2025 has felt more like a boat in a storm for investors in Fluor (FLR 0.02%), a global construction business that's accustomed to dealing with concrete and steel.

In the past seven months alone, the Irving, Texas-based company has seen its stock go from a 40% slump in April to a 20% gain in July followed by another 20% plunge in August. Most recently, the stock has had to claw its way back to "only" a 7% year-to-date loss.

NYSE: FLR

Key Data Points

With a $7.3 billion market cap, Fluor is not only the smallest of six Construction & Engineering (C&E) industry stocks in the SPDR S&P MidCap 400 ETF Trust (MDY +0.10%); it's also the only one that is still in the red for the year.

The five other C&E stocks -- Comfort Systems USA (FIX 1.64%), AECOM (ACM +0.98%), APi Group (APG 1.78%), MasTech (NYSE: MTZ), and Valmont Industries (VMI 1.59%) -- are all up anywhere from 20% to 120% this year and have each reached all-time highs within the past two weeks. For its part, Fluor is still about 55% below its all-time high of $102 hit back in 2008 and about 20% below its 52-week high of $57.50 set in late July.

Cashing in, cashing out

In fairness, Fluor has not done especially well when it comes to hitting analysts quarterly earnings targets. In fact, according to Koyfin data, Fluor's third-quarter results, reported on Nov. 7, showed that the company missed top-line sales estimates for the 8th consecutive quarter after its revenue fell 17% to $3.3 billion, which was well short of the average estimate of $4.2 billion. Bottom-line adjusted earnings per share, however, rose 33% to a better-than-expected $0.68 versus analysts' projections for $0.45.

Image source: Getty Images.

Fluor also announced that it won $3.3 billion in new contracts in Q3, raising its backlog to $28.2 billion, 82% of which is reimbursable -- i.e., they pay the company for its actual costs -- rather than fixed rate projects, which offer potentially wider margins but don't cover cost overruns.

Speaking to investors on the Q3 earnings call, CEO James Breuer said the first order of business concerned the company's just-announced agreement to monetize its remaining 39% stake in NuScale -- the fast-growing maker of small modular reactors whose stock has risen over 600% in the past two years amid newfound demand for nuclear energy needed to power AI data centers.

After selling its first 15 million-share block of NuScale in October for $605 million, Fluor was happy to inform investors that plans were now set to liquidate the rest of its stake in an orderly fashion by the end of Q2 2026, Breuer said on the call. He noted that the company expects to raise $800 million by the end of February and apply it to the ongoing stock-buyback program.

In the company's October announcement, Fluor pointed out that its NuScale shares had appreciated by more than 300% since taking the company public in May 2022. Fluor has not paid a dividend since April 2020.

Brighter days ahead?

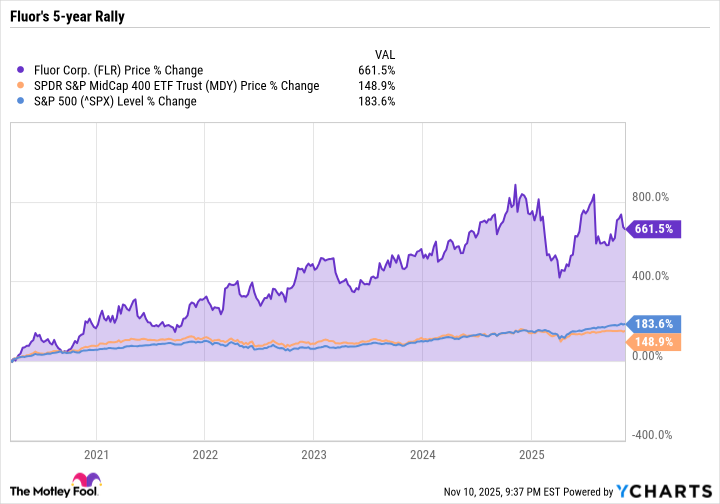

For a company founded in 1912, Fluor certainly has a long track record for investors to study, including its dramatic underperformance over the past 10 and 20 years. Tighten that range up to the company's all-time low in March of 2020, and its 650% gain is more than triple the returns delivered by the S&P 400 and 500.

Its forward price-to-earnings (P/E) ratio of 22x lands Fluor in the top quintile (20%) of where it's been over the past 10 years, meaning it has carried a lower P/E over 80% of the time. On a price-to-sales (P/S) basis, Fluor's 10-year rank is even higher, currently falling in the 90th percentile.

Of the 10 analysts who cover the stock, five rate it a buy, and the other five say hold, with an average 12-month price target of $51, which implies about 12% upside from its current level. Looking out a year, analysts currently expect Fluor to deliver full-year 2026 earnings growth of about 7% on about an 8% increase in revenue.

There's clearly a lot going on with Fluor at the moment, and a major transition is underway. While its NuScale windfall offers a nice tailwind, the company also needs to execute better if it is to win deeper support from investors.