The rise of artificial intelligence (AI) has ushered in a generational growth wave for companies all across the technology arena. In particular, semiconductor stocks have been some of the greatest beneficiaries of generative AI development.

When it comes to chip stocks, companies such as Advanced Micro Devices, Broadcom, and Taiwan Semiconductor Manufacturing have witnessed outsized enthusiasm throughout the AI revolution. Of course, there is also the king of the chip realm -- Nvidia (NVDA 2.82%), which has seen its stock price rise by nearly 1,000% in just three years, propelling it to the most valuable company in the world.

However, rising competition in the graphics processing unit (GPU) industry as well as the proliferation of custom application-specific integrated circuits (ASICs) from cloud hyperscalers Amazon, Microsoft, and Alphabet is slowly starting to change the narrative around Nvidia from one of an unstoppable rally to a potential headwind directed straight at its data center empire.

Against this backdrop, I'm predicting that a new chip stock will emerge as the favorite among growth investors this year. Enter Micron Technology (MU 4.17%), whose critical role in the AI chip landscape is only just beginning to enter the spotlight. Let's dig into the tailwinds that could fuel Micron's business in 2026 and assess why now looks like a no-brainer opportunity to buy the stock hand over fist.

Image source: Micron Technology.

What could fuel Micron stock this year?

For nearly three years, semiconductor businesses all across the chip value chain have generally impressed investors each quarter when earnings season rolls around. One of the issues with gauging a company's health through the lens of an individual earnings report is that investors don't have much to work with in terms of what to expect going forward.

A deeper look at big tech's spending patterns should help shed some light on demand trends for AI accelerators, though.

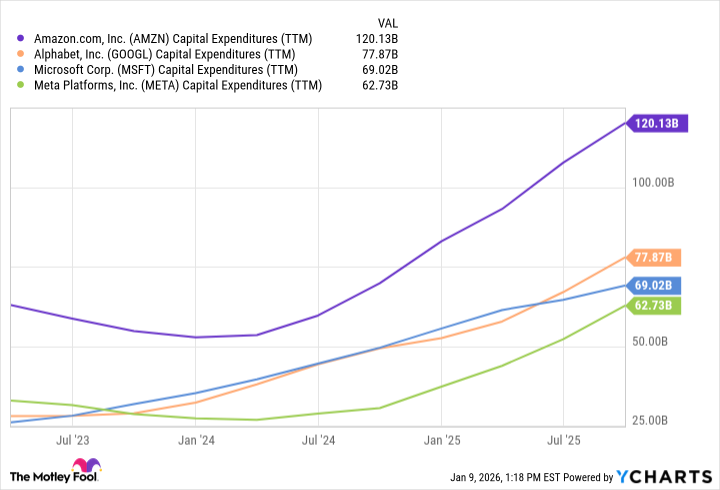

AMZN Capital Expenditures (TTM) data by YCharts.

Not only have the hyperscalers poured hundreds of billions of dollars into capital expenditures (capex) over the last three years, but each of these behemoths is actually accelerating their AI infrastructure budgets. According to research from Goldman Sachs, the big tech companies above are expected to spend nearly half-a-trillion dollars on AI infrastructure in 2026.

On the surface, this is terrific news for GPU designers like Nvidia and AMD. Subtly, however, it may be even more lucrative news for Micron. Why is that? The key reason the hyperscalers are doubling down on AI capex is because workloads are becoming both larger and more complex. This dynamic is what fuels unrelenting demand for chip procurement from Nvidia and AMD. In other words, compute capacity is not optional -- it's a necessity.

But as data center build-outs scale, the hidden bottleneck is at the data movement layer: memory and storage systems. The explosion of AI workloads is going to increasingly require more investment in high-bandwidth memory (HBM) as well as dynamic random access memory (DRAM) and NAND solutions to keep GPUs fully operational. The intersection of memory and storage is Micron's bread and butter, making now an interesting time in the company's next growth arc.

Micron's valuation setup looks interesting

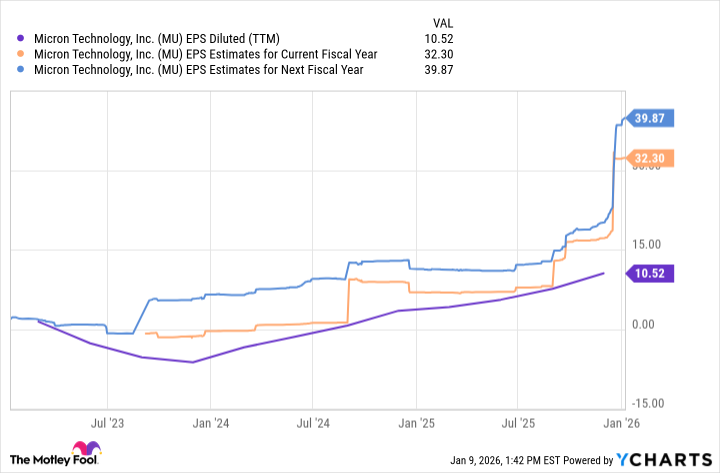

On a trailing-12-month basis, Micron has generated earnings per share (EPS) of roughly $10. According to Wall Street's consensus estimates, however, Micron's earnings power is expected to rise between threefold and fourfold over the next two fiscal years.

MU EPS Diluted (TTM) data by YCharts.

Not only does this level of optimism validate Micron as a winner of the AI infrastructure era, it also implies that analysts are confident that the company will be able to strengthen its profitability profile.

Despite this robust outlook, Micron currently trades at a rather modest forward price-to-earnings (P/E) ratio of 10.6. If the company is able to execute on its growth roadmap, I think there is a high chance that Micron could be set up for meaningful valuation expansion.

If the company's forward P/E were to double to roughly 20 -- which is still relatively muted compared to adjacent AI chip stocks -- then Micron's share price could land in the $650 range. These are not unreasonable assumptions to buy into here.

In my eyes, Micron is on the precipice of its own "Nvidia" moment. I think Micron stock is dirt cheap right now and makes for a highly compelling buy-and-hold opportunity for investors with a long-term horizon.