Information technology is the largest of 11 sectors in the S&P 500, with a weighting of 33.9%. That's partly because the sector is home to the world's three most valuable companies: Nvidia, Microsoft, and Apple, which have a combined market capitalization of $11 trillion.

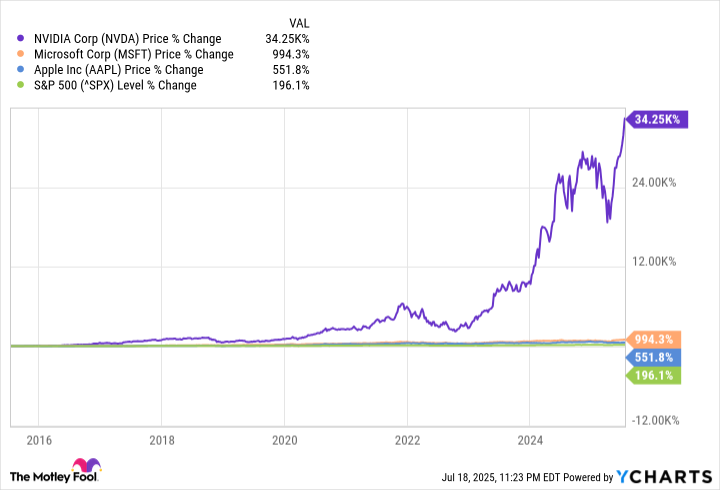

They have each obliterated the return of the S&P 500 over the past decade:

Investors who haven't owned those three tech titans have probably underperformed the broader market. However, they aren't the only high-flying stocks in the information technology sector, and there's a simple way to buy them all.

The Vanguard Information Technology ETF (VGT 0.64%) is an exchange-traded fund (ETF) that invests exclusively in information technology stocks. It outperformed the S&P 500 every year, on average, since it was established in 2004, and it's on track to do so again in 2025.

Image source: Getty Images.

The world's most dominant tech stocks packed into one low-cost ETF

The Vanguard ETF isn't limited to the information technology stocks within the S&P 500 alone -- it invests across the entire sector. It holds 319 stocks from 12 \information technology subsegments including semiconductors, systems software, and application software.

The semiconductor segment is the largest by far with a weighting of 30.4%, which shouldn't be a surprise considering data center hardware is at the heart of the artificial intelligence (AI) boom. Nvidia's market capitalization recently topped $4.2 trillion because of the enormous demand for its data center chips, and even Broadcom has become a trillion-dollar giant thanks to its AI hardware sales.

But the AI theme is prevalent throughout the entire information technology sector. In fact, each of the top 10 holdings in the Vanguard ETF -- which represent 58.8% of the value of its portfolio -- is participating in the AI race.

|

Stock |

Vanguard ETF Portfolio Weighting |

|---|---|

|

1. Nvidia |

16.74% |

|

2. Microsoft |

14.89% |

|

3. Apple |

13.03% |

|

4. Broadcom |

4.57% |

|

5. Oracle |

2.05% |

|

6. Palantir Technologies |

1.64% |

|

7. Cisco Systems |

1.58% |

|

8. International Business Machines |

1.56% |

|

9. Salesforce |

1.47% |

|

10. Advanced Micro Devices |

1.31% |

Data source: Vanguard. Portfolio weightings are accurate as of June 30, 2025, and are subject to change.

Microsoft and Oracle are two of Nvidia's biggest customers. They operate a growing number of data centers fitted with thousands of AI chips, and they rent the computing capacity to businesses and developers for profit. Microsoft, however, has also become a leader in AI software thanks to its Copilot virtual assistant, which is integrated into each of its most popular products including Windows and 365 (Word, Excel, and PowerPoint).

Palantir is another AI software powerhouse. It operates three core platforms: Gotham and Foundry help businesses and governments extract actionable insights from their data, and AIP (Artificial Intelligence Platform) helps them integrate AI into their everyday workflows. Prominent tech analyst Dan Ives from Wedbush Securities believes Palantir's valuation could soar by 177% to reach $1 trillion within the next three years, as enterprises race to turn their data into dollars.

Outside of its top 10 holdings, the Vanguard ETF holds a number of other prominent AI software stocks. They include AI cybersecurity giants Palo Alto Networks and CrowdStrike, plus Adobe, and Snowflake, to name just a few.

The best part about the Vanguard ETF might be its ultra-low cost. It has an expense ratio of just 0.09%, so a $10,000 investment would incur an annual fee of just $9. Vanguard says competing funds across the industry charge an average of 0.93%, so they are a whopping 10 times more expensive to own.

On course to beat the S&P 500 again in 2025

The Vanguard Information Technology ETF generated a compound annual return of 13.7% since its inception in 2004, handily beating the S&P 500 which has returned an average of 10.1% per year over the same period.

That trend looks set to continue in 2025, because the ETF was sitting on a year-to-date gain of 10.3% as of market close July 18, whereas the S&P was sitting on a lesser gain of 7.3%. Tech stocks are having yet another stellar year thanks to AI, with shares of Microsoft, Nvidia, and Palantir up 21%, 24%, and 104%, respectively.

But investors should never put all of their eggs in one basket. If the AI boom falters, those high-flying stocks could suffer steep corrections which might lead the information technology sector to temporarily underperform the rest of the market. As a result, this Vanguard ETF should only be added to a diversified portfolio to mitigate risk.

That strategy can still drive incredible returns if things go well. An investor who placed $20,000 in the S&P 500 in 2004 would be sitting on $167,000 today. But had they split the $20,000 equally and placed $10,000 in the S&P 500 and $10,000 in the Vanguard ETF, they would have $264,800 today. That's a life-changing difference for most people.