If you're invested in stocks and dream about seeing your money multiply, your best bet is to buy rock-solid stocks with indisputable growth catalysts and hold them tight for years, even practically forever, and ignore their day-to-day price movements all along. Compounding works like magic over years, and that's the only recipe you need to build wealth. Here are five such incredible stocks from diverse industries you can hold forever.

Winning the clean energy game

If countries targeting net-zero emissions by 2050 were to meet their goal, the International Energy Agency projects renewables to supply 60% of global electricity by then, up from only 27% in 2019. That makes for an incredibly compelling investment criteria for renewable-energy stocks, especially ones that are already setting themselves up to exploit the massive opportunities. NextEra Energy (NEE 0.13%) is the stock that comes straight to my mind for three key reasons:

- It is the world's largest solar and wind energy producer.

- It has a backlog larger than its existing capacity.

- It's a dividend growth stock.

Image source: Getty Images.

To top that, NextEra is also the largest utility in the U.S., which means this stock offers you the best of both worlds -- resiliency that comes with a defensive utility stock, and growth from renewable energy. That also makes NextEra one of the rare Dividend Aristocrats primed for growth, which is a winning combination any long-term investor in stocks would want to own.

A steadfast all-weather stock

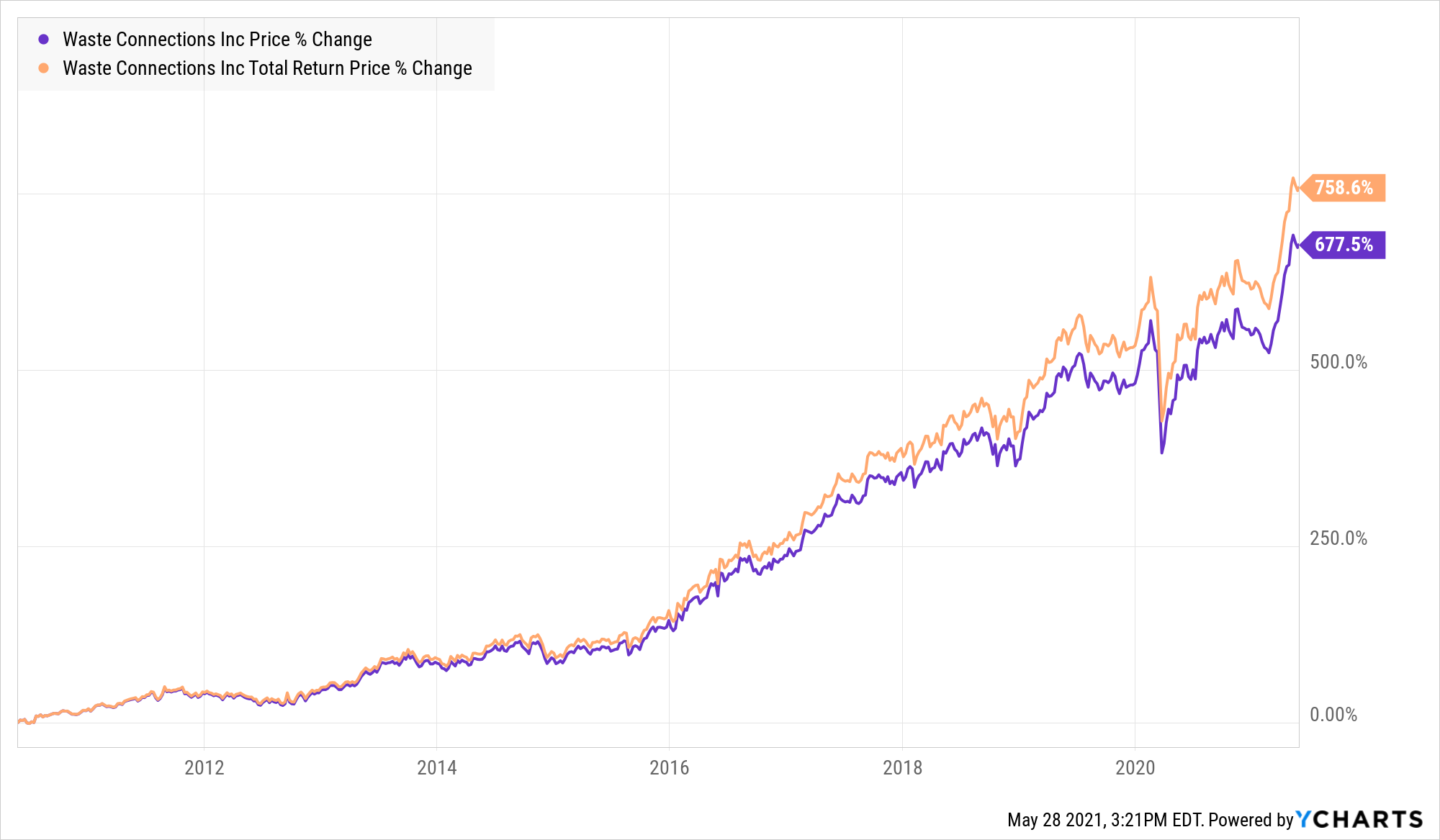

You may find high-flying tech stocks alluring, but you'd be stunned to know how some of the most boring, underrated stocks can be massive multibaggers. Here's a chart of one such stock you'd want to chew on.

It doesn't take much to understand why Waste Connections (WCN -0.43%) has stood the test of time. The business of collecting, disposing, and recycling waste is timeless and immune to the ups and downs of the economy. If this ensures steady income and cash flows for Waste Connections, the company's two-pronged strategy has helped it grow. First is its hunger for acquisitions, particularly in the less-penetrated rural markets, and second is its foothold in the oil and gas sector that's made it a leading oil waste management player.

To top that, Waste Connections has grown dividends by double-digit percentages every year for the past 10 years. The trend should continue, which is yet another reason to own this stock for as long as you can.

The War on Cash and trillion-dollar opportunities

The world still largely transacts in cash, a large portion of global population remains unbanked, and e-commerce still has a long way to go in most parts of the world. In short, e-commerce and digital payments are two megatrends that could drive monstrous gains for investors in a stock like Mastercard (MA 0.79%) in coming decades.

While its core payments processing platform which facilitates payments made using credit, debit, and prepaid cards is a steady cash cow, Mastercard is a nimble company making all the right growth moves for a bigger future. A cryptocurrency rewards credit card, investment in blockchain technology, and its recent acquisition of digital identity company Ekata are just some of Mastercard's recent fintech moves.

