Netflix (NFLX 2.18%) is one of the world's most popular streaming platforms, with more than 325 million paid memberships across 190 countries. More than just a technology stock, Netflix has become a creator of its own hit shows and franchises like Stranger Things and KPop Demon Hunters.

But since June 30, when it closed at $133.91, Netflix stock has tumbled by about 38%. What's driving the slide in Netflix's share price, and can this global entertainment platform bounce back?

NASDAQ: NFLX

Key Data Points

Competition for viewers remains intense

Netflix stock began to come under pressure in July 2025 due to valuation concerns. The company is also facing stiff competition for viewers. According to Nielsen data, YouTube ranked first in the Nielsen Media Distributor Gauge report for July 2025, capturing 13.4% of all TV watch time. Netflix ranked third, with only 8.8%. That was the sixth straight month that Alphabet-owned YouTube had the lead in total TV watch time, according to Nielsen. And it took the top spot among distributors not from Netflix, but from Disney.

On Oct. 21, Netflix delivered its third-quarter results, and its earnings per share of $5.87 missed analysts' consensus estimate by $1.10 per share, or 15.8%. But that result didn't appear to be related to problems with Netflix's business model.

The company's revenue rose 17.2% year over year to $11.5 billion. But its operating margin dropped from 34.1% in the previous quarter to 28.2%. Management pointed to a $619 million expense related to a dispute with Brazilian tax authorities as the reason for its earnings miss, and made it clear that it doesn't expect that matter to have a material impact on future results.

Netflix reported its fourth-quarter earnings on Tuesday. Its 18% revenue growth and 25% operating margin were both slightly better than had been forecast, and its earnings beat expectations. But its share price still fell in after-hours trading.

Netflix's earnings multiple is below average -- and still too high

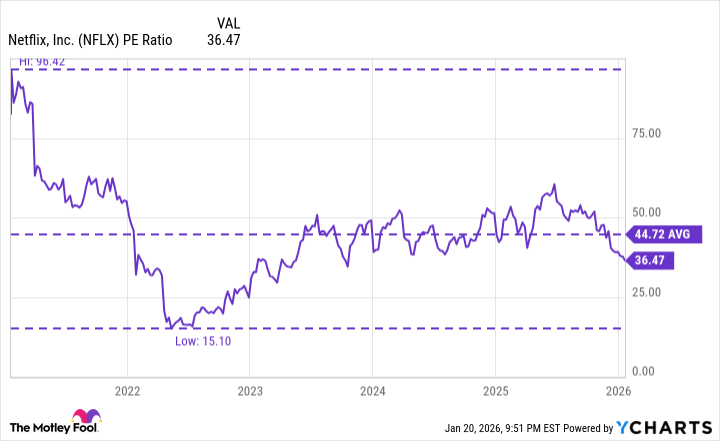

Netflix stock is trading at a price-to-earnings ratio of 36.5, which is below its five-year average of 44.7. This earnings multiple is higher than the S&P 500 index P/E ratio of 31.3. But the Invesco QQQ Trust, which tracks the tech-heavy Nasdaq-100 index, has a P/E ratio of 33.6.

NFLX PE Ratio data by YCharts.

That below-average P/E ratio could be a sign that Netflix is undervalued. But I believe the more important point is that Netflix's P/E ratio is higher than other growth technology stocks. This indicates that it has further room to fall. I wouldn't rate this stock as a buy right now. And a big reason is the significant uncertainty surrounding its planned acquisition of Warner Bros.

Concerns about the Warner Bros. deal

On Dec. 5, 2025, Netflix announced an agreement to buy Warner Bros. from Warner Bros. Discovery (WBD +1.03%). The deal would give Netflix ownership of Warner Bros.' film and TV studios, the company's impressive catalog of movies, shows, and intellectual property, as well as HBO and the HBO Max streaming service.

But investors are understandably skeptical that this deal will cross the finish line, and given its hefty $82.7 billion price tag and the debt load it will saddle the buyer with, some would prefer that it didn't. Since the merger announcement, Netflix stock has fallen by 12%. Meanwhile, Paramount Skydance has continued to pursue its own hostile bid to buy all of Warner Bros. Discovery -- not just the business segments Netflix is after. Though the Warner Bros. Discovery board has repeatedly supported Netflix's bid, the outcome is far from clear.

Image source: Getty Images.

Moreover, investors have valid reasons to be skeptical of this plan even if Netflix does get its way. According to a much-cited 2011 study published in the Harvard Business Review, between 70% to 90% of corporate mergers and acquisitions fail to deliver the hoped-for results for the acquirer. Warner Bros., in particular, has been part of several prominent media company marriages that didn't work out, including the infamous AOL-Time Warner merger.

First announced in 2000 near the height of the dot-com bubble, that deal was touted as a synergistic unification of "old media" (magazines and cable companies) and "new media" (websites). But instead of delivering big gains, AOL-Time Warner turned into a fiasco as a host of cultural and technological differences between the two organizations stymied their integration. Then the dot-com bubble burst, and the overinflated shares that AOL had paid for Time Warner with tanked. In the end, the merger contributed to the destruction of $200 billion in shareholder value.

But Netflix might succeed where previous Warner Bros. owners have failed.

On Jan. 7, Netflix said it expected the Warner Bros. transaction to close within 12 to 18 months of the original merger announcement. And on Tuesday, Netflix announced it was adjusting its bid for Warner Bros. to be an all-cash transaction for $27.75 a share. Previously, Warner Bros. Discover shareholders were set to receive a combination of cash and Netflix stock equal to that same amount. But until there is more certainty about whether this pricey deal will happen, how it will impact the buyer's finances if it does, and how the integration of two media giants with very different cultures will play out, it's not surprising that investors are being cautious about Netflix stock.