Industrial real estate investment trusts (REITs) are entities that own industrial properties, such as warehouses and manufacturing facilities. Manufacturing and logistics companies are increasingly finding they don't need to own their real estate. That's opening the door for industrial REITs to buy these properties and lease them back to industrial companies, helping to drive growth for both groups.

Here's a closer look at the industrial REIT sector, including its advantages and risks, and some industrial REITs worth considering.

Understanding industrial REITs

Industrial companies use many different types of real estate to develop, manufacture, or produce goods and products. They require specialized real estate to support the movement and storage of products and goods. Properties in the sector include:

- Light manufacturing facilities.

- Food manufacturing facilities.

- Temperature-controlled warehouses (e.g., cold-storage facilities).

- Growing facilities and other properties for medical-use cannabis.

- Flex/office space, meaning a combination of office and industrial space, like a warehouse or light manufacturing.

- Logistics properties such as warehouses and fulfillment centers.

Industrial REITs lease these properties to tenants under long-term contracts, some as long as 25 years. They'll often rent an entire industrial building to one tenant under a triple net lease structure, making the tenant responsible for covering building insurance, real estate taxes, and maintenance. The agreements supply the REIT with steady cash flow.

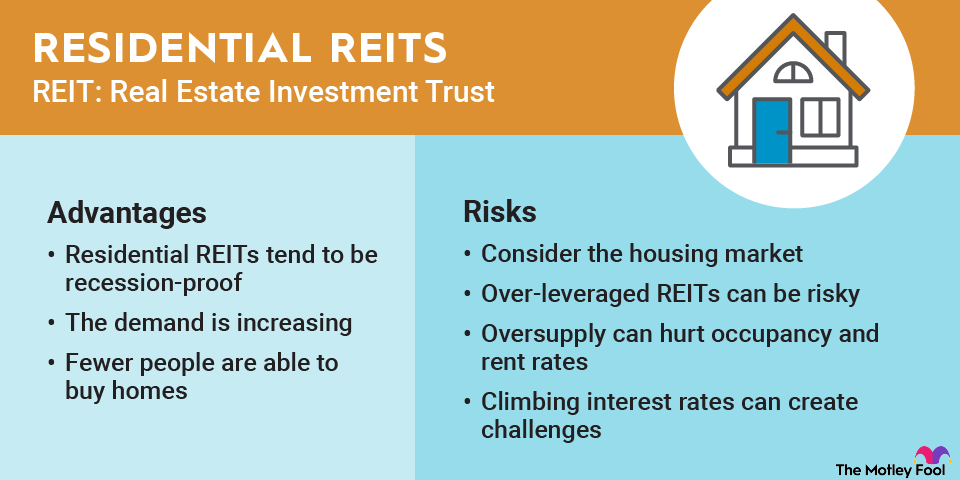

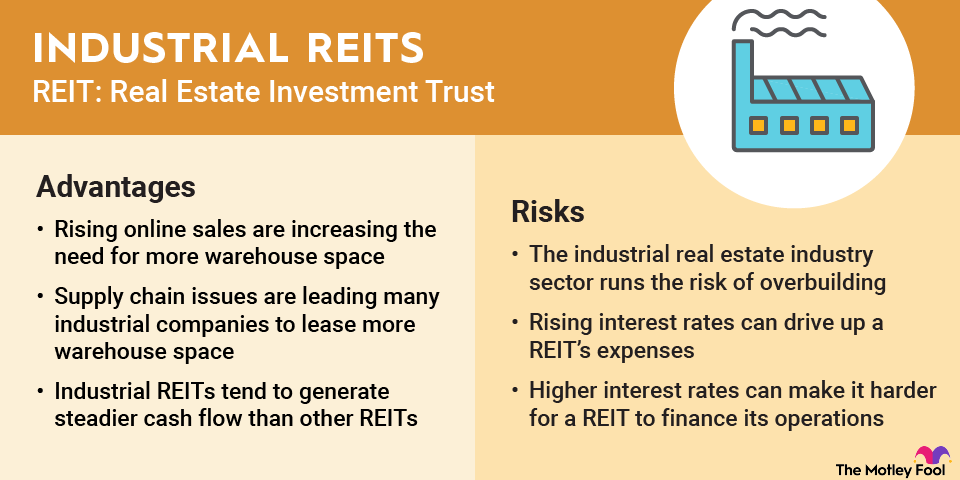

Advantages of investing in industrial REITs

Industrial REITs have a lot to offer investors, including:

- Upside to the growth of e-commerce: Rising online sales are increasing the need for more warehouse space, which these REITs provide.

- Cashing in on supply chain issues: Supply chain disruptions since the COVID-19 pandemic are leading many companies to lease more warehouse space to store additional inventory.

- Capitalizing on the onshoring of manufacturing: Tariffs and other catalysts are leading many companies to bring manufacturing back to the U.S. because of supply chain issues and other factors, providing new growth opportunities for industrial REITs.

- Stable cash flows: Industrial REITs typically sign long-term triple net leases (NNN). These leases produce stable cash flow, often making the sector relatively recession-resistant.

Risks of investing in industrial REITs

The industrial real estate industry isn't without risk. Notable risk factors to consider include:

- Overbuilding: Many industrial REITs develop new properties on speculation or without securing a tenant before starting construction. Problems arise if developers build too much speculative capacity in certain markets, which can cause occupancy levels and rental rates to decline.

- Tenant troubles: Tenants can experience financial trouble, affecting their ability to pay rent. That can affect a REIT's financial results until it finds replacement tenants for those properties.

- Interest rates: Rising interest rates can increase a REIT's interest expenses, affecting its cash flows. It can also make it more expensive to fund new developments and acquisitions.

