If you're interested in investing in exchange-traded funds (ETFs), you have probably heard something about expense ratios. If you want to learn more about ETF expense ratios, then you're in the right place.

An ETF's expense ratio indicates how much of your investment in a fund will be deducted annually as fees. A fund's expense ratio equals the fund's operating expenses divided by the average assets of the fund.

Typical ETF expense ratios are less than 1%. That means that, for every $1,000 you invest, you pay less than $10 a year in expenses.

How the ETF expense ratio works

Let's say you invest $100,000 in the Horizon Kinetics Inflation Beneficiaries ETF (INFL -0.73%), which, according to the fund's fact sheet, has a current expense ratio of 0.85%. You will pay $850 to the fund's manager this year and increasing amounts in following years, assuming the value of your investment continues to grow. If the fund's value increases by 10% annually for the next 10 years, then your initial investment will be worth $259,374. Over the 10 years, you would pay fees totaling $19,360.

Over time, an ETF's expense ratio can significantly impact your investment returns. An annual fee of 1% or less may not seem like much, but, as the example illustrates, it becomes increasingly impactful over time. Every dollar that comes out of your account in fees is a dollar whose value is not compounded for all future years. Considering some ETFs have expense ratios close to zero, you have attractive options.

As for the logistics, the fee you annually owe to the ETF's manager, as determined by the prevailing expense ratio and value of your shares, is automatically deducted from your investment account.

How to find the best ETF expense ratio

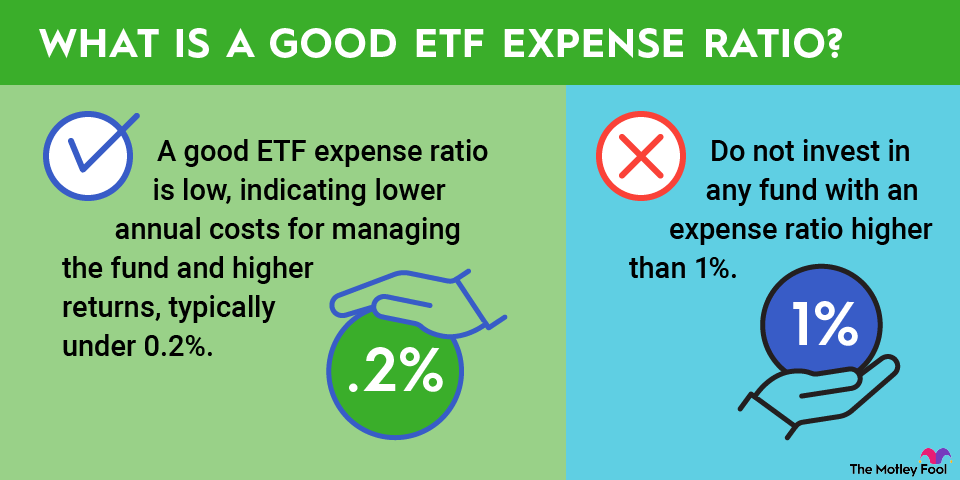

High fees can turn any investment into a poor one. A good rule of thumb is to not invest in any fund with an expense ratio higher than 1% since many ETFs have expense ratios that are much lower. Also, ETFs tend to be passively managed, which keeps the management fee low.

Because many ETFs have low expense ratios, only investing in those with very attractive expense ratios doesn't limit your investment options by much. Once you exclude any ETFs that are actively managed, you can consider what kind interests you and diversify your fund selections among many different sectors, company sizes, and indexes.

Expense Ratio

Use an ETF screener

With so many ETFs available in the market, you can find those with the best expense ratios in categories that interest you by using an ETF screener. A simple web search produces several options, and brokerages can also screen the market for you based on your preferences.

Let's say you want to invest in a dividend-focused ETF with a low expense ratio. Using an ETF screener tool, you can search for ETFs with dividend yields greater than, say, 2%. Your search returns 40 results, with expense ratios ranging from 0.16% to 3.90%.

You may be tempted to simply choose the fund with the lowest expense ratio, but a better approach is to conduct further research. (However, you can safely exclude from consideration the fund with the 3.90% expense ratio.)

An ETF can have a low expense ratio but not be right for you, based on one or several factors. By reading an ETF's fact sheet or its prospectus, you can verify that the fund in practice follows a strategy that appeals to you. Funds can be included in search results by mistake, may use more leverage than you like, or may be not appealing in some other way.

Prospectus

Reading a fund's prospectus can also tell you whether its advertised expense ratio is artificially low. Many funds offer fee rebates during their first few years to attract investors, but those rebates expire, and long-term investors are faced with permanently higher fees.

Also check that the range of expense ratios associated with the type of ETF that interests you is competitive. For dividend-focused ETFs, the lowest available expense ratio is 0.16%, while other types of ETFs have expense ratios that are even lower. If a low ETF expense ratio is important to you, you can prioritize investment options such as index funds.

Related investing topics

What's a good ETF expense ratio?

According to Morningstar, the weighted average expense ratio for ETFs in 2019 was 0.45%. That's just over half of what it was in 1999, and the downward trend is expected to continue.

What constitutes a good expense ratio for an ETF is a matter of judgment. What's clear is that investors are not obligated to pay high fees to invest in ETFs, and they should prioritize investing only in those ETFs with competitive and stable expense ratios.