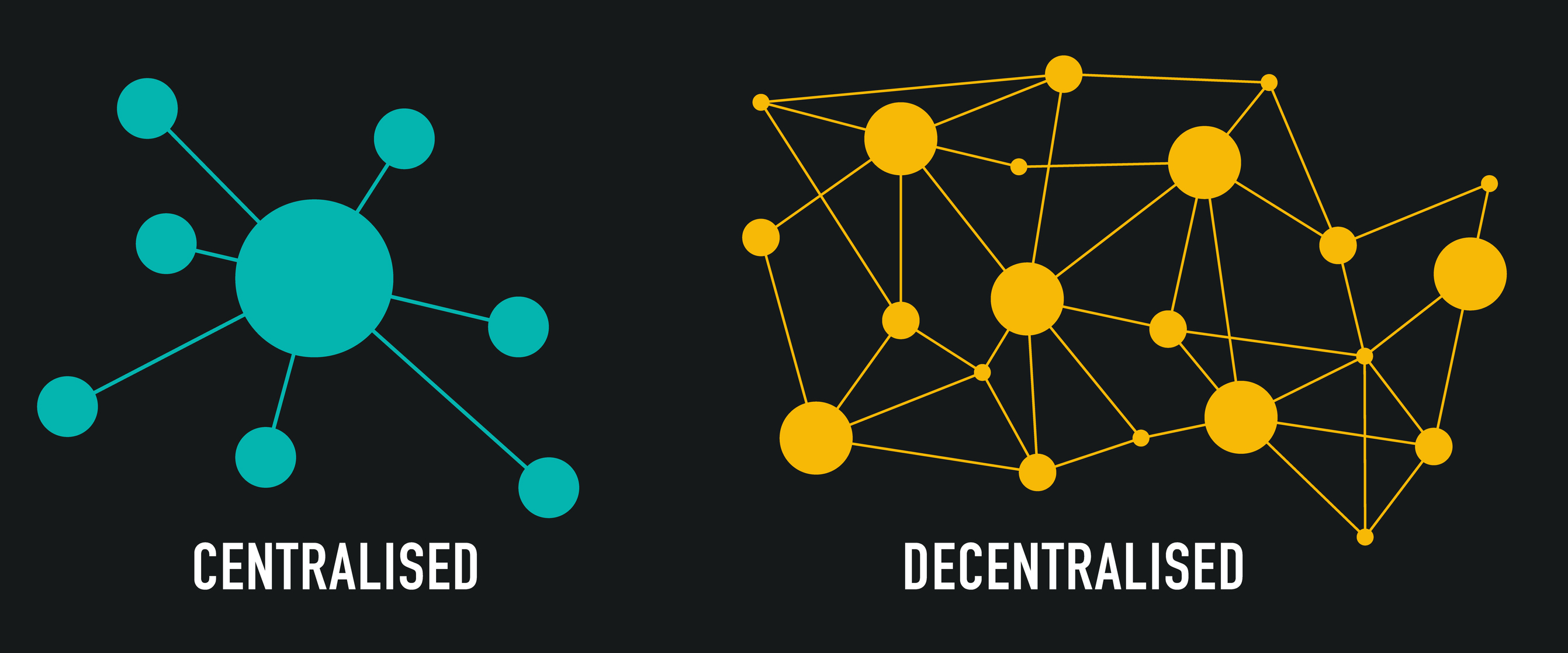

Decentralization is one of the key elements of the cryptocurrency industry. The hope is for a world where more peer-to-peer interactions can take place online and third-party intermediaries are removed -- giving two parties the ability to execute a direct transaction.

Atomic swaps and crypto investing

Lower trading fees and faster transaction times have always been a priority in investing and trade. Atomic swaps hold a lot of promise on this front for the crypto universe. However, ease of use and low cost don’t automatically mean an investment class is for every investor.

Atomic swaps are an emergency technology. They likely will continue to evolve and be implemented by more blockchains since interoperability expands a blockchain's ecosystem, and that's a good thing. If your favorite blockchain doesn't support atomic swaps yet, there's a good chance that it will in the future, whether you directly use them or not.

The cryptocurrency industry is still young and is developing quickly. There is debate on how -- or even if -- the value of cryptocurrencies can be accurately measured like other assets. Use cases for crypto and blockchain technology are also still being implemented at a limited scale in the economy, although a growing number of companies are testing the waters. As a result, the value of cryptocurrencies are highly volatile, atomic swaps or not.

Keep these risks in mind when deciding whether or not to make crypto a part of your diversified investment portfolio. And, if you’re just getting started, remember to take a measured approach as you learn more about how crypto and blockchain works.