An inverse ETF is an exchange-traded fund designed to produce returns that are the opposite of its underlying index or benchmark. Investors often use inverse ETFs in advanced investment strategies, serving to hedge existing positions or take a bearish stance in a certain market sector.

Inverse ETFs vs. short selling

An inverse ETF can produce similar results to short selling for investors. Short selling is when you borrow shares of a stock or other security from your broker and sell them with the goal of buying back the shares at a lower price later. As such, you can profit when prices of the shorted asset decline, similar to how an inverse ETF performs.

There are several key advantages of inverse ETFs over short selling for investors to know.

- Limited downside. Buying an inverse ETF means your downside is limited to the amount invested. The lowest price an inverse ETF can trade for is $0. If you short shares of an ETF, though, the price can go up indefinitely. You’ll be on the hook to buy back shares at some point. Your broker will likely alert you, prompting you to either add more cash to your account or cover your short sale before things get too out-of-hand. That’s known as a margin call.

- Trade in any account. Since short sales are done on margin -- i.e., a loan from your broker -- they’re not allowed in certain types of accounts. IRAs, for example, do not allow margin loans, so you couldn’t take a short position in the retirement account. You could, however, use an inverse ETF to accomplish something similar.

- Potentially lower fees. When an investor shorts a stock, they might pay a fee to borrow the shares on top of interest on the margin loan used to borrow them. There’s no fee to buy an inverse ETF, but they do charge high expense ratios.

A neutral point to consider is that a broker may be unable to obtain shares for an investor to short. Similarly, someone interested in a thinly traded leveraged ETF may find it difficult to buy or sell shares. If you're bearish on a small market sector, you may not have a practical choice between shorting an index fund and buying an inverse ETF.

A big disadvantage of inverse ETFs

Perhaps the biggest difference between inverse ETFs and short selling is the potential for volatility loss. Volatility loss describes the effect of volatility on total returns.

An investor can be directionally accurate in their assessment that the underlying security will decline in value but still lose money by investing in an inverse ETF. Here’s how:

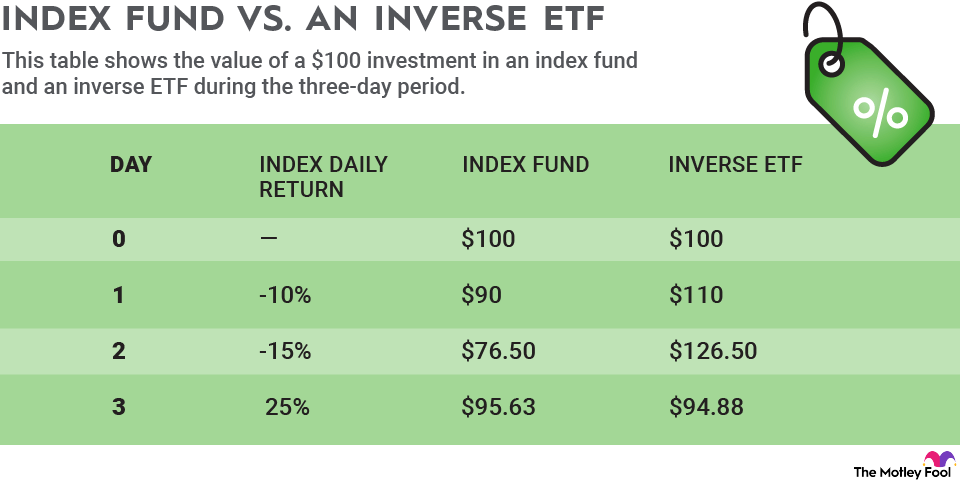

If the underlying security of an inverse ETF declines by 10% one day, the inverse ETF’s value will increase by 10%. The security might decline another 15% the next day but recover 25% the day after that. Over the three-day period, the security is still down more than 4% from its starting point.

Meanwhile, the inverse ETF is also down in value. That’s because while it gained 10% and 15% on the first and second days, respectively, it lost 25% of its value on the third day. In fact, it lost more value than the underlying security as a result of the significant volatility.

Index Fund

The table below shows the value of a $100 investment in an index fund and an inverse ETF during the three-day period.

Do Inverse ETFs belong in your portfolio?

Inverse ETFs are very interesting financial vehicles, but most investors probably won’t be able to use them as part of a solid investment strategy. They’re most useful as a very short-term hedge due to the high expense ratios and the mechanisms used for providing inverse returns. It’s important to do your research and consider the potential upside and downside of putting your money in an inverse ETF.

Most investors will do well to simply buy an ETF that tracks a broad-based market index and charges a very low expense ratio. That simple strategy can produce great results with minimal effort.