To confidently buy and hold a stock for a decade, one needs to find a good growth opportunity in a durable industry. Things that are prone to rapid change may require investors to check in more frequently to verify that the situation hasn't changed too much for the investment to still work out.

I believe I've found three good opportunities for the next 10 years: Rubrik (RBRK +1.15%) in cybersecurity, Comfort Systems USA (FIX +2.55%) in data centers, and Xometry (XMTR +1.86%) in manufacturing.

Here's why I believe all three could be long-term winners for those who buy today.

Image source: Getty Images.

1. Rubrik

I can already hear the objections: Cybersecurity is a rapidly evolving space, making it difficult to predict. This, of course, is true. But the need for cybersecurity isn't going to go away in the next 10 years -- it will likely only increase. And while the space is fast-changing, Rubrik has embraced a culture of change, which could help it keep pace.

NYSE: RBRK

Key Data Points

This is why Rubrik co-founder and CEO Bipul Sinha says that innovative products don't offer competitive moats like they used to. In a fast-changing world, Sinha says that the only moat is how fast you can innovate. This is why he has built this ethos into the company's mission. It's a refreshing perspective, and that's why I'm optimistic it can continue to ride the cybersecurity trend over the long term.

Rubrik allows businesses to get back to business as usual as fast as possible after a cybersecurity breach. And it's certainly resonating with customers. In the third quarter of 2025, the company grew its revenue by 48% year over year to $350 million. Moreover, management already has the business generating positive free cash flow, which is encouraging for a relatively small company.

There are plenty of other players in the cybersecurity space. But I like Rubrik stock because it embraces change, is growing fast, is cash-flow positive, and still has a long runway ahead, considering its annual recurring revenue is still only $1.35 billion.

2. Comfort Systems USA

Comfort Systems is a mechanical, electrical, and plumbing (MEP) contractor. By acquiring many smaller regional players over the years, it rewarded shareholders with steady growth. However, growth has accelerated to a new level as artificial intelligence (AI) drives demand for data centers.

NYSE: FIX

Key Data Points

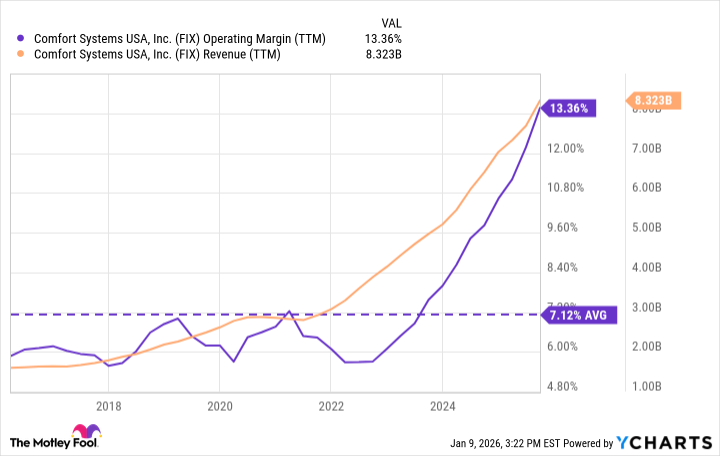

AI data centers are buildings that are densely packed with computing equipment. The need for power and water (for cooling) is high, resulting in Comfort Systems having more work than it can handle. But this is actually a good thing -- management is signing contracts for only the most attractive jobs. The end result is that as its revenue has soared, its operating margin has likewise skyrocketed to an all-time high.

Data by YCharts.

The AI data center buildout is expected to continue for years, which is why Comfort Systems can continue to excel. Its growing backlog is another reason for optimism. As of the third quarter of 2025, the company's backlog reached an all-time high of $9.4 billion, more than double its backlog in 2022.

With a strong balance sheet and a growing dividend, Comfort Systems is a growth stock to buy and hold for the next decade.

3. Xometry

Finally, Xometry has an interesting tailwind behind it. With tariffs and incentives, the global manufacturing supply chain is being reshuffled. As U.S. companies look to do business with more American shops, Xometry's opportunity is growing.

NASDAQ: XMTR

Key Data Points

A buyer needing custom manufacturing can visit Xometry's platform, upload the specifications, and receive instant pricing thanks to the company's artificial intelligence software. Xometry then bids out the orders to small shops in its network for lower prices, pocketing the difference.

The adoption trends are overwhelmingly in Xometry's favor. The company finished the third quarter of 2025 with 78,000 active buyers, up 21% year over year. And it had nearly 4,400 active suppliers (manufacturing shops), which was up 28%.

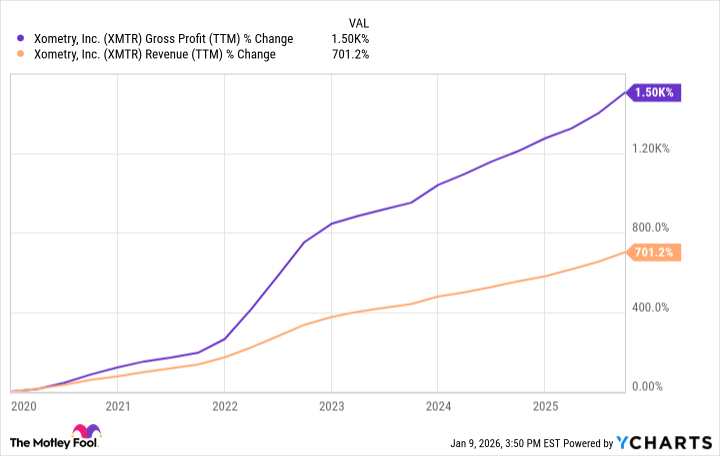

Xometry's revenue is growing fast -- up 28% in Q3 to a record $181 million. But the company's gross profit is growing even faster, which is the more exciting trend.

Data by YCharts.

This trend tells investors that Xometry's AI software is pricing jobs effectively. And as the business grows, it can eventually create a network effect that could further help the company's revenue and profits.

To be clear, the custom manufacturing space is worth over $1 trillion, and Xometry's trailing-12-month revenue is less than $650 million. In short, Xometry can continue to comfortably grow for at least a decade. And changes in the manufacturing supply chain can boost adoption.

Some may find it risky to invest in breakout stocks. But I believe that Rubrik, Comfort Systems USA, and Xometry are enjoying durable trends that can make them winners over the coming decade. And it's why I like all three today.