The United States has had a complicated history with Keynesian economics. While Keynesianism has frequently been used during downturns, the jury is still out on its long-term effectiveness. Read more to learn about the history of Keynesianism and alternatives.

Named for British economist John Maynard Keynes, Keynesian economics is a theory that government intervention is needed to stimulate demand and stabilize the economy, particularly during recessions.

Keynesian economics emerged as a response to the Great Depression. Although disciples of Adam Smith argued that free markets would always provide full employment (as long as workers were willing to compromise on wages), Keynes believed that government spending could spur demand and boost an economy.

Keynes made the case for governments to use three main tools:

- Interest rates. The cost of borrowing money has a major effect on the economy. Interest rates that are too low can lead to inflation. But if rates are too high, reduced borrowing can prompt a recession. Keynes also believed that banks should build up cash reserves when interest rates are high to prepare for potential downturns.

- Tax rates. Government should increase taxes when the economy is performing well. It can also try out new programs during economic booms, using extra money generated from increased tax revenue. During economic slumps, the government should reduce personal and business taxes to boost spending and increase investment.

- Social programs. When the economy isn’t doing well, unemployment rises. The government should then spend more on programs that create more skilled workers, allowing businesses to hire them without an enormous increase in salaries. When times are good, employment is steady, and workers earn steady wages, so government intervention isn’t required.

History of Keynesian economics

Massive government spending during World War II likely did more to pull the U.S. from the depths of the Great Depression than Keynesian economics generally associated with Franklin D. Roosevelt’s New Deal. But it’s been argued that the defense spending was a form of Keynesianism. Either way, a majority of U.S. presidents elected over the past half-century have resorted to some form of Keynesian economics, whether they admitted to it or not.

Richard Nixon, a conservative Republican for his era, attempted in 1971 to curb high inflation and growing unemployment with wage and price controls, as well as tax reform legislation. Nixon described himself to an interviewer as “now a Keynesian, in economics.”

Faced with soaring interest rates when he took office in 1981, Ronald Reagan slashed taxes and increased defense spending. During his two terms in office, George W. Bush pushed three tax cuts through Congress and oversaw wars in Afghanistan and Iraq. Barack Obama signed legislation for a $787 billion stimulus package during the 2008-09 financial crisis, and Donald Trump approved a $1.9 trillion tax cut in 2017.

More recently, Joe Biden won approval for the $1.9 trillion American Rescue Plan in 2021 designed to help the economy recover from the COVID-19 pandemic; a $1 trillion measure designed to upgrade the nation’s transportation, communications, and utility infrastructure; a $53 billion CHIPS and Science Act to boost U.S. production of semiconductors; and the 2022 Inflation Reduction Act, an $891 billion measure that primarily focused on renewable energy spending designed to mitigate climate change.

Related investing topics

Alternatives to Keynesian economics

Although recent U.S. history has favored Keynesian economics, it’s not the only response to economic downturns. Arguments also have been made for theories that include:

- Classical economics. The basis for capitalism, classical economics argues the government involvement in the economy should be minimal or nonexistent. Businesses should be privately owned and scarce resources allocated by the laws of supply and demand.

- Supply-side economics. Pushed heavily during the Reagan years, supply-side economics argues that the economy prospers when the amount of goods and services increases. The increase occurs when governments reduce barriers to production, generally via tax cuts.

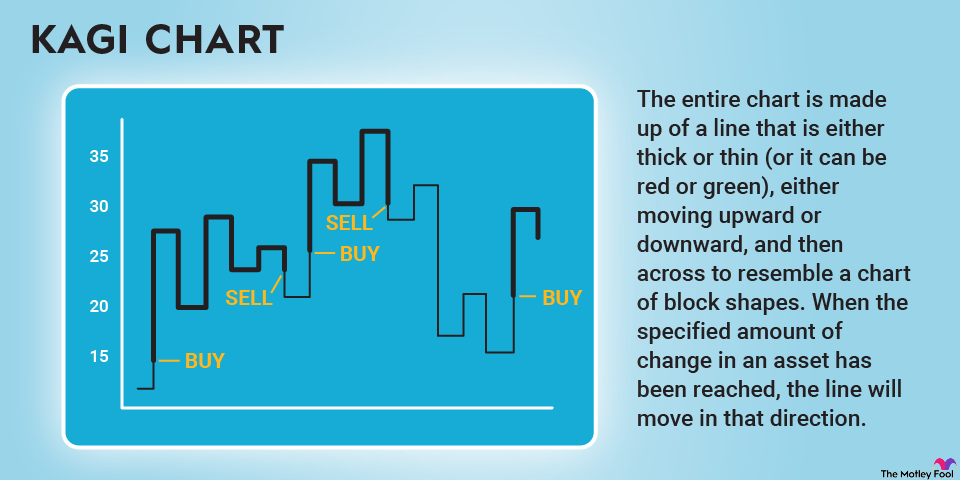

- Monetarism. Central banks are key to this economic theory, which holds that policy objectives are best achieved through control of the money supply. If prices are too high, interest rates can be increased to curb inflation; during times of high unemployment, lower interest rates can add money to the economy and encourage greater investment in jobs.

- Modern monetary theory. A controversial concept that has gained more attention over the past decade, modern monetary theory argues that there should be no limits on government spending, as long as it’s done by a country with its own currency and as long as its own currency isn’t tied to the value of another country’s currency.