Free cash flow (FCF) is the cash that remains after a company pays to support its operations and makes any capital expenditures (purchases of physical assets such as property and equipment). Free cash flow is related to, but not the same as, net income. Net income is commonly used to measure a company's profitability, while free cash flow provides better insight into both a company's business model and the organization's financial health.

What is free cash flow?

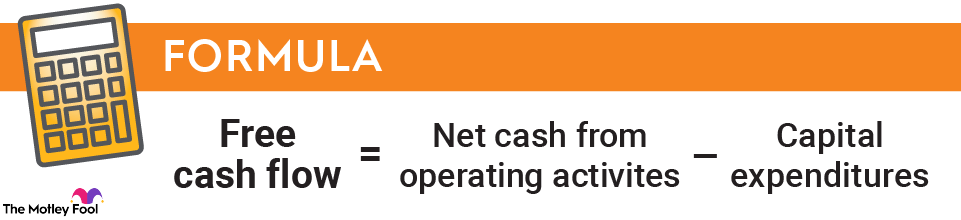

Free cash flow is calculated using several items from a company's cash flow statement. To determine FCF, subtract "capital expenditures" from "net cash from operating activities" (sometimes listed as "cash provided by operations" or a similar term). The formula looks like this:

Free cash flow = Net cash from operating activities - Capital expenditures

If a company (such as many high-growth technology companies) has "capitalized software expenses" or regularly reports "business acquisitions" on its cash flow statements, then these cash outlays are also subtracted from "net cash from operating activities" to calculate FCF.

To find these items in a company's quarterly or annual filing, look for the cash flow statement. This table is divided into three sections: Operating activities, investing activities, and financing activities. "Net cash from operating activities" (or something similar) can be found under the operating activities section, while "capital expenditures" and other qualifying expenses are listed under investing activities.

Cash Flow

How FCF differs from net income and EBITDA

Free cash flow is different from a company's net earnings or net loss, which are used to calculate the popular earnings per share (EPS) and price-to-earnings (P/E) ratios.

FCF excludes non-cash items like depreciation and amortization (assessed for only tax purposes to account for the values of assets paid for in the past), changes in inventory values, and stock-based employee compensation. Because FCF only encompasses cash transactions, it gives a clearer picture of just how profitable a company is.

FCF can also reveal whether a company is manipulating its earnings -- such as via the sale of assets (a non-operating line item) or by adjusting the value of its inventory of products for sale. Or, if a company made a large purchase (like buying a new property or investing in new intangible assets) in the recent past, then free cash flow could be higher than net income -- or still positive even when a company reports a net loss.

FCF is also different from earnings before interest, taxes, depreciation, and amortization (EBITDA). Unlike FCF, EBITDA excludes both interest payments on debt and tax payments. Like FCF, EBITDA can help to reveal a company's true cash-generating potential and can be useful to compare one firm's profit potential to its peers.

Asset

FCF is important -- but still has limitations

FCF, as compared with net income, gives a more accurate picture of a firm's financial health and is more difficult to manipulate, but it isn't perfect. Because it measures cash remaining at the end of a stated period, it can be a much "lumpier" metric than net income.

For example, if a company purchases new property, FCF could be negative while net income remains positive. Likewise, FCF can remain positive while net income is far less or even negative. If a company receives a large one-time payment for services rendered, its FCF very likely may remain positive even if it incurs high amortization expenses (like the costs of software and other intangible assets for a cloud computing company).

Because of the short-term variability inherent in FCF, many investors opt to evaluate the health of a company using net income since it smooths out the peaks and valleys in profitability. However, when evaluated over long periods of time, FCF provides a better picture of a company's actual operational results. FCF is also useful for measuring a company's ability to pay down debt and fund dividend payments.

Negative FCF reported for an extended period of time could be a red flag for investors. Negative FCF drains cash and assets from a company's balance sheet, and, when a company is low on funds, it may need to cut or eliminate its dividend or raise more cash via the sale of new debt or stock.

Related investing topics

Use FCF as part of your stock selection process

Free cash flow has its limitations, but it can also be a powerful tool. Consider it along with other metrics such as sales growth and the cash flow-to-debt ratio to fully assess whether a stock is worthy of your hard-earned money.