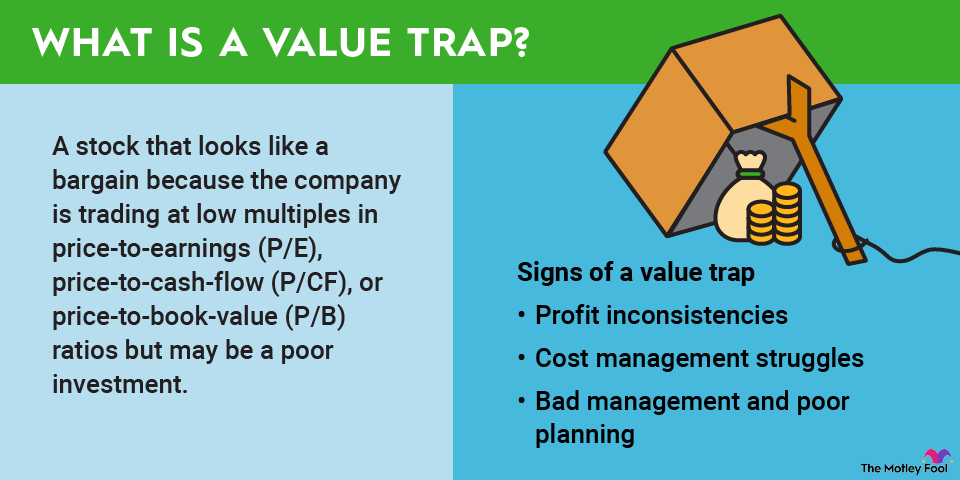

Comparing the company to the sector. Your potential value trap should be considered in the context of its competition. If the competition is outpacing the stock you're considering by a great deal, you already know why that stock is cheap.

Examining the company's history. Knowing how to read a financial statement is vital to understanding stocks well enough to avoid most value traps. Again, a company that has inconsistent returns, isn't doing great at keeping overhead costs low, has a lot of management turnover, or has a history of poor management is one to avoid.

Understanding who holds the stock. Many different types of investors can hold stock. Retail investors certainly play a role, but institutional investors can really help move a stock price faster than any group of small-scale investors. Those mutual funds in everyone's 401(k)s help keep a stock alive. When a price drops so low that institutional investors are no longer buying, it gets a lot harder to see dramatic price recoveries.