Mastercard has grown revenue and earnings by double-digits in the past four decades, and its dividend growth all along have hugely added to the stock's returns. With the global digital payments market projected to grow double-digits in just the next five years and Mastercard making inroads into multitrillion-dollar markets like China, it's one blue-chip stock you'd love to own forever.

The healthcare giant that's built to last

The global medical devices market could surpass $600 billion in just the next couple of years, and the global pharmaceutical market could grow at double-digit compound annual growth rates and cross $900 billion by 2027. One company that could make the most of these opportunities is Johnson & Johnson (JNJ 6.21%). And let's not forget its consumer health division, which sells products under popular brand names like Band-Aid, Listerine, Neutrogena, and Tylenol.

In 2020, Johnson & Johnson derived 55% sales to the tune of $45.6 billion from pharmaceuticals. And although its medical-device sales were hit by the COVID-19 pandemic, the segment accounted for 28% revenue and generated sales worth $23 billion. Johnson & Johnson has an enviable biotech pipeline, recently made a big headway into immunology with the Momenta Pharmaceuticals acquisitions, continues to prioritize spending on research and development, and is committed to shareholder returns through dividends and share repurchases.

Johnson & Johnson's unbeatable 59-year streak of dividend increases has, in fact, been a big reason long-term investors in the stock have become millionaires.

Johnson & Johnson's COVID-19 vaccine ran into some hurdles, but that doesn't and shouldn't steal the thunder from the company's inherent capabilities. Johnson & Johnson has been around for more than a century, and it's one of the best Dividend Kings you could buy and hold forever.

Balancing two hottest megatrends: e-commerce and streaming

Despite its run-up in recent years, Amazon.com (AMZN -1.41%) remains a no-brainer stock to hold, especially after its latest megamove.

Amazon's impending $8.45 billion move to acquire MGM is a masterstroke to gain headway into the hot TV streaming space that's projected to grow at double-digit compound annual rates in coming years. Proof of the growth potential lies in Amazon's numbers itself: Its Prime Video streaming hours jumped 70% in 2020, and its Prime membership count crossed 200 million earlier this year. On its first-quarter earnings call, management highlighted how Prime Video is "a significant" channel to acquire and retain members in countries where Prime is offered.

And while it tries to gain clout in content streaming, Amazon's leadership in e-commerce remains undisputed and its cloud infrastructure services, Amazon Web Services (AWS), a major profit center and growth driver. AWS is a high-margin segment and had a backlog of $52.9 billion as of the end of March. For perspective, AWS generated net sales worth $45 billion in 2020.

In short, it's hard to quantify Amazon's addressable market, which is why you wouldn't regret owning this stock.