Shares of Virgin Galactic (SPCE 2.56%) stock soared 13.5% through 11:45 a.m. ET Monday, and for a most surprising reason: Investment bank TD Cowen lowered its price target on the space stock to $2 per share this morning.

Now why would investors look at this report and think it good news? Because despite the lower price target, Cowen says Virgin Galactic stock is still a buy.

NYSE: SPCE

Key Data Points

Is bad news good news for Virgin Galactic?

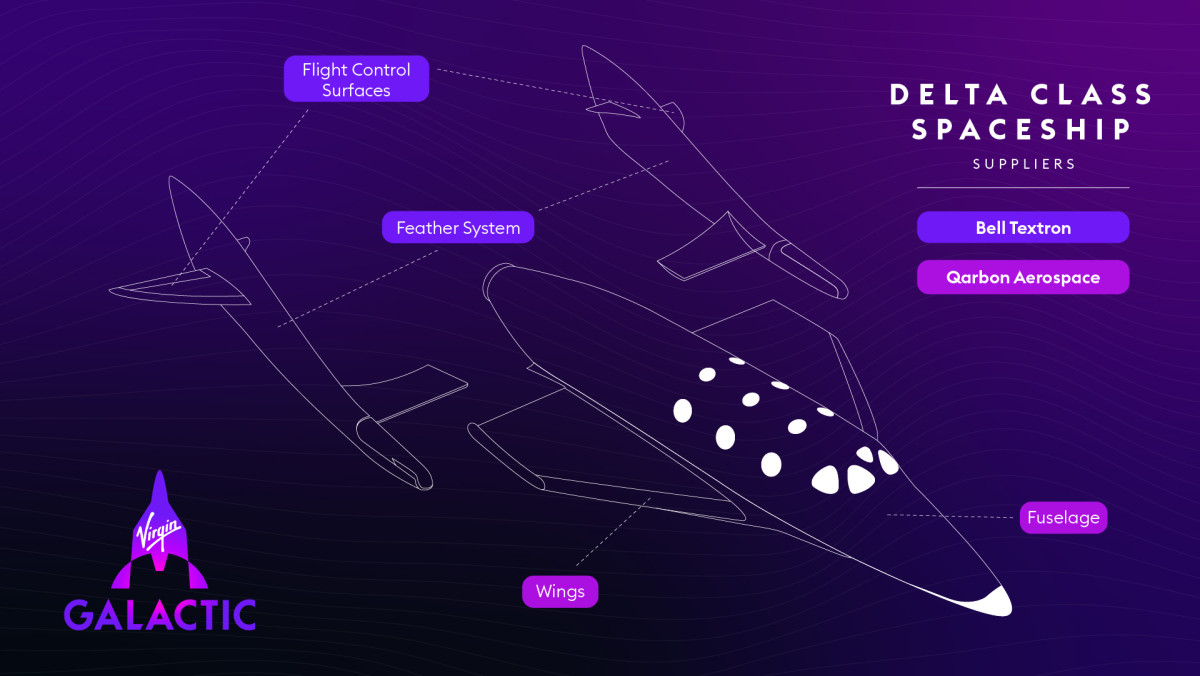

As the analyst explains in a note covered on The Fly, Virgin Galactic confirmed in its last earnings report that it is on track to build two new Delta-class spaceplanes by early 2026. With two planes flying weekly, and charging more for tickets, the analyst anticipates Virgin Galactic will generate about $450 million in annual revenue and be free-cash-flow-positive to boot.

All of these estimates tally with what Virgin Galactic itself has already told investors, and aim to allay worries about what happens before 2026 -- specifically, the fact that Virgin Galactic will retire the only spaceplane it is currently flying next month, and will spend the next two years with no means of generating any revenue at all.

Is Virgin Galactic stock a buy?

And so investors are presented with a sort of all-or-nothing bet on Virgin Galactic. In a worst-case scenario, two years of no revenue could turn into three or four or more years if problems arise with Delta's development, the spaceplane fails to arrive on schedule -- or it even simply gets significantly delayed. Virgin Galactic could run out of money and go bankrupt before it builds a new business model.

Alternatively, everything could go exactly as planned, Virgin Galactic's cash could hold out just long enough to get Delta built and flying, and the business could turn profitable in late 2026. If Cowen's right and this is how things play out, Virgin Galactic stock could be worth nearly twice its current price.

The problem for investors of course, is that they'll have to wait two more years to find out if Cowen was right!