Exchange-traded funds (ETFs) are an easy way to begin investing. They are fairly simple to understand and can generate impressive returns with minimal expense and effort. They are also easy to buy and sell. Here's what you should know about ETFs, how they work, and how to invest in them.

What is an ETF?

An ETF allows investors to purchase a diversified portfolio of stocks or bonds at once. People buy shares of ETFs, and the money is invested according to a certain objective. For example, if you buy an S&P 500 ETF, your money will be invested in the 500 companies in the S&P 500 index. As a result, your investment's performance should roughly match that of the index over time.

ETFs versus mutual funds

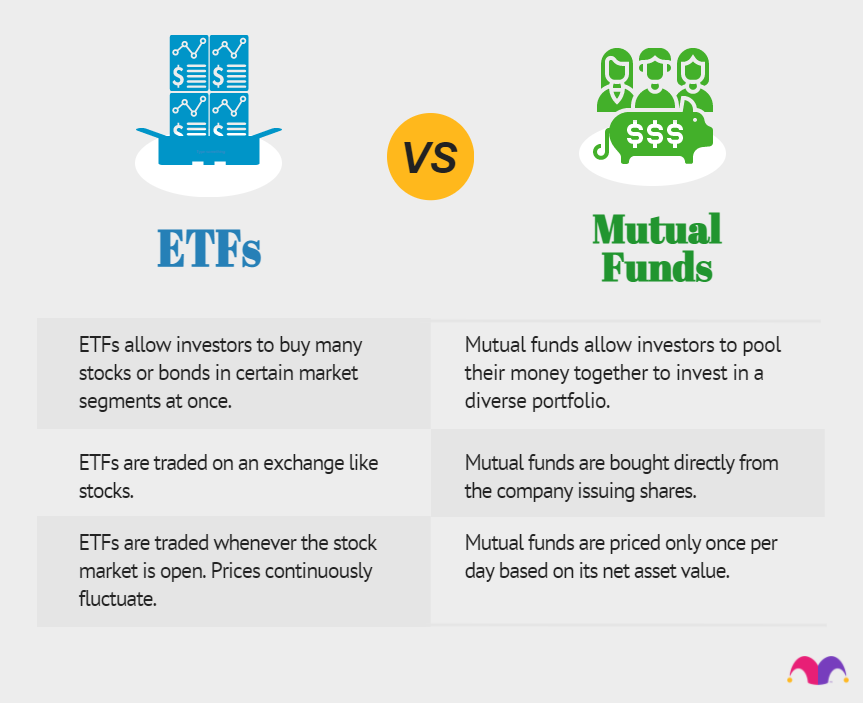

One common question is how ETFs differ from mutual funds since the basic principle is the same. The key differences between these two types of investment vehicles have to do with how you buy and sell them.

- Mutual funds are priced once per day, and you typically invest a set dollar amount, such as $1,000.

- Mutual funds can be purchased through a brokerage or directly from the issuer.

- ETFs trade just like stocks on major exchanges such as the New York Stock Exchange (NYSE) or the Nasdaq Stock Exchange.

- Instead of investing a specific dollar amount in an ETF, you simply buy shares of the ETF like you would buy shares of any stock.

- ETF share prices continuously fluctuate throughout the trading day.

Understanding ETF basics

Before we get any further, there are a few concepts that are important to know before you buy your first ETFs.

- Passive versus active ETFs: There are two basic types of ETFs. Passive ETFs (also known as index funds) simply track a stock market index, such as the S&P 500. Alternatively, active ETFs employ portfolio managers to manage their investments. The key takeaway: Passive ETFs aim to match an index's performance, while active ETFs want to beat it.

- Expense ratios: ETFs charge fees, known as the expense ratio. You'll see the expense ratio listed as a percentage. For instance, a 1% expense ratio means you'll pay $10 in annual investment fees for every $1,000 you invest. To be clear, an ETF expense ratio isn't a fee you have to pay -- it is simply reflected in the ETF's performance over time.

- Dividends and DRIPs: Many ETFs pay dividends. For example, an S&P 500 ETF receives dividends from many of the 500 stocks it owns and then passes those along to investors. You can choose to have your dividends paid as cash or automatically reinvested in additional shares of the same ETF through a dividend reinvestment plan (DRIP).

How ETFs work

Think of ETFs as having some features of stocks and some features of mutual funds.

ETFs trade just like stocks on major exchanges such as the NYSE and the Nasdaq. They have a share price that fluctuates throughout the trading day, and investors buy a certain number of shares.

Like mutual funds, ETFs are designed to pool investors' money to invest for a common purpose. For example, an S&P 500 ETF would allocate the fund's money proportionally to the 500 companies that make up the popular benchmark index.

Understanding ETF taxes

If you buy ETFs in a standard brokerage account (i.e., not a retirement account), you should know that they could result in taxable income. Any gains you make from selling an ETF will be taxed according to capital gains tax rules, and any dividends you receive will likely be taxable as well.

Of course, if you invest in ETFs through an individual retirement account (IRA), you won't have to worry about capital gains or dividend taxes. In a traditional IRA, money in the account is considered taxable income only after it is withdrawn, while Roth IRA investments aren't taxable at all in most cases.

How much money do you need to be able to invest in ETFs?

ETFs don't have minimum investment requirements -- at least not in the same sense that mutual funds do. However, ETFs trade on a per-share basis. Unless your broker offers the ability to buy fractional shares of stock, you'll need at least the current price of one share to get started.

