What happened

Shares of silver miner Pan American Silver (PAAS 8.87%) jumped as high as 10.6% Thursday morning, and were up 9.6% as of 1 p.m. EDT. The price increase comes on the heels of Pan American's second-quarter earnings results, which were much higher than analyst expectations.

So what

This is the second quarter in a row that Pan American blew past Wall Street expectations. This most recent quarter, the company generated earnings per share of $0.24 from $216.5 million in revenue. Wall Street analysts were expecting EPS at $0.14. Even though the average price per ounce of silver was lower this past quarter than the prior year, the company was able to maintain earnings with an all-in sustaining cost per silver ounce sold of $6.45, which was 40% lower than this time last year. Management attributed the lower costs to expansions at its La Colorada and Dolores mines in Mexico.

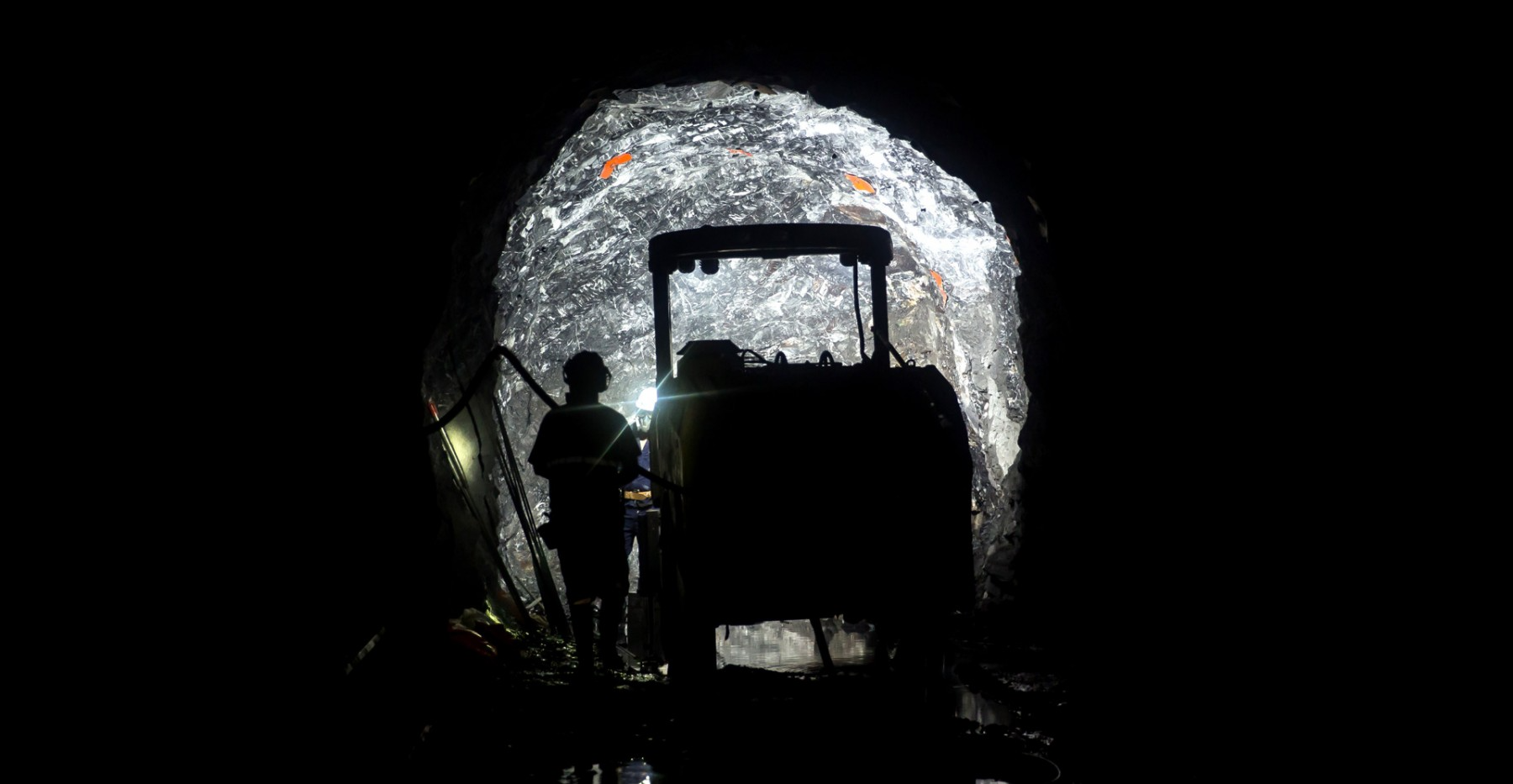

Image source: Getty Images.

The company's strong performance this past quarter also enabled management to revise its guidance. It lowered its full-year all-in sustaining costs from $9.30 to $10.80 per silver ounce to a range of $8.50 to $10.

Now what

Pan American Silver is continuing to do all the things you would want it to do as an investment. It is keeping its costs incredibly low, its balance sheet has more cash than debt, and it's on track to deliver modest growth. Even though commodity prices will make this stock wax and wane, Pan American Silver looks to be well positioned to generate high returns if commodity prices remain high, and it should be able to survive any upcoming market downturn. While I'm personally averse to precious metal miners, this looks like one of the better companies in the industry.