standard repayment rate, whichever is less. Loans are forgiven after 20 years (or 25 years for older loans) of payments.

- Income-contingent repayment (ICR): Pay a monthly amount equal to 20% of your discretionary income or a fixed payment based on a 12-year loan term, whichever is lower. Loans are forgiven after 25 years.

Federal parent student loans

Federal parent student loans are taken out in the parent's name on behalf of the student. They're also known as Direct PLUS loans.

Although parents will be able to borrow up to the full amount needed for their child’s education regardless of financial need, there are several drawbacks to federal parent student loans:

- Loan fees are deducted from each disbursement.

- Direct PLUS loans require a credit check to determine creditworthiness.

- Interest rates are higher than federal student loans.

- Less flexible repayment terms than federal student loans.

- The loan cannot be transferred to the student; the parent is permanently responsible for the debt.

- No loan forgiveness.

Although parents can ask for deferment or forbearance on the Direct PLUS loan, the requirements for the government to grant it are much higher than with student loans.

One workaround for the fixed payments and ineligibility for loan forgiveness is to use a Direct Consolidated loan. That requires rolling the Direct PLUS loan into a new, bigger loan -- possibly with a higher interest rate.

That loan would be eligible for income-contingent repayments and could be forgiven after 25 years of payments. Parents who qualify under the Public Service Loan Forgiveness program will be able to apply after 10 years of payments.

Interest Rate

Private loans

The federal government isn’t the only place to get a student loan. There are numerous private lenders, such as Sallie Mae, that are willing to help you pay for your child’s education.

Typically, private student loans are made in the name of the student. The parent may co-sign the loan, backing the payments for the student. In that case, the loan will show up on both the student’s and parent’s credit reports.

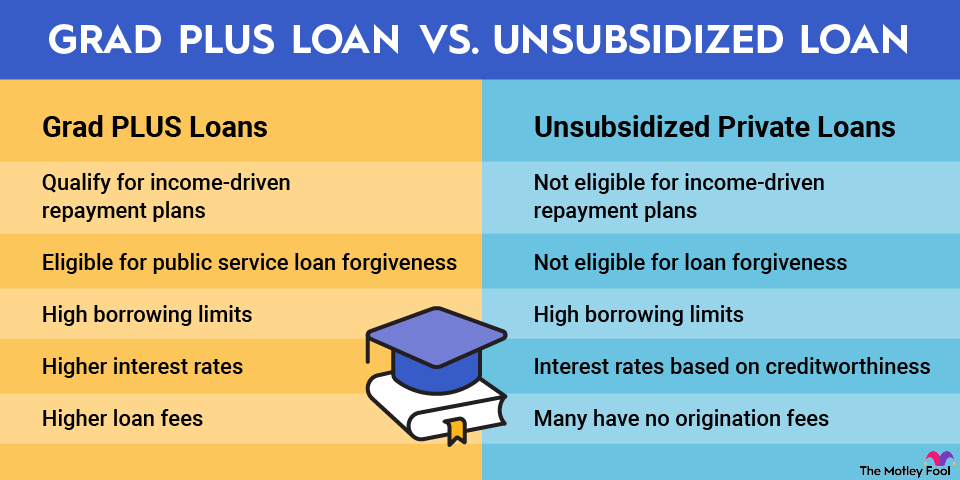

Private student loans

Private student loans are an option for students who need more money for school than they can receive from federal loans. Unlike federal loans, however, private loans usually require a credit check and demonstrable income.

Private loans will usually have a higher interest rate than federal loans, and there aren't any subsidies. Repayment plans may be stricter as well, and there's no loan forgiveness.

There may be opportunities to refinance the loan down the road if interest rates decline.

Refinancing

Private parent student loans

Less common are private parent student loans. These loans are given to the parents to pay for their child's education. They may be a good option for parents with very good credit since the interest rate could be lower than a Direct PLUS loan from the federal government.

Private (parent) student loans may not have an option for deferment or forbearance, so be sure to check with the lender on the terms. If you're unable to keep up with payments, it could be very damaging to your credit.

Related investing topics

The bottom line on student loans vs. parent loans

Deciding between a student loan vs. a parent loan will come down to several factors that are unique to each family.

- How much do you need to borrow? Federal student loans may not allow a student to borrow enough to pay for school. A parent loan or private student loan may be necessary to supplement the federal loan.

- How confident are you in your ability to repay? Student loans have more flexible payment terms and more loan forgiveness options.

It's important to discuss who will be responsible for paying, regardless of who takes out the loan. While parents may want to pay for their child's college, a student loan may still be a great option due to the lower interest rate and government subsidies. Ultimately, however, the student is on the hook for payments if the parent cannot come up with the money.

Likewise, a parent may take out a Direct PLUS loan with the expectation that the student will help pay for it after graduating. But the parent is still responsible in the eyes of the lender. So, be sure everyone's comfortable with the arrangements.

Combined with money in a savings account or investments in a 529 plan, a student loan can help bridge the gap to ensure your child gets the best education you can afford.

Savings Account

Student loans vs. parent loans FAQs

About the Author

The Motley Fool has a disclosure policy.