The tech sector has crushed the S&P 500 in recent years, largely due to outsize gains from semiconductor stocks like Nvidia and Broadcom. But many application software companies have been struggling.

Shares of Adobe (ADBE +1.36%), a design software specialist, are down about 27% year to date. Here's what investors should look for when Adobe reports earnings on Dec. 10, and if the former market-darling growth stock turned value stock is a buy now.

Image source: Adobe.

Adobe's roots are steeped in software as a service

Adobe was a pioneer in transitioning from a traditional software licensing model to a recurring-revenue model based on software as a service.

By bundling Photoshop, Illustrator, Premiere Pro, After Effects, InDesign, and other apps into a stand-alone subscription package, the company unlocked huge growth by capturing market share and leveraging pricing power. Its suite of apps, known as its Creative Cloud, has become the standard across major corporations, smaller businesses, professional programs, students, and individuals.

In the late 2010s, Adobe began transitioning from a revenue-focused company to a high-margin cash cow. The stock reached an all-time high in late 2021, then sold off in lockstep with the broader market in 2022, before largely recovering by the end of 2023.

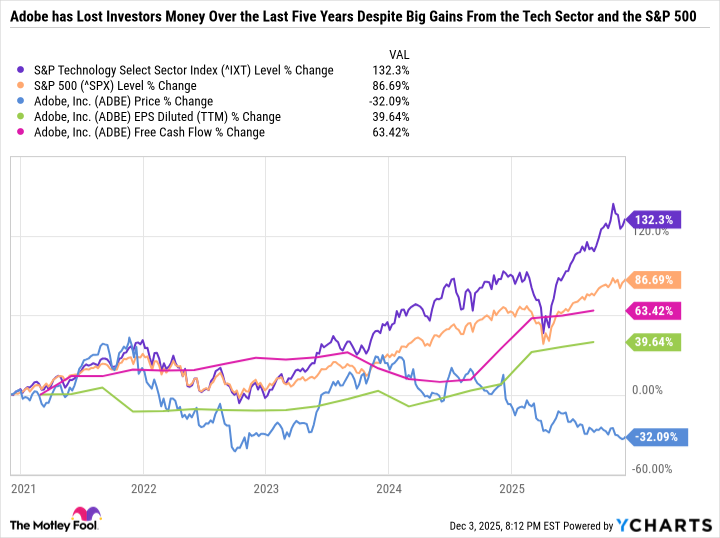

^IXT data by YCharts; TTM = trailing 12 months; EPS = earnings per share.

But Adobe has been on a downward spiral for the last two years, and it has nothing to do with its earnings. In fact, the company is generating all-time-high earnings and free cash flow (FCF). And yet, its stock price is down over the last five years.

Sentiment can overpower fundamentals in the near term

The plummeting stock price is a reminder that the market cares more about a company's future direction than its current position. And in Adobe's case, investors are concerned that the company may not be a leader in artificial intelligence (AI) -- or, at the very least, that AI will erode its competitive advantages by making it easier to interact with text, images, and videos without using its software.

The concerns are warranted because this is exactly the kind of functionality available from many generative AI tools. But it would take a lot for creatives to switch from Adobe's apps to newer tools for their professional work.

The sell-off in its stock is eerily similar to what happened to Apple and Alphabet earlier this year. Both stocks were down big because investors criticized Apple's lack of spending and slow growth, along with weak iPhone demand in China. And investors assumed that Alphabet's Google Search would lose market share to large language models, such as those developed by OpenAI, which power ChatGPT.

But Apple and Alphabet proved the doubters wrong. And since their stock prices were beaten down, both Apple and Alphabet were coiled springs waiting for a recovery.

A similar recovery could occur with Adobe if it can effectively implement AI tools and monetize them to boost productivity. Sure, it may lose some subscribers if users can do more with less and enterprises need fewer accounts. But it may be a wash if management can price its tools effectively, thereby maintaining its high margins and steadily growing revenue.

The stock hasn't been this cheap in over a decade

Adobe stock is priced as if its once-wide moat in software for creatives is already shrinking, when that is hardly the case. At 20.4 times earnings and just 14 times forward earnings, the stock is the cheapest it has been in over a decade and is trading at a steep discount to the S&P 500's 23.6 forward price-to-earnings ratio. You'll find stodgy companies growing earnings in the low single digits with multiples far higher than Adobe's.

Its stock is particularly cheap because the company continues to buy back shares rapidly, reducing the share count by 12.4% in the last five years. And that's even when factoring in a hefty amount of stock-based compensation. For context, Apple, which is known for using the bulk of its FCF on buybacks, has reduced its share count by 11.5% in the last five years.

Since Adobe has been using FCF to support buybacks and not debt, its balance sheet remains in exceptional shape -- exiting its September quarter with just $260 million in long-term debt net of cash, cash equivalents, and short-term investments.

A compelling deep-value stock to buy now

Adobe stock is dirt cheap, so the company doesn't have to do a lot right to be a market outperformer over the next three to five years. However, because the stock price continues to decline despite decent earnings growth, the market is sending a clear signal that it cares more about the composition of that earnings growth than the number itself.

As in, if Adobe can chart a clear path toward monetizing AI within its existing system, it could be a game changer for how the stock is perceived. That would be similar to how Alphabet proved that Google Search would benefit from AI by integrating Gemini into Chrome, as well as having the stand-alone Gemini app.

Adobe reports earnings on Dec. 10. Typically, management is very positive on these calls with big promises of being a leader in AI. That talk isn't good enough. Investors should sift through the confident rhetoric to uncover the measurable ways Adobe is actually monetizing AI, rather than how it claims to be doing so.