Seven industrial REITs to consider in 2026

According to the National Association of Real Estate Investment Trusts (NAREIT), there were 12 publicly traded industrial REITs in late 2025. Here are a few interesting ones for investors to consider:

| Name and ticker | Market cap | Dividend yield | Industry |

|---|---|---|---|

| Prologis (NYSE:PLD) | $119.9 billion | 3.13% | Industrial REITs |

| Rexford Industrial Realty (NYSE:REXR) | $9.1 billion | 4.41% | Industrial REITs |

| Americold Realty Trust (NYSE:COLD) | $3.7 billion | 7.11% | Industrial REITs |

| Stag Industrial (NYSE:STAG) | $6.9 billion | 4.04% | Industrial REITs |

| Innovative Industrial Properties (NYSE:IIPR) | $1.4 billion | 15.36% | Industrial REITs |

| Lineage (NASDAQ:LINE) | $8.1 billion | 5.96% | Industrial REITs |

| EastGroup Properties (NYSE:EGP) | $9.6 billion | 3.28% | Industrial REITs |

1. Prologis

NYSE: PLD

Key Data Points

Prologis (PLD +0.50%) is the largest industrial REIT by a wide margin and one of the largest REITs overall. In mid-2025, the company had investments in almost 5,900 buildings encompassing roughly 1.3 billion square feet of space leased to about 6,500 tenants. The company has a global logistics business with operations in 20 countries.

Prologis stands out from other logistics-focused industrial REITs. It has a global reach; most rivals typically emphasize the U.S. market. Prologis also has an investment management platform, enabling it to earn management fees in addition to rental income. Finally, it has a global development platform, which enhances its growth prospects. These differences have enabled Prologis to grow faster than other logistics REITs over the years.

2. Americold Realty Trust

NYSE: COLD

Key Data Points

NYSE: STAG

Key Data Points

STAG Industrial (STAG +0.03%) owns a diversified portfolio of industrial real estate. It had more than 600 buildings exceeding 119 million square feet of space in late 2025, including warehouses, light manufacturing, and flex/office space. It leases its buildings to single tenants under triple-net leases. STAG is also highly diversified by tenant, market, and industry.

Aside from its diversification, two factors make STAG stand out from other REITs. First, it's one of the few REITs that pays a monthly dividend. The REIT primarily grows by acquiring additional properties, many with the intention of adding value through leasing, expansion, and development opportunities.

4. Innovative Industrial Properties

NYSE: IIPR

Key Data Points

Innovative Industrial Properties (IIPR -0.89%) focuses on owning specialized industrial properties leased to state-licensed cannabis operators. As of late 2025, the company owned 112 properties across 19 states.

Innovative Industrial Properties helps provide capital to the cannabis sector. It completes sale-leaseback transactions to acquire dispensaries, cultivation facilities, processing facilities, manufacturing facilities, and other properties that it leases back to regulated operators, giving them the capital to continue expanding their operations.

The REIT started a new initiative in 2025 to invest in life science properties. It agreed to invest up to $270 million in IQHQ, a life science real estate platform with more than $5 billion in assets. The company expects to pursue additional investment opportunities in this large and growing sector.

5. Rexford Industrial Realty

NYSE: REXR

Key Data Points

Rexford Industrial (REXR -0.03%) is a pure-play industrial REIT focused solely on the Southern California industrial market. It's one of the largest markets in the world, benefiting from high demand, low supply, and high barriers to entry. Those market conditions keep occupancy levels high, driving healthy rental growth rates.

The REIT owns about 420 properties in Southern California with 51 million square feet of space leased to more than 1,600 customers. It steadily expands its portfolio by acquiring new properties, often with the purpose of adding additional value through leasing, expansion, or redevelopment.

6. Lineage Logistics

NASDAQ: LINE

Key Data Points

NYSE: EGP

Key Data Points

Related investing topics

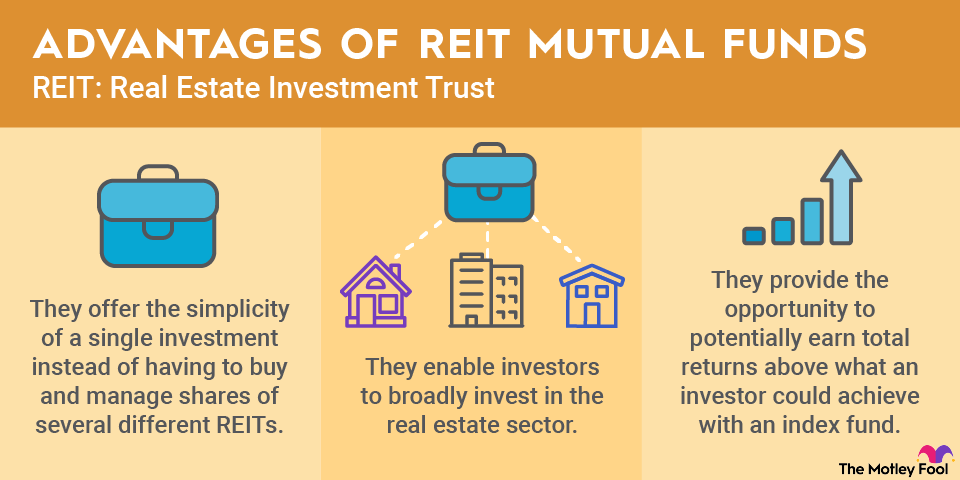

Ways to invest in industrial REITs

Investors have a few ways to invest in industrial REITs. They can invest in an individual industrial REIT that they believe can meet their needs (dividend income or total return potential). They could also invest in a basket of several industrial REITs focused on different property types or regions to build a more diversified portfolio. Finally, an investor can buy shares of a REIT ETF to gain exposure to the entire REIT sector, including industrial REITs.