Can I contribute to both?

You can contribute to a Roth 401(k) and a traditional 401(k) at the same time. If your plan allows for Roth contributions, you can set separate contribution amounts for your Roth and traditional accounts.

Note that the IRS does limit your annual 401(k) contributions. Those limits apply to the combined total of your Roth and traditional 401(k) contributions. In 2025, savers younger than age 50 can contribute up to $23,500 to their 401(k) for the year. In 2026, the limit if you're under 50 is $24,500.

So if you contribute $5,000 to a Roth 401(k), that leaves $19,500 available to contribute to a traditional 401(k) in 2026.

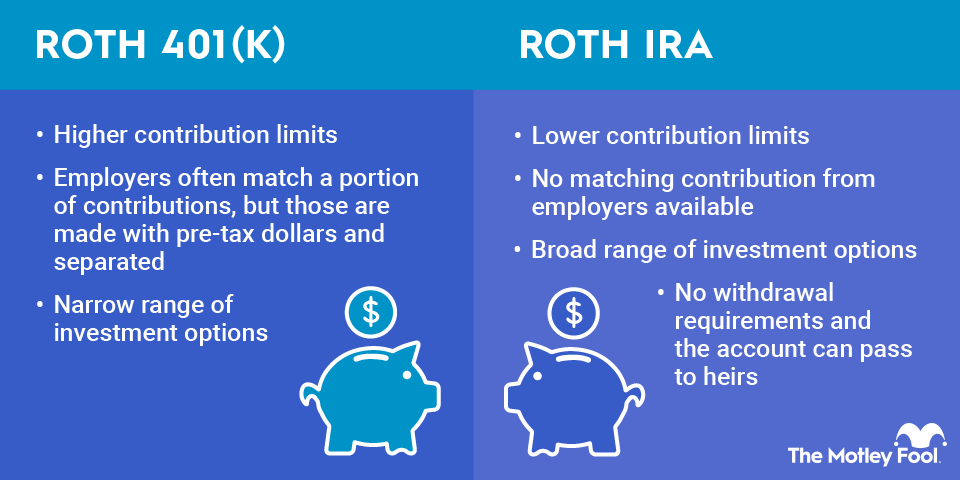

Matching contributions. Matching contributions are deposits your employer makes to your retirement account based on your savings activity. If your 401(k) offers a matching program, you should get those matching contributions for any qualified Roth contributions you make. Matching contributions have historically been pretax and would go into your traditional 401(k) account instead of the Roth one. Under the Secure Act 2.0, employers can now make post-tax Roth contributions; however, many plans haven't yet implemented this feature.

Withdrawals. Once you reach age 59 1/2 and it's been five years since you funded the Roth 401(k), you won’t pay penalties or taxes on Roth 401(k) withdrawals. You can avoid the taxes and penalties by qualifying for an exception or by waiting. If you become disabled, for example, the IRS will waive the penalty for withdrawing earnings early.

Unlike with a Roth IRA, you can’t withdraw your Roth 401(k) contributions whenever you want. If you withdraw money early, the IRS will use a pro-rata formula to determine how much of the distribution is taxable and subject to a 10% early withdrawal penalty. For example, if your account consists of 80% contributions and 20% earnings, you’d owe taxes and a penalty on 20% of the withdrawal.

Note that in a traditional 401(k), there's no tax distinction between contributions and earnings. Unless you qualify for an exception, you'll pay taxes and penalties on any early withdrawal.

Required minimum distributions. Traditional 401(k)s are subject to required minimum distributions, or RMDs. These are IRS-mandated withdrawals you must take after your 73rd birthday. (Previously, RMD age was 72). The Secure Act 2.0 eliminated RMDs for Roth 401(k)s in 2024 and subsequent tax years.

The big negative of RMDs is that they force you to move the funds to another account where you won't get a tax deferral on your earnings. Another RMD downside is that these withdrawals limit your ability to bequeath your retirement funds to loved ones.