Nvidia (NVDA 1.33%) is the most valuable stock in the world today, with a market cap of $4.5 trillion, as its name has become synonymous with artificial intelligence (AI). Its AI chips dominate the market, and it has partnerships with a seemingly endless number of companies in tech and other sectors. Along the way, the company has generated fantastic numbers on both its top and bottom lines.

But as well as it has done, I don't think it'll end up finishing 2026 as the most valuable company in the world. Instead, I think another tech giant could soon take that crown from it: Alphabet (GOOG 0.60%)(GOOGL 0.20%).

Image source: Getty Images.

Alphabet's business has been undervalued for far too long

Many investors and analysts weren't big believers that Alphabet would be a winner in AI. After all, if chatbots crippled its search business, then that would likely destroy its earnings and send the tech stock into a tailspin. And there were many doubts about its chatbot early on, which was called Bard in 2023. It was garnering a reputation for being unreliable.

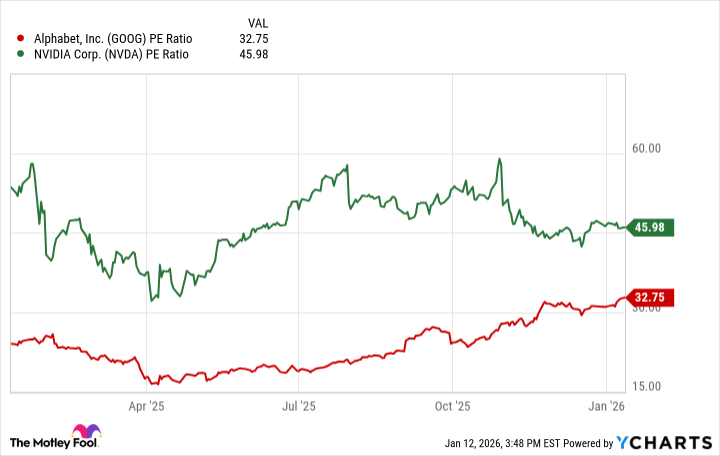

Now, however, Alphabet has a formidable chatbot in Gemini that is proving it can go toe-to-toe with ChatGPT and other top chatbots. Not only is Alphabet's core business looking solid and continuing to grow, but investors are starting to value it more appropriately to factor in the opportunities it has in AI. But even with the stock rising more than 70% over the past 12 months, it's still arguably undervalued when compared to Nvidia, when looking at their respective price-to-earnings multiples.

GOOG PE Ratio data by YCharts

Why Nvidia could struggle this year

Not only does Alphabet look relatively undervalued, but I also believe it faces a bit less risk than Nvidia this year.

Nvidia's dominance thus far has hinged on its ability to continually grow at incredibly high rates. In its most recent earnings report, its sales rose by 62% (for the October quarter). But as other tech companies make their own chips (including Alphabet), that can diminish Nvidia's dominance over time.

NASDAQ: NVDA

Key Data Points

Any sign of demand being worse than expected for Nvidia could put significant pressure on the stock. It may appear to be a reasonably cheap buy, trading at an estimated 24 times its future earnings (Alphabet's forward earnings multiple is around 30), but that's based on analyst projections, which remain optimistic.

If there's a deterioration in the market for AI chips or tech companies cut back on their capital expenditure budgets, Nvidia could be among the most vulnerable due to its dependence on strong forecast growth. While Alphabet is by no means immune to a slowdown in spending and its shares could also fall, its business is more diversified, and I believe that can make it less susceptible to a sharp reduction in value.

NASDAQ: GOOG

Key Data Points

Both are solid, but Alphabet's stock provides more value for investors

It's hard to go wrong with either one of these companies if your goal is to buy and hold for the long term. However, Alphabet is arguably the more attractive option for tech investors today when considering not only its valuation, but also its diverse business and the plentiful growth opportunities it possesses. Its the safer all-around investment.

If investors didn't underestimate the stock's opportunities due to AI and it skyrocketed alongside other tech giants, Alphabet would likely already be more valuable than Nvidia today. And as the year goes on, I think it'll be inevitable that Alphabet will overtake Nvidia as the most valuable company in the world. With a market cap of around $4 trillion, it's already not too far behind the chipmaker.