It's been five years since Strategy (MSTR +1.66%) shocked the world with a new internal treasury policy -- it's using every dollar it can access to buy cryptocurrency Bitcoin (BTC 0.13%). Since its first Bitcoin purchase on Aug. 11, 2020, Strategy stock is up more than 1,000%.

Despite that performance, I'm glad I've never owned a single share, and I don't plan to ever buy from here.

To be clear, my aversion to Strategy stock has nothing to do with my opinion of Bitcoin. In fact, I believe that the world's largest cryptocurrency will continue to appreciate in value over the long term. Investors, businesses, and even governments want to diversify into this new asset class, and Bitcoin is the "gold standard" of cryptocurrency, so to speak.

My aversion to Strategy stock has everything to do with how it's buying Bitcoin.

Image source: Getty Images.

Stock investors are at the back of the line

Strategy owns roughly 650,000 Bitcoins at the moment, which are worth roughly $55 billion as of this writing. To acquire this much of the cryptocurrency, the company has invested over $48 billion. These funds were primarily supplied by investors -- both public and private -- rather than from its operations.

Strategy has creatively raised cash from investors. It's taken on traditional debt, issued convertible notes, created new classes of shares, and issued new Class A shares. But regardless of the method, the money ultimately comes from investors. And some of the money needs to be repaid.

NASDAQ: MSTR

Key Data Points

So far, Strategy is winning because the price of Bitcoin and its stock price keep going up. This allows it to access enough capital to buy more Bitcoin while still satisfying all of its obligations. But in a bear market, things become more difficult. And the company clearly believes a bear market is coming.

For evidence, consider that Strategy just created a $1.4 billion cash reserve fund so that it can keep paying its dividends for at least two years -- different share classes are entitled to different payouts. Creating reserves now indicates that management believes it will be harder to get funded by investors in the future.

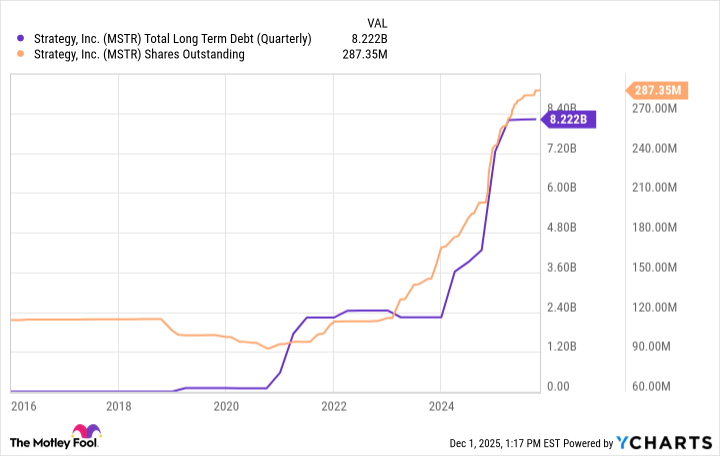

To be clear, Strategy didn't sell Bitcoin to increase its cash reserves -- that's something it's said it's unwilling to do. Rather, the company issued more shares, further diluting shareholders. The chart below shows that the share count is skyrocketing right along with its debt.

Data by YCharts.

In conclusion, Strategy's first commitment is to buy Bitcoin. Its second-highest priority is ensuring it delivers returns for institutional investors through its dividend. At the end of the line are common shareholders. And the company is demonstrating a willingness to dilute common shareholders if necessary. This reality could become exacerbated in a prolonged bear market.

In my view, buying a Bitcoin ETF or buying Bitcoin directly are better long-term options for investors thinking about Strategy stock. Buying Strategy comes with a heavy debt load and a management team that's demonstrated its lowest priority is the common shareholder. And it's why I'll never own it.