The appeal of Nebius Group (NBIS +16.64%) is understandable. It's expected to report triple-digit revenue growth for last year as well as this year, so it seems like a must-have stock. And even more so since peeling back from its mid-October high.

This lull, however, may not be mere profit-taking following the surge stoked by landing Microsoft as a customer. This weakness arguably reflects the fact that Nebius is neither profitable now, nor expected to be in the foreseeable future. Analysts believe its losses will ultimately widen for years before contracting, which makes it tough for investors to buy in and then stay in.

Fortunately, there's a much safer, similar option hiding in plain sight -- one that's already profitable and likely to remain so indefinitely. That's DigitalOcean (DOCN +9.12%). Here's why.

Image source: Getty Images.

What's DigitalOcean?

It's not a household name. There's a very good chance, however, that you or someone in your household regularly benefits from the service DigitalOcean provides. Video game developer Double Eleven, workflow guide creator Scribe, and travel-planning website Framey are just some of its 640,000 paying customers.

But the question is: What makes this relatively small business a go-to name when higher-profile players like Alphabet's Google or Microsoft -- or smaller providers like the aforementioned Nebius, for that matter -- can seemingly offer the same service?

That's just it: They can't. Most of them can get close. But DigitalOcean has figured out and refined an offering that's exactly what a large number of smaller customers want at a price they can afford.

Chief among its distinguishing features, however, is the fact that it's built to scale up, allowing a smaller customer to ease into the artificial intelligence (AI) arena at a relatively small cost, learn the ins and outs of the technology, and then purchase more services as it makes sense for such an investment.

And that's precisely how things have taken shape since the company adopted the pricing and upgraded the menu it utilizes today. It's possible to test-drive its technology for as little as $50 per month.

The majority of its clients, however, spend between several hundred and a few thousand dollars per month for its services, and happily so. As of the third quarter of last year, the number of its users reporting annual recurring revenue in excess of $1 million saw a hefty 72% year over year increase in their annualized revenue run rate.

In this vein, the company's net dollar retention rate now stands at 99%, suggesting that once prospects become paying customers, they're almost guaranteed to remain one.

NYSE: DOCN

Key Data Points

The bull case

Great, but what does this mean in practical terms for interested investors?

DigitalOcean certainly isn't going to put up the same sort of growth numbers that Nebius likely will for the next couple of years. That's not necessarily a meaningful comparison, though. Nebius' data center business is barely off the ground, so any new business is going to drive dramatic growth.

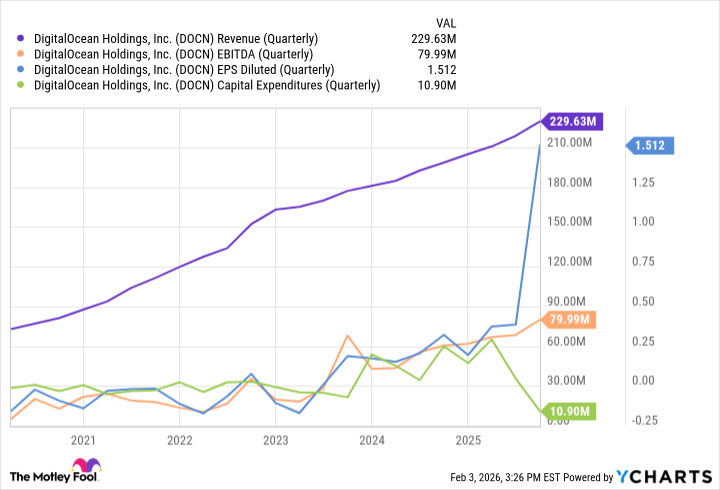

DigitalOcean has been around since 2012, building its business even before there was an AI component to it. The company is on pace to report nearly $900 million in revenue for 2025, up a respectable 15% year over year.

While this year's projected earnings per share (EPS) of just over $2 are more than twice 2024's adjusted profits, bear in mind that the company was spending pretty heavily most of that time in an effort to secure its future share of the fast-growing market for AI data centers. With EBITDA profit margins now right around 40% of revenue as measured by earnings before interest, taxes, depreciation, and amortization (EBITDA), it's unlikely to continue growing its bottom line at this pace.

Data by YCharts; EPS = earnings per share.

But what DigitalOcean lacks in raw growth firepower, it more than makes up for in reliable consistency and a promising future. The analyst community expects the growth we've already seen of late to last at least through 2027. In light of Global Market Insights' belief that the planet's AI data center industry is poised to grow at an average yearly pace of 35.5% though 2034, though, this specialist's ongoing sales and earnings growth could easily continue well past that point.

Much more reward than risk

If there is one knock against DigitalOcean stock, it's that it's already trading right around analysts' consensus target of $55.33. This leaves little room for further upside. There's also no denying the business is vulnerable to a popping of any AI bubble, if that's what's in the cards. Just be sure to remain aware of the near-term circumstances that could make an impact on an otherwise long-term trade.

On the flip side, don't be stingy here and wait for a major pullback that probably just isn't going to happen. The stock is reasonably priced right now at only about 25 times this year's expected EPS of $2.20, and it has beaten its bottom-line estimates for 10 consecutive quarters now (by more than a little in most of those instances). And there is a good chance that analysts are still underestimating this company's potential growth.