When investors are on the prowl for market-beating investments, many don't drop by the automotive industry with their first stop. The industry is known for being brutally competitive, low margin, and capital intensive, and disruptions in trade policy or tariffs can throw a kink in complicated global distribution networks. The share price returns these stocks provide generally don't beat the market.

But Ford Motor Company (F 1.45%) has something some stocks don't have: a lucrative dividend yield of around 4.2%. That's something that income investors can take to the bank.

Image source: Ford Motor Company.

A long-term look

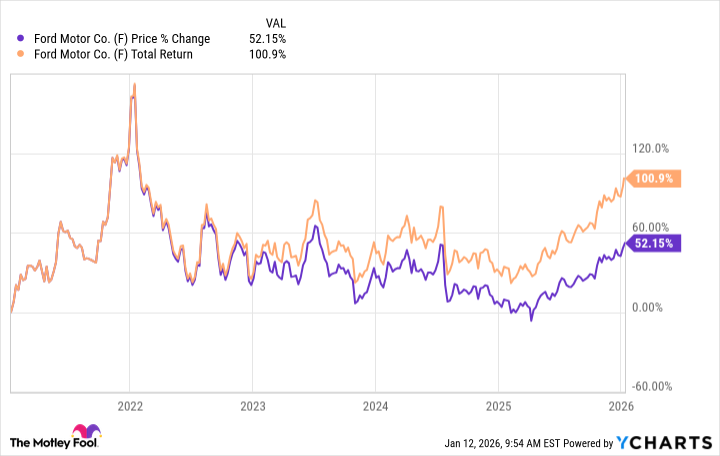

The earning potential of dividends, and the power of compounding interest on reinvested dividends, is too often overlooked by investors. A great way to see the earning power of dividends is to compare Ford's total return, including dividends, to just its stock price appreciation -- the difference is significant. Check out the five-year data below:

Data by YCharts.

Even just over the past five years, Ford's total return to investors, including dividends, was twice as valuable as its stock price appreciation alone. Ford has previously stated its target to distribute 40% to 50% of its annual free cash flow to shareholders through its dividends. When Ford finds itself with surging cash flow, it still meets this target by dishing out a supplemental dividend to investors, which is just a bonus additional dividend payment.

Is Ford on the rise?

Dividend stocks are a popular option among investors, especially income investors, and historically, dividend-paying stocks have outperformed non-dividend-paying stocks. Investors looking for income can take Ford to the bank. The company has a strong balance sheet, a mountain of cash and liquidity, and there's room for upside as the company works to improve the profitability of its electric vehicles.

NYSE: F

Key Data Points

Remember that in 2024, Ford's Model e business unit, responsible for its electric vehicles, lost over $5 billion. Ford has gone back to the drawing board to remove costs and improve efficiency, and expects dramatic improvements in the coming years as its Universal EV Platform is incorporated into operations. Even simply breaking even with its electric vehicle ambitions in the near term could open up valuable capital that could potentially help fund a dividend increase.

Investors can also rest assured that their dividend interests are aligned with Ford, as the company's family still owns significant special shares of the automaker, which give it voting privileges as well as dividends. It's well known that the Ford family appreciates the dividend income, and it's a critical component of Ford's strategy to return value to shareholders.

Ford's dividend makes it a better investment, and investors can take that to the bank.