While most utilities are exiting coal as fast as they can, one utility is doubling down on new pollution-reduction technology to keep its plants pushing power. Going against the grain can be smart -- or incredibly stupid. Let's find out which.

The dirty details

Integrys' (NYSE: TEG) Wisconsin Public Service utility is revamping a 321 MW coal-fired power plant near Wasau, Wis. The utility is installing a "multi-pollutant control system" that will enable its plant to meet new environmental standards that are pushing other power companies to cut their own coal.

"This single system is designed to significantly remove sulfur dioxide, nitrogen oxide, mercury and other emissions from the power plant's exhaust flow," said WPS President Charles Cloninger in a statement, "eliminating the need to build separate control systems for each individual emission."

The URS (NYSE: URS)-designed system is the first of its kind to be applied commercially in the United States, although Japanese companies have been using it for years.

The rejects

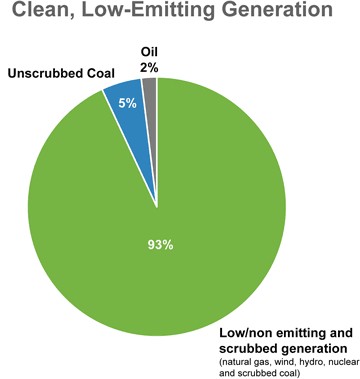

For most other utilities, coal just isn't cutting it. PPL (PPL +3.14%) announced this week that it's planning on adding natural gas and solar to make up for 800 MW of retired coal capacity. The company cited environmental regulations for the coal closure -- and it's not the first. FirstEnergy (FE +1.65%) announced that it would cut a whopping 2,080 MW -- 10% of total capacity -- of coal-fired generation to avoid $280 million in environmental costs. While the company currently relies on coal for 60% of its generation, only 5% of its power production comes from unscrubbed (read "polluting") coal.

Source: FirstEnergy

Source: FirstEnergy

And scale doesn't seem to be any protection. American Electric Power (AEP +0.47%) packs a total capacity punch of 38,000 MW, with more than 22,000 MW of coal (including one of the world's largest coal plants). But the company is pulling back on its investment and plans to retire 3,123 MW of coal capacity by 2016.

Smart move?

Intregrys' decision to save its coal capacity is, in its case, a sensible solution. Unlike most other utilities, Integrys' coal assets all fall under its regulated division, making it possible to recover pollution-cutting costs. With just 2,170 MW of total generating capacity for Wisconsin Public Service, a 321 MW loss would equate to a significant 15% reduction of total power.

And although WPS has a significant stake in natural gas (20% of 2012 revenue) to cover cut coal, keeping a diverse energy portfolio is the best way to avoid the shock of any price spikes.

Hanging on to a polluting power plant is a bad idea, but Integrys has defied convention by applying new technology to an old problem. With regulated finances to potentially recover costs, its industry-defying decision to keep coal is a smart move.