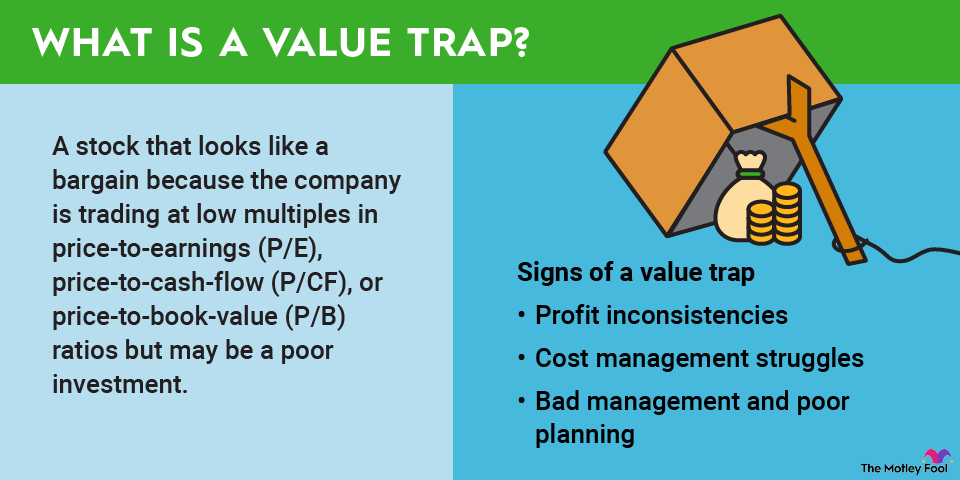

Bad management and poor planning. These two things often go hand in hand. Bad management is a great way to destroy an otherwise awesome company, often due to poor longer-term planning. Companies that aren't thinking about product innovation and business tactics five, 10, or 20 years into the future aren't worth investing in at any price.

Avoiding value traps

There's no way to guarantee you'll never hit a value trap and get stuck in it. That's why we advocate for diversification, but you can avoid most value traps by taking some precautions, such as:

Comparing the company to the sector. Your potential value trap should be considered in the context of its competition. If the competition is outpacing the stock you're considering by a great deal, you already know why that stock is cheap.

Examining the company's history. Knowing how to read a financial statement is vital to understanding stocks well enough to avoid most value traps. Again, a company that has inconsistent returns, isn't doing great at keeping overhead costs low, has a lot of management turnover, or has a history of poor management is one to avoid.

Understanding who holds the stock. Many different types of investors can hold stock. Retail investors certainly play a role, but institutional investors can really help move a stock price faster than any group of small-scale investors. Those mutual funds in everyone's 401(k)s help keep a stock alive. When a price drops so low that institutional investors are no longer buying, it gets a lot harder to see dramatic price recoveries.