In the hot field of artificial intelligence (AI), Nvidia (NVDA 3.13%) is arguably the king of the mountain. Its stellar AI-driven sales growth has been holding Wall Street's attention for several years now, but its blockbuster deals in 2025 are once again redefining its role in the AI ecosystem.

So it's no surprise Nvidia shares were up 40% this year through the week ending Nov. 7. The company broke a market cap record by being the first to surpass $4 trillion in July, then hit another big milestone a few months later by being the first to exceed $5 trillion.

Nvidia is an extraordinary company navigating extraordinary times, given the impact of AI across industries. But does it make sense to buy shares before it announces its fiscal third-quarter results on Nov. 19?

Image source: Nvidia.

Better valuation than its peers

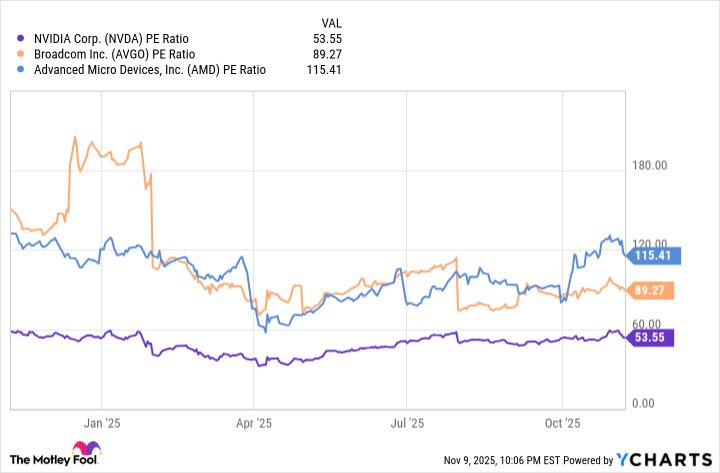

A key factor to consider when weighing whether to invest in Nvidia is its valuation. This can be assessed by comparing various metrics to competitors in the semiconductor space, such as AMD and Broadcom.

For example, let's consider their price-to-earnings (P/E) ratios, which reflect how much investors are paying for a dollar's worth of each company's earnings over the trailing 12 months.

Data by YCharts.

Nvidia has the lowest P/E ratio of the trio, indicating it's the best value among peers by that measure. In fact, Nvidia's earnings multiple is a bit lower than where it was a year ago, despite game-changing announcements since then, such as its deal to invest $100 billion in ChatGPT creator OpenAI.

Even so, a P/E ratio over 50 isn't cheap. But given where Nvidia's business is going, perhaps that valuation is warranted.

The company built its reputation on advanced semiconductor chips called graphics processing units (GPUs). These were first used for video game systems, but then, other uses for their parallel processing power were found that expanded the market for them. And with the advent of AI, the future of GPUs looks brighter than ever.

NASDAQ: NVDA

Key Data Points

Nvidia's AI revolution

Nvidia CEO Jensen Huang has predicted that AI will usher in a new industrial revolution supported by "AI factories" -- massive data centers built to handle AI workloads. His prediction is already coming to pass.

For example, the U.K. government plans to increase that country's sovereign computing capacity by a factor of 20 in just the next five years. To accomplish this, it will purchase as many as 120,000 Nvidia GPUs.

Yet that pales in comparison to OpenAI's commitment to buy millions of Nvidia AI chips in the coming years. And even that may be a drop in the bucket compared to the overall market for AI accelerators.

"AI needs specialized chips to run on, and trillions [of dollars] worth of processing chips will be up for replacement through this decade," Global X research analyst Tejas Dessai wrote in a recent research note back in August 2023. Based on what has happened since, that view has been validated.

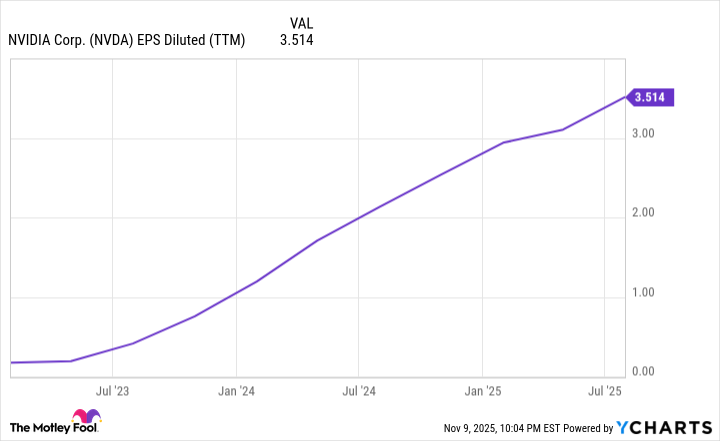

The growth ahead for Nvidia

The transition to specialized AI chips suggests Nvidia's GPU sales to date are still in the early days, and that success has already benefited shareholders. In the brief time since AI took off with the launch of ChatGPT toward the end of 2022, Nvidia's earnings per share (EPS) have been on a rocket ship.

Data by YCharts.

Moreover, outsized demand for Nvidia's GPUs is just one piece of the pie. The company went from its start providing enhanced graphics for video games to powering AI in the cloud. Now, it will deliver AI to mobile networks.

In October, Nvidia announced a deal to invest $1 billion in Nokia as they collaborate to launch the next generation of mobile telecommunications, called 6G, which will be capable of supporting AI-native wireless systems.

Nvidia also announced a $5 billion investment in Intel in September as part of a new partnership. Under the collaboration, Nvidia will make use of Intel's chip manufacturing capabilities. Nvidia has always been an entirely fabless chipmaker, outsourcing the production of its offerings. The deal also adds Intel's strengths in the PC chip arena to Nvidia's product suite.

Nvidia's dealmaking in recent months shows how it is extending its reach across the computing ecosystem. Its current P/E ratio may seem on the high side, but given its expansive and growing influence across the tech spectrum, as well as its rising earnings per share, Nvidia's shareholders could keep enjoying gains in the coming years.

That's why Nvidia remains a stock to invest in. And with its shares now down by around 7% from the 52-week high of $212.19 they reached on Oct. 29, buying them before the company announces its fiscal Q3 results on Nov. 19 may be a good move.