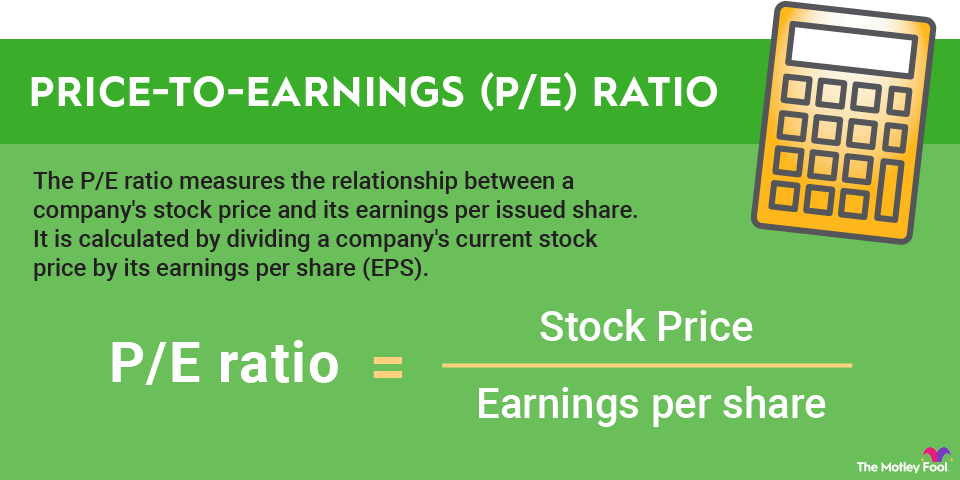

No valuation metric can tell you if a stock is an attractive investment opportunity all by itself, and the P/E ratio is no exception. For example, the stock of a faster-growing business should have a higher P/E ratio than a slower-growing one, all other factors being equal. So the P/E ratio is best used as one piece of the puzzle, in combination with earnings growth, cash and debt levels, gross and net profit margins, and other figures.

Finally, if a stock has a P/E ratio that is much lower than its peers, it can be a red flag that is worthy of further investigation. Companies with P/E ratios that seem too good to be true often have declining sales, poor balance sheet quality, or another underlying reason for the seemingly cheap valuation.