Nine publicly traded American companies are worth $1 trillion or more, but only four have graduated into the exclusive $3 trillion club so far: Nvidia, Apple, Alphabet, and Microsoft.

I think Amazon (AMZN +0.49%) could join them by the end of 2026 thanks to the accelerating revenue growth in its cloud computing division, and the surging profits in its legacy e-commerce business. The company has a market capitalization of $2.48 trillion as I write this, so investors who buy its stock today could earn a 21% return over the next year if it does cross the $3 trillion milestone.

Read on, and let's consider Amazon's growth prospects in the year ahead.

Image source: Getty Images.

All eyes on Amazon Web Services

Amazon's potential pathway to the $3 trillion club next year starts with its industry-leading cloud computing platform, Amazon Web Services (AWS). It used to be a place where businesses would simply store data and host their critical digital applications, but it has evolved to become the center of Amazon's artificial intelligence (AI) strategy.

AWS operates state-of-the-art data centers and it rents the computing capacity to AI developers who don't have the financial resources to build their own infrastructure. These data centers are filled with advanced AI chips from suppliers like Nvidia, but Amazon also designed its own chips called Inferentia and Trainium. Top developers like Anthropic are using hundreds of thousands of the latest Trainium2 chips, which offer up to 40% better price performance than competing hardware when training AI models.

Then there is the AWS Bedrock platform, where businesses can access hundreds of completed AI models from third-parties including Anthropic and Meta Platforms. Developing models from scratch is time consuming and expensive, so using a ready-made solution can help businesses achieve their AI goals much faster.

AWS generated a record $33 billion in revenue during the third quarter of 2025 (ended Sept. 30), which was up 20% year over year. That was the fastest growth rate since the fourth quarter of 2022, which highlights the platform's incredible AI-driven momentum. But it gets better, because AWS has a whopping $200 billion order backlog from customers who are waiting for more data center capacity to come online, so the strong top-line results are likely to continue.

Amazon's earnings continue to crush Wall Street's estimates

The $33 billion in third-quarter revenue that AWS brought in accounted for just 18% of Amazon's total revenue of $180 billion. However, the cloud business is the company's most profitable by far, contributing 65% of its total operating income. E-commerce is actually Amazon's largest source of revenue, but its profit margins are very thin because its Amazon.com site focuses on selling a high volume of products at low prices.

However, Amazon is pushing to improve profitability in its e-commerce business by boosting efficiency and implementing new technologies. In 2023, it broke its U.S. logistics network into eight distinct regions, so now the products in each fulfillment center are specific to their geographic region. As a result, orders travel shorter distances to reach customers, which brings down packing and shipping costs.

NASDAQ: AMZN

Key Data Points

Amazon also uses AI-powered software like Project Private Investigator in its fulfillment centers, which uses computer vision to identify defective products before they ship. This reduces returns and refunds, creating further cost savings.

The accelerating growth at AWS combined with improved efficiency in the e-commerce business is driving a huge increase in Amazon's overall profit. The company generated earnings of $5.22 per share during the first three quarters of 2025, which was a whopping 42% jump from the same period in 2024. Plus, Amazon's earnings have beaten Wall Street's consensus estimates in every single quarter of 2025, by an average of 22%.

How Amazon can cross the $3 trillion milestone in 2026

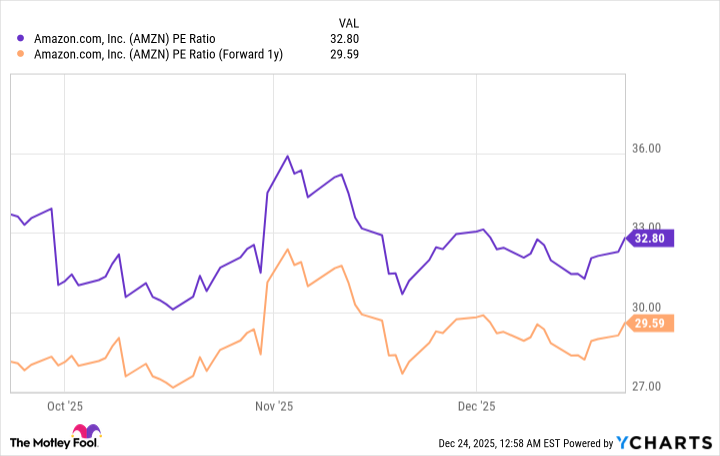

Amazon stock trades at a price-to-earnings (P/E) ratio of 32.8 as I write this. That's roughly in line with the Nasdaq-100 index which trades at a P/E ratio of 32.1, so Amazon stock is basically sitting at fair value relative to its peers in the tech sector.

Wall Street's consensus estimate (provided by Yahoo! Finance) suggests Amazon could generate earnings of $7.86 per share in 2026, placing its stock at a forward P/E ratio of 29.6.

AMZN PE Ratio data by YCharts

Assuming Wall Street is right, Amazon stock would have to climb by 11% next year just to maintain its current P/E ratio of 32.8, lifting its market cap to $2.75 trillion. But remember, the company has a habit of beating Wall Street's expectations.

If its 2026 earnings beat the consensus estimate by 22% like they have so far in 2025, then its stock could be poised for a 35% gain next year instead. That would catapult its market value to a whopping $3.35 trillion.

However, even an earnings beat of just 9% next year would be enough to see Amazon join the $3 trillion club. Given the incredible momentum across its e-commerce business and AWS, I think that's an achievable target.