Pros and cons of ETFs

Let's examine the pros and cons of investing in ETFs.

Pros:

- ETFs offer exposure to a diverse range of stocks, bonds, and other assets, typically at a lower expense.

- ETFs eliminate the guesswork from stock investing. Many ETFs are index funds, which enable investors to track the performance of a specific benchmark index over time.

- ETFs are more liquid (i.e., easy to buy and sell) than mutual funds. Online brokers make it easy to buy or sell ETFs with a simple click of the mouse.

- It can be extremely complicated to invest in individual bonds on your own, but a bond ETF can make the fixed-income portion of your portfolio very easy.

Cons:

- Since ETFs own a diverse assortment of stocks, they don't have quite as much total return potential as individual stocks.

- ETFs are often low-cost, but they aren't free. If you buy a portfolio of individual stocks on your own, you won't have to pay any management fees.

Common ETF investing mistakes

When you invest in ETFs, there are some big mistakes to avoid. Just to name the most common:

- Over-trading: The average stock fund investor underperforms the S&P 500 over time, and the biggest reason is over-trading. In other words, ETFs work best as long-term buy-and-hold investments. Moving in and out of ETFs tends to result in subpar performance.

- Following the crowd: Don't buy an ETF just because everyone else is. Buy ETFs that are the best fit for your own investing goals.

- Ignoring fees: Be sure to shop around to find lower-cost options for ETFs that meet your specific objectives. A seemingly small difference in expense ratios can make a big difference, especially if you hold the ETF for many years.

Criteria to choose an ETF

There are literally thousands of ETFs available for investment right now. In fact, the number of ETFs recently surpassed the number of publicly traded stocks for the first time ever. So, how do you find the right ETFs for you?

Here are some things to consider:

- Investment objective: This is the most important consideration. Do you simply want passive exposure to the entire stock market? Do you want exposure to a certain sector? Do you want to invest in a specific trend such as artificial intelligence?

- Active versus passive: Do you want to simply track an index's performance over time, or do you want fund managers who try to beat a benchmark index?

- Fees: You can find a basic S&P 500 ETF with a 0.03% expense ratio or a large-cap ETF with a similar portfolio that charges 1%. Of course, there are some good reasons to choose a higher-cost ETF, such as if you want to invest in a highly specialized stock index. But if you find an ETF that meets your needs, it's worth checking to see whether there's another that does essentially the same thing for a lower cost.

How to start investing in ETFs

- Open your brokerage app: Log in to your brokerage account where you handle your investments.

- Search for the ETF: Enter the ticker or ETF name into the search bar to bring up the ETF's trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this ETF.

- Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.

10 of the best ETFs for beginners

| Company name | Current price |

|---|---|

| Vanguard S&P 500 ETF | $632.60 |

| Schwab Strategic Trust - Schwab U.s. Mid-Cap ETF | $30.47 |

| Vanguard Russell 2000 ETF | $100.97 |

| Schwab Strategic Trust - Schwab International Equity ETF | $24.17 |

| Schwab Strategic Trust - Schwab Emerging Markets Equity ETF | $32.65 |

| Vanguard Whitehall Funds - Vanguard High Dividend Yield ETF | $144.70 |

| Schwab Strategic Trust - Schwab U.s. REIT ETF | $21.01 |

| Schwab Strategic Trust - Schwab U.s. Aggregate Bond ETF | $23.44 |

| Vanguard Scottsdale Funds - Vanguard Total World Bond ETF | $68.89 |

| Invesco QQQ Trust | $620.87 |

- Vanguard S&P 500 ETF (VOO -0.35%): Large U.S. companies (The S&P 500 is often regarded as the best benchmark for the overall U.S. stock market).

- Schwab U.S. Mid-Cap ETF (SCHM -0.59%): Midsize U.S. companies between those included in the S&P 500 and Russell 2000.

- Vanguard Russell 2000 ETF (VTWO -0.65%): Smaller U.S. companies (The Russell 2000 is the most widely followed small-cap index).

- Schwab International Equity ETF (SCHF -0.17%): Larger non-U.S. companies.

- Schwab Emerging Markets Equity ETF (SCHE -0.79%): Companies from countries with developing economies, also known as emerging markets.

- Vanguard High-Dividend Yield ETF (VYM -0.27%): Stocks that pay above-average dividends, mostly large-cap stocks.

- Schwab U.S. REIT ETF (SCHH +0.24%): Real estate investment trusts (REITs), which own properties and tend to pay high dividends.

- Schwab U.S. Aggregate Bond ETF (SCHZ +0.09%): Bonds of all different varieties and maturity lengths.

- Vanguard Total World Bond ETF (BNDW +0.00%): Includes international bonds and U.S. bonds of various lengths and maturities.

- Invesco QQQ Trust (QQQ -0.48%): Tracks the Nasdaq-100 index, which is heavy on technology companies and other growth stocks.

You may notice that this list is heavily weighted towards Vanguard and Schwab. There's a good reason -- both are dedicated to offering easy access to the stock market at a minimal expense, so ETFs from both tend to be among the cheapest in the business.

Related investing topics

Let your ETFs do the hard work for you

It's important to keep in mind that ETFs are generally designed to be maintenance-free investments. Newer investors often have a tendency to check their portfolios excessively and make emotional, knee-jerk reactions to major market movements. In fact, the average fund investor significantly underperforms the market over time, and overtrading is the main reason.

So, once you buy shares of some great ETFs, the best plan is to leave them alone and let them do what they're intended to do: produce excellent investment growth over long periods of time.