Stock investing can be volatile, creating short-term risk. But if you invest in stocks at their best value points, you can reduce some of the risk and set yourself up for better long-term returns. With that in mind, we asked three of our contributing investors to write about a stock that's deep in value territory right now and could help grow your nest egg. They gave us tech giant International Business Machines (IBM -0.35%), stalwart utility National Grid plc (ADR) (NGG 1.69%), and engineering upstart NV5 Global Inc. (NVEE -2.85%).

Image source: Getty Images.

Cheap for a reason, but worth the risk

Reuben Gregg Brewer (International Business Machines): IBM's price-to-earnings ratio, price-to-book value ratio, price-to-cash-flow ratio, and price-to-sales ratio are all below its own five-year averages for those statistics. It's more than 4% dividend yield, meanwhile, is well above its five-year average of around 2.7%. If you compare those metrics to the tech industry's current darlings, like Alphabet or Amazon, IBM comes away looking even cheaper.

IBM PE Ratio (TTM) data by YCharts.

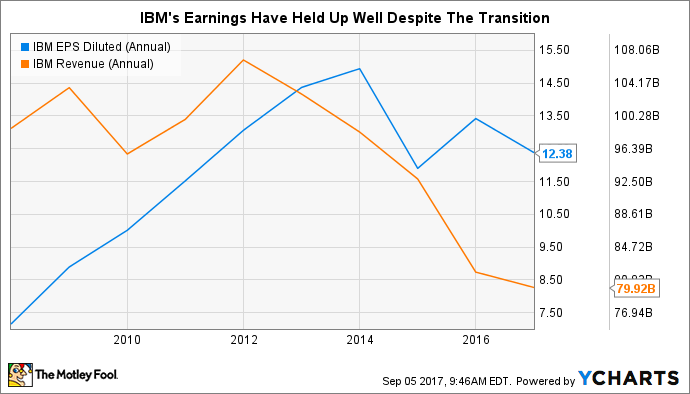

IBM appears to be a value stock today, but there's a good reason why. IBM is in the middle of transitioning from older businesses, like making computers, to newer ones, like cloud, security, and artificial intelligence. It hasn't been going as well as investors have hoped, with a string of 21 consecutive quarterly revenue declines. That said, the new businesses IBM is expanding into now represent nearly 45% of revenues. The company appears to be getting close to an important inflection point.

IBM EPS Diluted (Annual) data by YCharts.

Despite the revenue decline during the company's transition, IBM's bottom line has remained fairly resilient, while stock buybacks and wide margins have supported its dividend, with the streak of annual raises now at 22 years.

IBM offers investors a notable yield at current prices, an enviable track record of dividend growth, an out-of-favor price tag relative to its own history, and a highly profitable business that's transitioning slowly, but surely, toward a new business model. If you can stomach owning an out-of-favor name, IBM could help build your nest egg in a big way once revenues start heading higher again and investors give the company credit for all the work that's been done.

You shouldn't ignore the drop in this rock-solid utility stock

Neha Chamaria (National Grid): When looking for stocks to build a nest egg, a stable and a secure business with strong growth potential becomes a prerequisite. If the company also pays a dividend, it's a cherry on top. Utility National Grid has all this and more, and the best part is that the stock is down nearly 13% since mid-May, offering investors a great opportunity to buy.

Image source: Getty Images.

One factor that appears to have spooked investors lately is foreign-exchange fluctuations, particularly in the Great Britain pound (GBP), which proved to be a huge headwind for the U.K.-based company in FY 2017 and could linger on Brexit concerns. Investors, however, are overlooking the fact that National Grid's exposure to the pound has come down after the sale of 61% of its U.K. gas-distribution business in December 2016. In fact, the company is now prioritizing growth in the U.S. over the U.K. and intends to spend billions of dollars to expand its U.S.-regulated operations.

Furthermore, currency fluctuations are a near-term blip that shouldn't really hurt your long-term investing thesis for a fundamentally strong company. National Grid proved its commitment to shareholders, yet again, when it sent a major chunk of the nearly $7.5 billion that it earned from the stake sale of the U.K. gas business back to shareholders via a special dividend and share repurchases.

While that was a one-off treat for investors, National Grid's renewed focus on the U.S. should keep its cash coming in and dividends going out. Priced at less than seven times cash flow and yielding 4.5%, National Grid makes for a great value pick today for nest-egg growth.

The value of growth

Jason Hall (NV5 Global Inc): At first glance, small engineering and consulting upstart NV5 Global doesn't look like a value investment, trading for a lofty 40 times trailing earnings. But if you only get as far as looking at any company's P/E ratio and don't go any further, you'd miss out on some of the best opportunities, like NV5 Global.

NV5 is a small company -- compared to the big boys in its industry -- and in full-on growth mode. And that growth is driving a lot of earnings to the bottom line, making the company far cheaper if we look at its guidance for the current year versus the trailing one. Based on that measure, NV5 stock trades for between 21 and 28 times management's 2017 adjusted earnings guidance of $2.22-$2.36 per share.

Second, it's also proven to be very profitable. Its valuation isn't extreme when compared to even some of the biggest players in its industry:

NVEE PE Ratio (TTM) data by YCharts.

The real value here is the growth potential at a reasonable price. With annual sales of less than $280 million, NV5 is a tiny growth player in the multitrillion-dollar infrastructure industry. With insiders owning 35% of the company and a founder-led management team with decades of experience together, NV5 is both reasonably priced today and ideally positioned for potentially huge growth in the decades to come.