Over the last three years, some of the biggest gains from the artificial intelligence (AI) megatrend have centered on semiconductors, data centers, cloud computing infrastructure, and enterprise software. But like all maturing themes, investors are craving a new wave of opportunity.

Enter quantum computing, an emerging technology that is projected to have over $1 trillion in economic value by next decade, according to global management consulting firm McKinsey & Company.

Unlike traditional AI applications, investors seem infatuated with speculative opportunities when it comes to investing in quantum computing stocks. Rather than traditional power players such as Nvidia, Alphabet, Microsoft, or Amazon, one of the most talked-about names in the quantum era is Quantum Computing Inc. (QUBT +4.34%), or QCi for short.

Quantum Computing (the company) just reported earnings for the second calendar quarter of 2025 -- and let me tell you, there is a lot to unpack. Is Quantum Computing stock a buy after its Q2 report?

NASDAQ: QUBT

Key Data Points

Analyzing Quantum Computing's business results

QCi's second-quarter earnings report highlighted several updates -- including mentions of a partnership with NASA, its addition to the Russell 2000 index, and incremental progress on its photonic qubit technology.

While these details make for exciting headline content, how have they translated into measurable business results?

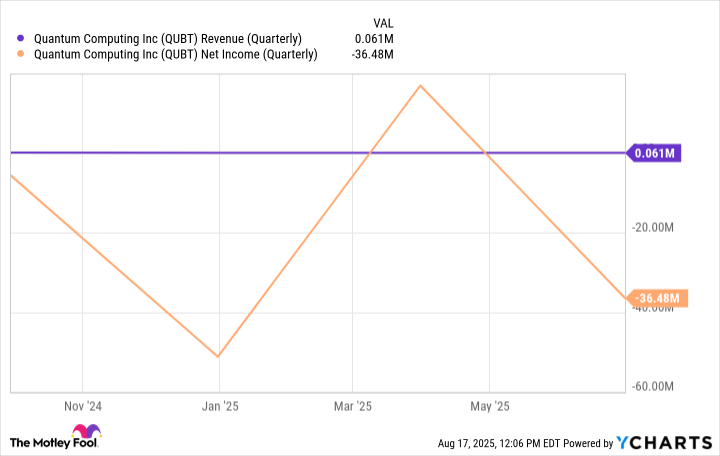

QUBT Revenue (Quarterly) data by YCharts

In Q2, the company generated just $61,000 in sales while posting a net loss of $36.5 million. In other words, QCi essentially remains a pre-revenue business with no proven path to a turnaround or sustained positive unit economics.

Distinguishing narrative from reality

While quantum computing (the technology) is increasingly hailed as the next frontier of AI, prudent investors should remain cautious. At present, the field is still dominated by research and development (R&D) rather than practical utility.

Quantum Computing (the company) is not signing Fortune 500 clients at a record pace because of any groundbreaking innovations it has achieved -- far from it.

Frankly, I see QCi more as a hype-driven branding story -- perhaps deliberately spinning an exciting narrative while the core business fundamentals tell a very different story.

Image source: Getty Images.

Is Quantum Computing stock a buy?

With such minimal traction and mounting losses, Quantum Computing looks more aspirational than investable -- focused on conceptual breakthroughs rather than tangible applications adopted by enterprise customers at scale.

Where bullish investors might push back is on the company's balance sheet. Despite QCi's tiny revenue base and recurring burn, the company ended Q2 with $349 million of cash and equivalents.

Investors should not be fooled by this. Quantum Computing's balance sheet strength comes from stock issuances as opposed to organic cash generation. This brings up the heart of the bear storyline: valuation.

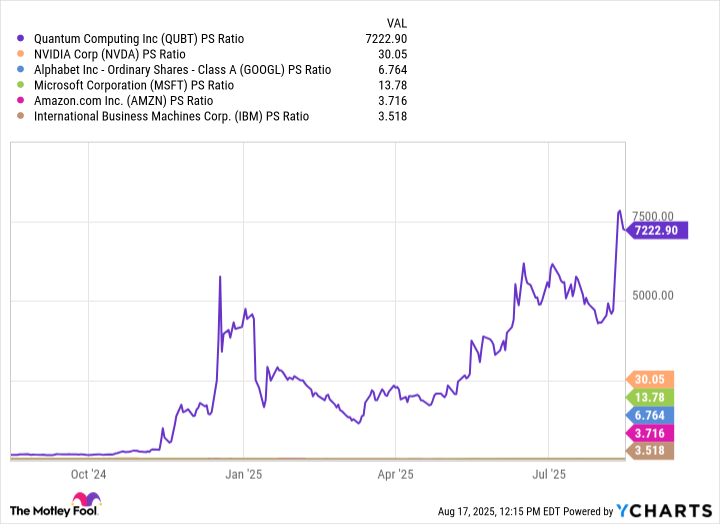

As of market close on Aug. 15, QCi boasted a market cap of $2.4 billion -- equating to a price-to-sales (P/S) multiple of more than 7,000. For perspective, this is orders of magnitude higher than established AI leaders with proven disruption.

QUBT PS Ratio data by YCharts

I think it's clear that Quantum Computing's management understands the disconnect between the company's valuation and business fundamentals. Issuing shares during a frothy stock market environment suggests that the company is capitalizing on enthusiasm driven largely by speculation and unsuspecting buyers before a valuation reset could -- and likely will -- occur.

The key takeaway here is that QCi stock may look like a bargain for "just $15" per share, but smart investors understand that the absolute share price does not solely determine the value of a business.

Quantum Computing (the company) is historically pricey and trading at levels reminiscent of the stock market bubble of the late 1990s driven by euphoria around the internet. With nearly no revenue, widening losses, and a dependence on equity raises, I think QCi is facing a looming liquidity crunch.

At best, QCi is a moonshot gamble. Unless you are an investor comfortable with extreme volatility and abnormally outsize risk, Quantum Computing stock is best avoided for the time being.