Investors in Intel (INTC 2.81%) will look back at 2025 with satisfaction, as the chip giant finally stepped on the gas after years of underperformance.

The stock has shot up 80% in 2025, with a significant chunk of its gains coming in the back half of the year thanks to a slew of favorable developments. Substantial investments by the U.S. government and SoftBank have given the company a cushion as it works on a turnaround. And Nvidia's strategic partnership and $5 billion investment in Intel's shares have further strengthened its balance sheet.

Now, there is another piece of good news that could help Intel stock get off to a strong start in 2026. Let's take a closer look.

Image source: Intel

Intel could give TSMC a run for its money

Intel has fallen behind Taiwan Semiconductor Manufacturing in recent years. It has been hamstrung by delays in the development of its advanced process nodes, allowing Taiwan Semiconductor (TSMC for short) to pull ahead with its technology and establish a significantly strong customer base. As a result, Intel has been losing share in markets where it has been historically strong -- server and client central processing units (CPUs) -- and has missed the artificial intelligence (AI) gravy train.

NASDAQ: INTC

Key Data Points

With TSMC all set to move to a new process node in 2026, Intel needs to step up its game in the new year. The Taiwan company's 3-nanometer (nm) process node has been a huge hit among customers, thanks to its performance advantages and higher power efficiency when compared to what its competitors offer. The 3nm node has been used by Apple, Nvidia, AMD, and others to make chips for various applications.

TSMC's 2nm process node, which is all set to go into mass production in 2026, is reportedly 15% more powerful and 35% more energy efficient when compared to the 3nm node. Intel, however, has an ace up its sleeve with its 18A process. Tom's Hardware, a website for tech news, reports that Intel's Fab 52 facility in Arizona is "bigger and better equipped" versus TSMC's Arizona operation.

Intel reportedly has a production capacity of 10,000 wafer starts per month (WSPM) at that manufacturing site, and it could quadruple that number once it fully ramps up the factory's output. The company has equipped its latest Arizona fab with ASML's most advanced semiconductor manufacturing equipment. On the other hand, TSMC's Arizona facility is likely to have a capacity of 20,000 WSPM once it is fully up and running with 3nm chips.

Also, Intel's 18A process is reportedly superior to both TSMC's and Samsung's equivalent process nodes in terms of performance, according to third-party estimates. Given that Intel has already started mass production of its most advanced chips in Arizona and is expected to significantly raise capacity at one part of that factory in 2026, the company should be able to meet the fast-growing demand for those chips.

Management said on its October earnings conference call that it was supply constrained and was unable to fully meet third-quarter demand. As the company increases the output of its most advanced process node, it should be able to fulfill more orders and experience stronger growth in its revenue and earnings.

The stock can deliver more gains in the new year

The chipmaker's 12-month median price target of $40 translates to potential upside of 10% in the next year. It is easy to see why analysts are expecting limited gains from Intel in 2026 following its stellar performance this year.

The stock has become expensive following its recent run, trading at 606 times trailing earnings. The forward earnings multiple of 62, though significantly lower than the trailing multiple, is still on the expensive side. However, the rapid growth in Intel's earnings, driven by its cost optimization efforts, justifies the valuation.

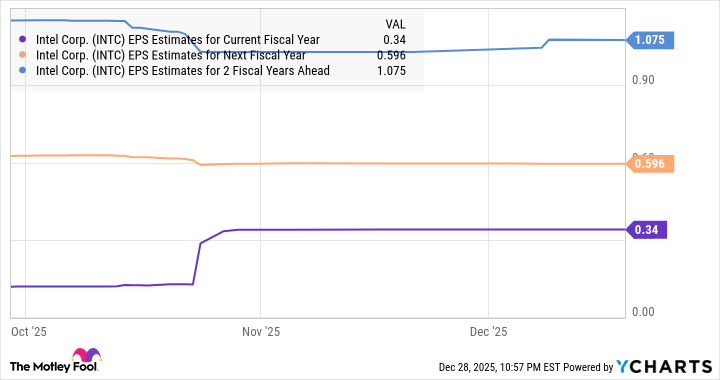

The company is expected to post an adjusted profit of $0.34 per share in 2025 as compared to a loss of $0.13 per share in 2024. And it is projected to clock strong earnings growth over the next couple of years as well.

INTC EPS Estimates for Current Fiscal Year, data by YCharts; EPS = earnings per share.

With new catalysts such as its partnership with Nvidia and the 18A node ramp-up, this semiconductor stock could continue to climb higher in 2026 and produce bigger gains than its 12-month median price target suggests.