If you want a lesson on how fast markets can shift, just look at data centers. Once a mere line item on a tech company's balance sheet, these facilities are starting to garner as much press as the chips and servers inside them.

And for good reason, too. If chips are the neurons of artificial intelligence (AI), then data centers are its nervous system. And it appears the U.S. will need a lot more of them to support the increasingly ambitious AI buildout ahead. As OpenAI CEO Sam Altman put it: "I do guess that a lot of the world gets covered in data centers over time."

The problem with data centers? They need power. And a lot of it. And without investment in new power generation capacity, the possibility of straining local grids could cause delays unless infrastructure is updated.

In short, the world needs new energy capacity. And Nano Nuclear Energy (NNE 3.77%) thinks it might have the answer.

Image source: Getty Images.

What is Nano Nuclear Energy?

Nano Nuclear Energy is one of the few nuclear stocks whose name isn't symbolic or cutesy, but is literally indicative of what it is. In a nutshell, Nano is an advanced nuclear company focused on making small reactors. While not technically on the "nano" scale (that would be virtually impossible), its reactors are much smaller than the typical nuclear power plant.

That compactness is intended to make them faster and cheaper to assemble. The long-term idea is to ship reactors on trucks to clients who badly need reliable power, like data centers, remote industrial sites, or even isolated communities.

NASDAQ: NNE

Key Data Points

Nano also envisions a vertically integrated future in which it not only builds reactors, but also makes and transports reactor fuel. The core of Nano's story, however, is its family of small reactors with epic names, like ZEUS, LOKI, and KRONOS, some of which are portable.

Although it's pre-revenue, the company has made some early strategic moves. In July 2024, it signed a memorandum of understanding (MOU) with Blockfusion to assess whether Nano's reactors can supply power to the data center operator's facility in Niagara Falls.

In November 2025, Nano also signed a paid feasibility study with BaRupOn to assess deploying several KRONOS reactors at the latter's 701-acre facility in Texas. The goal would be to supply 1 gigawatt of on-site nuclear power.

A reality check on Nano's valuation

For all its potential to power a future of AI, Nano isn't a safe stock. It doesn't have a license to build its microreactors commercially. While its KRONOS design is in early NRC pre-application stages, it's not clear when (and or) it will secure full approval.

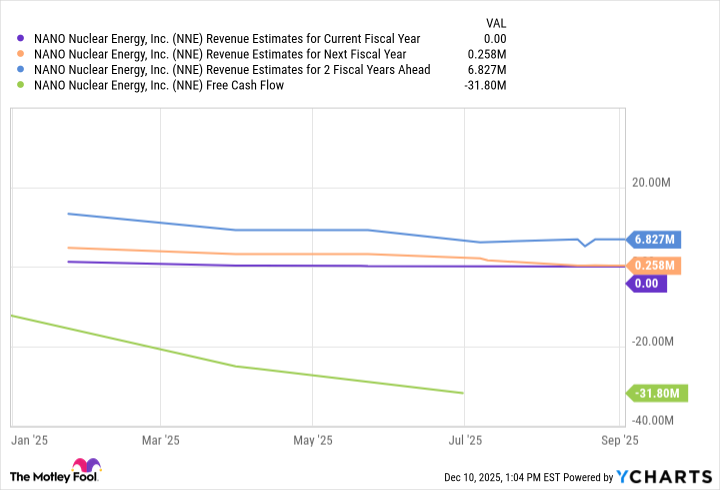

Despite that, the stock isn't cheap. The company has a roughly $1.8 billion market valuation despite no revenue. Indeed, consensus estimates don't anticipate meaningful revenue for at least a couple of years.

NNE Revenue Estimates for Current Fiscal Year data by YCharts

Of course, this is a nuclear start-up, and, as such, expectations about future growth is driving the stock price right now. The flip side of that enthusiasm, however, is sharp volatility. If sentiment shifts, stocks like Nano can sell off hard, even if there's no real change in the underlying business.

So, is Nano Nuclear a compelling buy?

Nano is a compelling play on the future of energy and AI. But investors should know what they're buying, assessing shares according to their risk tolerance.

On the one hand, Nano has a macro story working in its favor. Governments are once again talking about nuclear power as a means to achieving several goals at once (AI buildout, climate, electrification), and recent federal initiatives in the U.S. could streamline licensing for advanced nuclear technology.

Nano also had about $210 million in cash and equivalents at the end of June, with a $400 million private placement of common stock on top of that.

At the same time, Nano has to secure NRC approval for its designs in order to turn on the spigot of revenue. The company is burning cash, and it might need to raise fresh capital in the future, especially if NRC design approval takes longer than expected.

In short, Nano is a compelling buy for aggressive investors. Those with more risk aversion might be better served by a nuclear energy exchange-traded fund (ETF).