Adobe (ADBE 7.31%)'s stock has been struggling mightily in recent months. It has fallen by 25% this year, and it hasn't been trading at such low levels since 2023. For a leading tech company to be in such a rapid decline, this could open up a great opportunity for investors to buy right now, particularly as an investment to hang on to for the long term.

But is Adobe's stock really a bargain buy, or are there risks that are weighing on its valuation which should make you think twice about investing in it?

Image source: Getty Images.

Adobe has normally traded at a much higher earnings multiple

A year ago, Adobe was trading at a significant premium as its price-to-earnings (P/E) multiple was well over 40. Now, however, the stock's P/E multiple is around 21. A lower earnings multiple can signify that investors see problems with the business and are concerned about its future growth prospects, which is what I believe is happening.

In Adobe's case, there are reasons to indeed be concerned about its future. While it has some prominent software titles in its portfolio, including Photoshop and Acrobat, artificial intelligence (AI) is leveling the playing field for competitors and at the same time giving users new ways, such as chatbots, to edit and create images in seconds. As a result, it may become more difficult for customers to justify keeping a subscription to Adobe's software when there may be far cheaper alternatives.

The good news, however, is that despite these concerns, the business still hasn't been performing badly.

The business is still growing in double digits

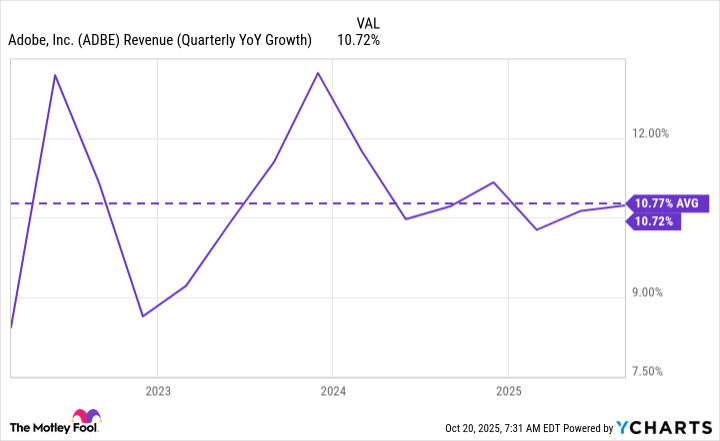

What's encouraging about Adobe is that despite the competition in AI and design software, its sales haven't fallen over a cliff. Its growth rate remains above 10%, which is in line with its average over the past few years.

ADBE Revenue (Quarterly YoY Growth) data by YCharts

But that doesn't mean it's out of the clear by any means, or that AI isn't a long-term concern. The big question boils down to whether this resiliency is a sign of strength in its brand and portfolio of products, or whether it's simply too early to tell if consumers are pivoting away from the software.

It could take some time before cancellations show up in the company's earnings and affect its numbers, as Adobe isn't known for making things easy. In the past, the Federal Trade Commissioner has taken action against the software giant about making it too difficult to cancel its recurring subscriptions, and there are plenty of social media posts expressing frustration over the issue.

While there's no denying how successful and popular Adobe's products have been over the years, whether they can withstand the threat from AI is what could make or break the stock as a long-term investment.

NASDAQ: ADBE

Key Data Points

Why Adobe's stock might be worth buying

AI is making it easier for anyone to be a photo editor, even without advanced skills, and that can make it difficult for Adobe to convince consumers that its premium-priced software is worth subscribing to now

But Adobe also has flexibility to adjust pricing and offer promotions to win over customers -- its gross profit margin is close to 90%, which gives it plenty of room to maneuver on price while still ensuring it posts strong earnings numbers. Adobe has also enhanced its applications with AI and that has helped give its sales a boost of late.

While there is some risk with the stock, at a significantly reduced valuation and its P/E multiple now below the S&P 500 average of 25, there's a good margin of safety that comes with these shares, which is why Adobe might be worth buying on weakness today. The business may face challenges, but by no means is it in a dire situation.