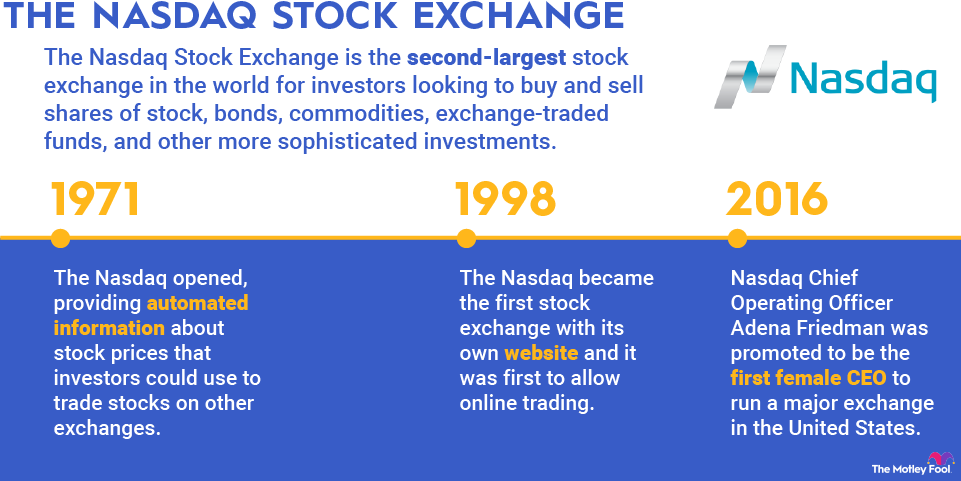

The Nasdaq Stock Market, or simply Nasdaq, is the second-largest stock exchange in the world. Nasdaq was initially an acronym, NASDAQ, which stands for the National Association of Securities Dealers Automated Quotations. It opened in February 1971, providing automated information about stock prices that investors could use to trade stocks on other exchanges.

Eventually the Nasdaq became the world's first electronic stock market, taking over trading for many stocks that had previously traded in places other than formal stock exchanges. Now the Nasdaq has formal listing requirements that companies have to meet to list their shares on its stock exchange. The Nasdaq has become the largest global exchange to rely solely on electronic trading.

Nasdaq history

The Nasdaq was established to provide an electronic alternative to the prevailing structure of stock exchanges, which involved having live traders on a trading floor to collect and execute orders to buy and sell shares of stock. However, the Nasdaq didn’t initially have investors directly trading any stocks. Instead, it used an automated information-gathering process to provide the latest prices for stock trades conducted elsewhere.

From there, the Nasdaq got more involved in the trading of stocks that weren't listed on the New York Stock Exchange or other established stock exchanges. These stocks, known as over-the-counter stocks, became the Nasdaq's first focus. Some investors still refer to the Nasdaq as an over-the-counter market.

As technology has advanced, the Nasdaq has created automated trading systems that not only match up orders from buyers and sellers but also provide the summary data and reporting required of all stock exchanges. Once the internet came into widespread use, the Nasdaq became the first stock exchange with its own website, and it was the first to allow online trading. The Nasdaq has also embraced cloud computing, using cloud-based solutions to store required regulatory documentation and other data.

Related investing topics

What are Nasdaq trading hours?

The Nasdaq Stock Market is generally open on weekdays from Monday to Friday, and is closed on Saturday and Sunday. Nasdaq trading begins at 9:30 a.m. Eastern time. The regular session stops after the closing bell rings at 4 p.m. Eastern time.

However, the Nasdaq also gives traders the chance to participate in special sessions before the regular session begins and after it ends. Pre-market trading hours run from 4 a.m. to 9:30 a.m. Eastern time each weekday. After-market hours start at 4 p.m. and run through 8 p.m. Eastern time Monday through Friday.

The Nasdaq closes for the following holidays in 2025:

Holiday | 2025 Date |

|---|---|

New Year's Day | Wednesday, Jan. 1 |

Martin Luther King Day | Wednesday, Jan. 15 |

Presidents' Day | Monday, Feb. 17 |

Good Friday | Friday, April 18 |

Memorial Day | Monday, May 26 |

Juneteenth | Thursday, June 19 |

Independence Day | Friday, July 4 |

Labor Day | Monday, Sep. 1 |

Thanksgiving Day | Thursday, Nov. 27 |

Christmas Day | Thursday, Dec. 25 |

The Nasdaq also is scheduled to close early, at 1 p.m. Eastern time on July 3; on Nov. 28, the Friday after Thanksgiving; and on Christmas Eve if it falls on a weekday and if the regular Christmas holiday is observed on Dec. 25.

The Nasdaq Stock Market is the second-largest stock exchange in the world, and it plays a vital role in incorporating technology into the trading process. The Nasdaq provides an alternative to the New York Stock Exchange for companies that want to list their stocks on a U.S.-based stock exchange. With a long history of innovation, the Nasdaq should continue to help investors for years to come.