Yield to maturity (YTM) is the annual expected return of a bond if held until maturity. Also referred to as book yield, yield to maturity provides investors with an accurate idea of the value of a bond’s coupon payments and value at maturity by accounting for the time value of money. Investors can use yield to maturity to determine if a bond is a good investment and get an idea of the interest rate risk for the investment.

Calculating yield to maturity (YTM)

Yield to maturity is similar to a discounted cash flow model for valuing stocks. In the case of calculating yield to maturity, all future cash flows can be known. Bonds have fixed coupon rates that pay on fixed schedules, and they have a certain face value paid at maturity on a certain date.

As such, it’s relatively straightforward to calculate the yield to maturity for a bond at any given price, assuming that all coupons are paid on time, the bond is held until maturity, and an investor can reinvest the coupon payments at the same rate as the yield to maturity. That last assumption makes yield to maturity purely theoretical since market conditions are constantly in flux. Still, the metric gives investors a way to compare bonds.

In order to calculate the yield to maturity, investors need to know the following:

- Current market price, or present value.

- Face value, or the value of the bond at maturity.

- Coupon rate.

- Maturity date.

- The number of compounding periods until maturity.

With those numbers, you can use a simple formula to approximate yield to maturity, or you can use a computer (or lengthy hand calculations) to solve for an exact yield.

Yield to maturity (YTM) formula

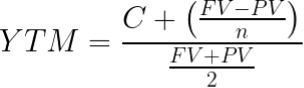

Calculating yield to maturity by hand requires the trial-and-error approach of plugging in discount rates back into the current price for a bond. But there’s a simplified formula that can approximate yield to maturity.

Present Value (PV)

Given coupon rate (C), face value (FV), present value (PV), and the number of periods until maturity (n), you can calculate yield to maturity with the following formula:

Note: If the compound period is different than a year, you’ll have to adjust your answer to find the yield to maturity. If you use the above formula to calculate the YTM of a bond that pays its coupon semiannually, you’ll double the result of the formula to get the annualized yield to maturity.

Using the formula above, we can calculate the approximate yield to maturity of a $1,000 bond currently selling for $900, maturing in three years with an annual coupon of $20. It has a yield to maturity of approximately 5.61%.

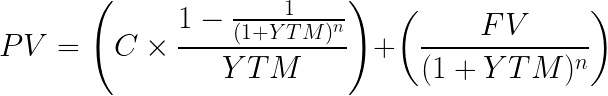

That’s a good starting point for the full yield-to-maturity formula. You can calculate the exact yield to maturity using the following formula:

Note: You’ll have to use trial and error to narrow down the exact yield to maturity using this formula. Plugging in 5.61% on our previous example produces a present value of $903. So you must adjust the yield slightly higher (lower-priced bonds produce a higher yield) in order to get the exact number. The exact yield to maturity is 5.722%.

Related investing topics

Limitations of yield to maturity (YTM)

Yield to maturity has several limitations that aren’t factored into the metric.

First and foremost is the impact of interest rate changes on realized returns. Yield to maturity assumes an investor can reinvest all of the coupon payments at the same rate as the calculated yield to maturity. This is typically not the case, as market fluctuations make it difficult to get the exact same yield from one day to the next.

Additionally, an investor may not be able to reinvest the entirety of the coupon payment. Investors usually have to pay taxes on the coupon in the year they’re paid. They may also use the coupon payments to pay for something else, like supporting their lifestyle.

Furthermore, YTM doesn’t factor in the potential for a debtor to default, which means an investor will not get future coupon payments, and their principal is forfeited. Likewise, the bond could be called before maturity if the contract has a clause that allows the issuer to do so.

How to use yield to maturity in investment decisions

Yield to maturity can be useful for investors trying to decide between multiple investment options. Calculating the YTM on each can give you an idea of what they’re getting for their money.

All else equal, an investment with a later maturity date should produce a higher yield to maturity. That’s because a bond maturing sooner is less exposed to interest rate risk. The higher the yield to maturity, the less susceptible a bond is to interest rate risk.

There are other risks, besides interest rate risk, that can increase yield to maturity: the risk of default or the risk of a bond getting called before maturity. Either can have an impact on yield to maturity, pushing the market to demand a higher yield for bonds with higher risk.

Many brokerages will automatically calculate yield to maturity for you, which makes it easy to compare potential investments. If you can determine that a premium is worth the risk, you may have found a great fixed-income investment for your portfolio that can pay consistently and appreciate in value.