Enbridge (ENB 1.15%) is one of my core energy holdings. That's partly because of the lofty 6% dividend yield, but the real appeal is the company's energy business. Here are 10 reasons I own Enbridge and you might want to own it, too.

1. Enbridge has an attractive dividend yield

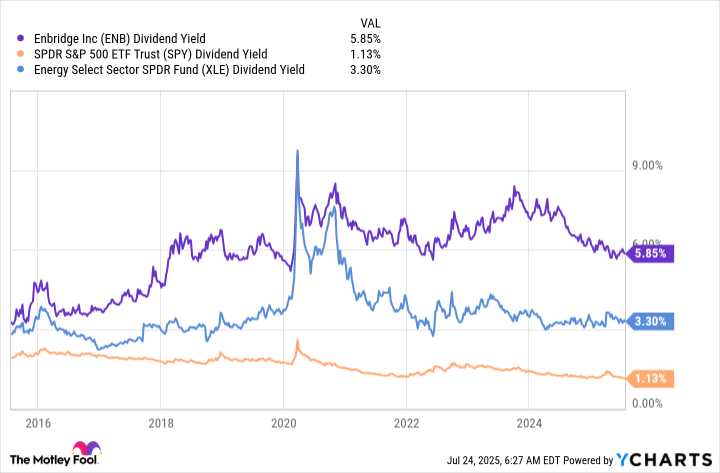

I'm a dividend investor, so Enbridge's dividend yield is important to me. At 6% it is high on an absolute basis. But it is high on a relative basis, too. For example, the S&P 500 is offering only a scant 1.2% yield, and the average energy stock's yield is just 3.4% or so. If you like dividends, as I do, Enbridge is going to be attractive.

Image source: Getty Images.

2. Enbridge's dividend is reliable

I learned the hard way that buying stocks based on their yield alone is a mistake. Which is why I also focus on dividend history. Focusing on companies that regularly increase their dividends weeds out a lot of bad businesses. Enbridge has hiked its dividend, in Canadian dollars, for 30 consecutive years. It has proven to be a reliable dividend stock.

3. Enbridge has a strong financial foundation

Even historically reliable dividend payers sometimes cut their dividends. So it is also important to check the balance sheet. Enbridge has an investment-grade credit rating. That means that not only does it have a strong financial foundation, but it also has access to affordable capital when it taps the debt markets.

4. Enbridge has a solid business model

On top of the foundation here, Enbridge has built a highly reliable and boring business. That's great news because it operates in the highly volatile energy sector. Essentially, it owns the infrastructure assets, like pipelines, that move oil and natural gas around the world. It charges fees for the use of these assets, which generates the income it uses to pay that fat dividend. Given the importance of energy to modern life, demand for Enbridge's services tends to be robust regardless of commodity prices.

NYSE: ENB

Key Data Points

5. Enbridge is big enough to be an industry consolidator

There are plenty of companies that do something similar to what Enbridge does. But Enbridge happens to be one of the largest players in the midstream sector in North America. Being an industry giant with a market cap of roughly $100 billion not only provides the company with scale, but it also means that Enbridge can buy up smaller peers to augment its business or expand into new businesses (more on this below). That's helped along, of course, by the company's financial strength.

6. Enbridge has plenty of levers to pull

Not only can Enbridge grow via acquisition, but its vast portfolio of assets also affords it plenty of opportunity for capital investment. In fact, internal growth is a core focus as the company looks to upgrade assets and expand capacity. And when it buys new assets, it often looks for situations where it can add value over time via additional capital investment, helping to create a virtuous and ongoing cycle of growth. Which brings up the next point, about the other assets Enbridge owns.

7. Enbridge is getting regulated in a good way

Enbridge's core business is moving oil and natural gas. However, its big-picture focus is providing the world with the energy it needs. That's why the company has been shifting more and more toward natural gas and other cleaner energy sources. For example, it recently bought three regulated natural gas utilities from Dominion Energy. These regulated assets are reliable cash flow generators, and they shift the business toward a "cleaner" fuel and provide ongoing investment opportunities. This move solidifies the company's growth prospects and makes additional dividend hikes more likely.

8. Enbridge's future isn't just about gas

The shift toward natural gas is one big reason why I like Enbridge's energy business. But the hidden value here is the company's modest exposure to renewable power. Enbridge has been investing in clean energy for a while at this point and understands the business well. It owns some large offshore wind farms in Europe and other, more modest renewable power assets. This toehold prepares Enbridge for a future in which meeting the world's energy needs means focusing more on clean energy.

Data by YCharts.

9. Enbridge is easier than an MLP

Enbridge has peers that offer similar positives, most notably Enterprise Products Partners (EPD 0.27%). But Enbridge is a traditional corporation, while Enterprise is a master limited partnership, which is a lot more complicated to own. I prefer to keep my financial life as simple as possible, and dealing with the K-1 tax forms that MLPs require every year just isn't worth it to me if I can get all the benefits without the hassle from a great business like Enbridge.

10. I can skip the tax headache from owning a Canadian stock

Enbridge is a Canadian company, which means U.S. shareholders have to pay Canadian taxes on the income they collect. But there's a workaround. A tax treaty allows U.S. investors to avoid Canadian taxes if the shares are owned in a tax-advantaged account like a Roth IRA. The ability to take advantage of this depends on your broker, which has to fill out some forms to make it happen. My broker has done its homework, and I can happily avoid the Canadian tax issue. The only negative I can't avoid is that the dividends U.S. investors receive will vary along with interest rates.

Enbridge checks almost all the boxes

When I look down the list of positives for Enbridge, I am very happy to be a shareholder. Is it a perfect investment? Of course not, but no company is. The balance of positives to negatives, however, is so compelling that I almost had no choice but to buy the stock. And my plan is to hold it forever now that I have.