Over the past couple of decades, hydrogen stocks have not been particularly good investments. The technology has been expensive, access to hydrogen as a fuel has been limited (and also expensive), and the applications of the technology have remained quite niche.

Moreover, hydrogen has been incredibly unprofitable. The oldest public companies in the hydrogen and fuel-cell business, FuelCell Energy (FCEL -2.82%), Plug Power (PLUG -0.65%) and Ballard Power Systems (BLDP -3.48%), have spent the past decade soaking up investor capital, then burning through it faster than you can say "innovation."

Even with investors flooding into the sector over the past year, sending shares up sharply, they've continued to burn cash. There's one exception: Bloom Energy (BE -2.45%) has generated positive operating cash, and -- in a bit of a spoiler -- that's one reason I bought shares of Bloom Energy recently.

The hydrogen industry could be reaching an inflection point at last. Image source: Getty Images.

Here's why I (finally) invested in a hydrogen company, and why Bloom was the stock I chose.

The game is changing

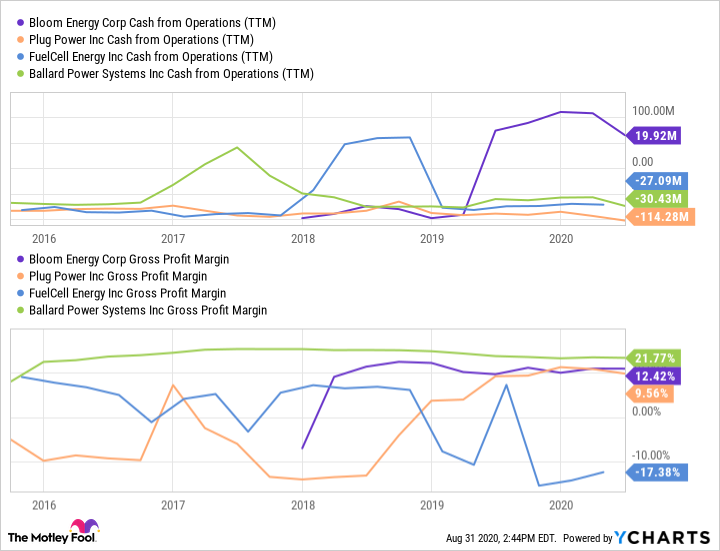

Hydrogen/fuel-cell companies have been cash-burning machines over the past 20 years. Plug Power, FuelCell Energy, and Ballard Power Systems have long -- very long -- track records of cash consumption and net losses:

PLUG Cash from Operations (TTM) data by YCharts.

There are multiple reasons behind this, but most notable is the difficulty all three companies have had in developing a large market for their various products and services. While all three have grown revenue over the past 20 years, their combined revenues were less than $450 million over the last four quarters:

PLUG Revenue (TTM) data by YCharts.

Despite decades of research and development spending and market-building, hydrogen fuel cells have remained an expensive niche industry. The technology has remained limited, and the cost for hydrogen has made it relatively expensive compared to other energy sources.

The biggest reason is that most hydrogen is produced from fossil fuels, mainly natural gas. It will never be cheaper to produce hydrogen from natural gas than it is to just use the natural gas as a fuel directly. Moreover, hydrogen's "environmentally friendly" status is undermined by its reliance on fossil fuels.

But that narrative is starting to shift. Renewable energy production from wind and solar is getting cheaper. And that means electrolysis -- producing hydrogen by separating water molecules -- is getting cheaper, too.

Bloom Energy is in the best position to profit and grow from the falling costs of renewables, which could finally unlock hydrogen's potential as a truly zero-emission fuel. Bloom has announced several major partnerships this year, including a venture with Samsung Heavy Industries, and a separate deal with a major South Korean engineering and construction company. These two joint ventures could be worth some 700 megawatts per year in fuel-cell deployments. For context, that would be almost seven times Bloom's total sales over the prior year. (Editor's note: The previous sentence has been corrected.)

While many of hydrogen's limited successes so far have been in smaller applications like forklifts and in remote power generation, Bloom is betting big on utility-scale and industrial applications like container-ship power plants.

Bloom's scale is an advantage

Bloom is the biggest pure play in hydrogen. It generated almost 60% more revenue than its three major rivals combined over the past 12 months. And that scale looks to be an advantage, as the two partnerships highlighted above show.

It's one of the reasons Bloom has been able to generate positive operating cash over the past year, while its smaller peers have struggled to generate positive operating cash:

BE Cash from Operations (TTM) data by YCharts.

As the chart above shows, Bloom has also had better gross margins than its peers with the exception of Ballard Power Systems.

I expect that Bloom's scale will continue to act as an advantage. The power generation industry is a multitrillion-dollar market. And the push to clean up the emissions from ocean-going vessels is another business that Bloom's technical expertise and its size position it to profit from.

Inflection point, or just another bubble?

Over the past year, investors have sent hydrogen stocks rocketing higher:

That's happened even as the industry -- Bloom included -- has continued to lose money, and with only Bloom generating positive operating cash over the period.

The truth is, this isn't unusual for hydrogen stocks: Ballard, FuelCell Energy, and Plug Power have all gone through similar periods of booming stock prices, only to go bust. I'll be the first to admit that we could see the same thing happen again, just by looking at the price-to-sales multiples investors are paying for Ballard and Plug Power, and to a lesser extent, FuelCell Energy:

But at a price of less than 3 times sales, Bloom Energy isn't nearly as expensive as its much smaller peers. It's also the biggest business of the group, even if it has a much smaller market cap than Plug Power and Ballard after the massive run-up in their stock prices over the past year.

I fully expect Bloom's peers will come back to earth at some point, barring a remarkable turnaround in their business results. That could impact Bloom's share price as well, as investors "punish" the group. I also expect that Bloom will have to spend a lot of cash to build out its capacity even further, and that could add operating expense faster than it results in new sales as those ventures get up to speed.

But looking at the bigger picture, and considering the risks, I think Bloom's prospects as a solid long-term investment are good. Between its scale, partnerships, and the falling costs of renewables to unlock the potential for hydrogen, Bloom has the best chance at delivering something hydrogen investors have yet to see in more than two decades of hoping: profitable growth.