Finding the next great growth stock is difficult, but if you manage to catch lightning in a bottle, the results can be life-changing. That's why I'm constantly on the hunt for stocks that promise fast growth in the years ahead.

One way that I search for winning growth-stock ideas is to plug the following traits into Finviz:

- S&P 500 component

- Profitable on a trailing and forward basis

With the resulting basic list in hand, the next step is to sort by the highest projected earnings-growth rates over the coming five years. This methodology produced a list of three stocks -- Chevron (CVX 0.64%), Vertex Pharmaceuticals (VRTX 0.51%), and Netflix (NFLX -0.90%) -- that all promise greater-than-60% EPS growth over the long term. Let's take a closer look at each to see if any could be worth owning.

Image source: Getty Images.

An oil giant on the rebound

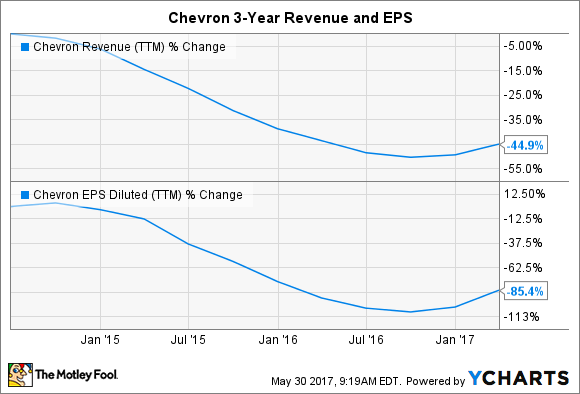

Just like every other energy company, Chevron has faced considerable challenges in its recent past. The huge downturn in energy prices has had a huge impact on the company's financial statements. Revenue has fallen by more than 40% while profits have dropped more than 85% in the last three years. The carnage would have likely been even worse if Chevron didn't also operate countercyclical energy businesses such as refining and marketing.

CVX Revenue (TTM) data by YCharts.

Thankfully, extreme diversification and strong balance sheet allowed the oil giant to afford its generous dividend payment throughout the downturn. That's likely helped its stock to keep afloat. Meanwhile, the company's recent results paint an encouraging picture. Production rates and energy prices are on the rise, which is helping to drive revenue higher. Meanwhile, costs and capital spending are declining. When combined with Chevron's planned asset sales, these factors have resulted in a bottom line that has been on the upswing.

Looking ahead, Chevron's plans call for more of the same, which should allow for a strong rebound in profitability. That's why analysts are projecting EPS growth of 76% annually over the next five years. That's exciting, but it is important to remember that this is a cyclical business that is simply bouncing back from a drubbing, so investors should likely take these extreme profit-growth projections with a grain of salt.

A biotech with next-generation drugs on the way

Biotechnology is an industry that is known for eye-popping growth, so it shouldn't surprise investors to see that Vertex Pharmaceuticals has made this list. The top dog in cystic fibrosis (CF) has been posting steady revenue growth thanks in large part to the launch of its newest CF drug, Orkambi. However, the company's expenses have also been on the rise in recent years as it invests heavily in clinical trials to bring new drugs to market. Until recently, that's kept the company's bottom line in the red.

VRTX Revenue (TTM) data by YCharts.

Moving forward, Wall Street expects that the company's days of producing losses are a thing of the past. Vertex's two CF drugs that are on the market -- Kalydeco and Orkambi -- should ring up nearly $2 billion in annual sales combined thanks to expanding labeling claims and the securing of reimbursement overseas. That appears to be enough revenue to cover the company's costs and drive meaningful growth on the bottom line.

Turning the pipeline, Vertex has a number of combination cocktails in mid- and late-stage development that combine new compounds with already approved drugs. Investors can look forward to a steady stream of data readouts and regulatory submissions from these products over the next few years if everything goes according to plan.

Between its current products and pipeline, Vertex's top line is poised for steady gains in the years ahead. This, combined with operating leverage gained from higher revenue, gives analysts reason to expect that the company's EPS will soar by 64% annually over the next five years. That makes Vertex a great growth stock for biotech investors to get to know.

A media colossus turning on the profit stream

DVD-by-mail business turned video-streaming giant Netflix recently passed a big milestone. The company now boasts more than 100 million streaming subscribers worldwide thanks in large part to its decision to spend heavily on original content. Hit shows like House of Cards, Stranger Things, and 13 Reasons Why continue to draw in new member around the globe.

Passing 100 million members might make it seem as though Netflix has saturated its market opportunity, but the numbers tell a different story. An estimated 1.1 billion consumers are expected to subscribe to some form of pay-TV service by 2019, which still represents a 10-fold opportunity for Netflix since it is currently available in nearly every country in the world. That untapped opportunity is great for investors since Netflix finally has enough scale to focus on profit growth. While management still plans on spending heavily on its original content to drive subscriber growth -- and is being forced to take on debt to do so -- it intends to drive "material global profits" through margin expansion from here. Add in steady top-line growth through subscriber acquisition and market watchers are projecting long-term EPS growth in excess of 60% annually over the next five years.

Are any worth buying?

While there's an argument to be made for welcoming any of these stocks into your portfolio, I'm personally the most excited about Netflix. While shares are trading at a premium valuation, I can't help but be bullish on the company's long-term prospects given the ample market opportunity and the potential for margin expansion. As long as the company can continue to execute against this plan, I for one plan on remaining a happy shareholder.