While Peter Thiel's roots are in entrepreneurship, the billionaire has become one of Wall Street's brightest minds over the last couple of decades. Thiel originally co-founded both PayPal and Palantir Technologies (PLTR +2.23%), but for quite some time the Silicon Valley legend has assumed the role of a venture capitalist and hedge fund manager.

According to recent filings, the Thiel Macro fund sold 76% of its position in Tesla (TSLA 0.04%) and redeployed capital into another trillion-dollar tech stock: Apple (AAPL 0.07%).

Let's dig into what may have influenced this decision and whether investors should follow Thiel's playbook to begin 2026.

Image source: Getty Images.

Does selling Tesla stock make sense right now?

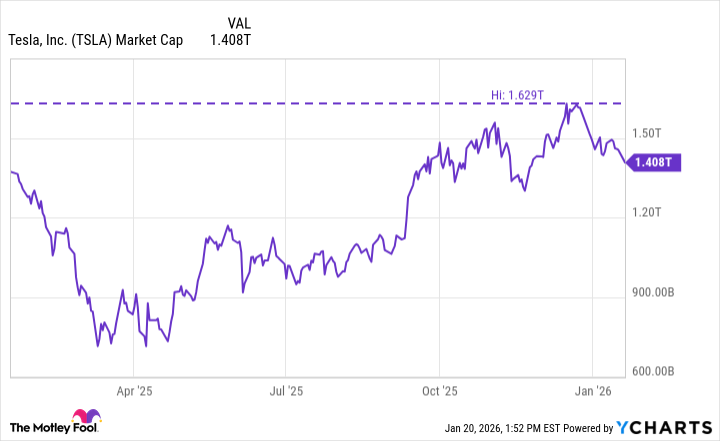

As of Jan. 20, Tesla boasts a market capitalization of $1.4 trillion -- about 16% below all-time highs.

TSLA Market Cap data by YCharts

From a valuation perspective, almost nothing about Tesla's profile makes sense. Tesla's price-to-sales (P/S) ratio currently hovers around 16. This is meaningfully high for a capital-intensive automobile business.

On top of that, the company's price-to-earnings (P/E) and forward P/E multiples of 283 and 195, respectively, have expanded over the last year despite the facts that that Tesla is losing market share overseas and competition in the autonomous vehicle landscape is on the rise.

While Elon Musk has enjoyed touting the company's progress on its robotaxi efforts, Tesla has little to show for these ambitions as it relates to measurable growth. Against this backdrop, it's difficult to justify Tesla's premium price point.

Is Apple stock a good buy for 2026?

Right now, the stock market and the broader economy are flashing some conflicting signals.

On one hand, the S&P 500 remains elevated thanks in large part to a euphoric artificial intelligence (AI) narrative. But on the other, inflation has proven to be stubborn while unemployment is at its highest level in four years. When you layer on the geopolitical unrest that's also unfolding, I'd say it's anyone's guess as to where stocks are headed in 2026.

With such fluid dynamics taking shape by the day, I'm not entirely surprised by Thiel's recent investment decisions. What I take away is that he has decided to take some gains off the table in a volatile and unpredictable momentum stock and instead opted for a more blue chip opportunity.

While Apple may not carry the same potential upside as an AI growth stock like Tesla, it also remains more insulated from selling pressure should the stock market experience a correction this year.

Thiel is positioned for upside no matter what

Here's what makes Thiel's portfolio management so genius: Tesla remains the largest position in his fund. Apple is actually Thiel's smallest allocation.

I think this is pretty savvy hedging. If Tesla miraculously surprises everyone this year and is able to launch its autonomous robotaxi fleet nationwide, the upside could be epic and completely change the narrative around the company's business. In such a scenario, Thiel stands to gain from these AI-driven tailwinds.

But if Tesla disappoints, I would not be surprised to see institutional capital flow out of more high-flying hopefuls and toward safe-haven stocks like Apple.

At the end of the day, Thiel is well positioned for solid risk-adjusted returns across both AI and macro environments.