Dividend stocks outperform nondividend-paying stocks over the long run. It happens in good markets and bad, and the benefit of dividends can be quite striking: Dividend payments have made up about 40% of the market's average annual return from 1936 to the present day.

But few of us can invest in every single dividend-paying stock on the market, and even if we could, we're likely to find better gains by being selective. Today, two of the world's most-watched industrial bellwethers will square off in a head-to-head battle to determine which offers a better dividend for your portfolio.

Tale of the tape

Founded in 1892, General Electric (GE +1.67%) is a multinational conglomerate headquartered in Fairfield, Conn. The company ranked among the top 10 Fortune 500 companies by revenue for 2013 and is currently the third-largest company on the Forbes Global 2000 rankings. While it was originally a manufacturing concern producing Thomas Edison's many electrical creations, General Electric has over the years diversified into many other areas through a combination of innovations and acquisitions, and it now manages operations in more than 100 countries. Its product lines range from electrical turbines to jet engines to solar panels to consumer lighting and beyond, making it a good indicator of the health of a highly interconnected and energy-intensive global economy.

Established in 1968, Intel (INTC 2.34%) is the world's largest semiconductor manufacturer by revenue. The company, which commands about 80% of the microprocessor market and has remained ahead of its peers in the development of advanced chip-making technology, has ridden its x86 series of microprocessors to world domination in one of the world's most important industry segments. Intel's early placement in PCs gave it a critical edge over its peers, but the era of smartphones has eroded the company's dominance and may threaten its future. Intel has rushed to meet this challenge with improved chip designs and a line of low-power processors, but it has yet to capture this fast-growing market.

|

Statistic |

General Electric |

Intel |

|---|---|---|

|

Market cap |

$261.3 billion |

$118.9 billion |

|

P/E ratio |

17.2 |

12.8 |

|

Trailing 12-month profit margin |

9.7% |

18.1% |

|

TTM free cash flow margin* |

9.6% |

19% |

|

Five-year total return |

25.7% |

23.9% |

Source: Morningstar and YCharts. *Free-cash-flow margin is free cash flow divided by revenue for the trailing 12 months.

Round one: endurance (dividend-paying streak)

According to Dividata, Intel has been paying quarterly dividends since late 1992, for a continuous period of 20 years. That's a strong streak for a tech company, but the chipmaker falls far short of GE's streak -- Edison's legacy has paid uninterrupted dividends for more than a century. This one's an easy win for General Electric.

Winner: General Electric, 1-0.

Round two: stability (dividend-raising streak)

This might not look like an easy win for Intel, which has only been increasing its dividend yearly since 2004. However, GE was forced to cut its payouts during the financial crisis and thus has only been continuously increasing its dividend since 2010.

Winner: Intel, 1-1.

Round three: power (dividend yield)

Some dividends are enticing, but others are merely tokens that barely affect an investor's decision. Have our two companies sustained strong yields over time? Let's take a look:

GE Dividend Yield (TTM) data by YCharts.

Winner: Intel, 2-1.

Round four: strength (recent dividend growth)

A stock's yield can stay high without much effort if its share price doesn't budge, so let's take a look at the growth in payouts over the past five years:

GE Dividend data by YCharts.

Winner: Intel, 3-1.

Round five: flexibility (free cash flow payout ratio)

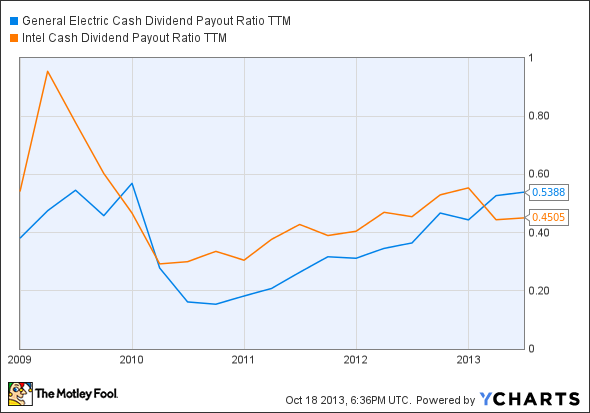

A company that pays out too much of its free cash flow in dividends could be at risk of a cutback, particularly if business weakens. We want to see sustainable payouts, so lower is better:

GE Cash Dividend Payout Ratio TTM data by YCharts.

Winner: Intel, 4-1.

Bonus round: opportunities and threats

Intel may have won the best-of-five on the basis of its history, but investors should never base their decisions on past performance alone. Tomorrow might bring a far different business environment, so it's important to also examine each company's potential, whether it happens to be nearly boundless or constrained too tightly for growth.

General Electric opportunities:

- GE is well-positioned to benefit from extended wind-energy tax credits.

- GE Aviation continues to produce the world's most advanced jet engines.

- GE Capital will spin off its consumer-focused lending business.

- GE is a leader in producing products for the Industrial Internet.

Intel opportunities:

- Intel's current dividend yield is about 3.8%, one of the highest in the tech sector.

- Its Quark SoC might replace some traditional embedded microprocessors.

- Intel is also forging new ground with its low-power Haswell and Atom processors.

- Its Bay Trail mobile processor will be part of more than 50 new products.

- The company will begin manufacturing 14-nanometer chips at the start of 2014.

General Electric threats:

- Boeing's 787 Dreamliner design failures undermine GE's aviation segment.

- GE's solar business faces major headwinds from low-cost Chinese panels.

- Weak conditions in the mining industry continue to hinder GE's growth prospects.

Intel threats:

- Weakening PC sales and slow progress in the mobile segment hinder Intel's prospects.

- Qualcomm's Snapdragon chips pose stiff competition in the mobile chip market.

- ARM Holdings' Cortex-A50 designs are a threat to Intel's server business.

One dividend to rule them all

In this writer's humble opinion, it seems that Intel has a narrow edge at long-term outperformance, considering its proven ability to develop breakthrough chips and its unmatched dividend yield -- but its reliance on PCs may well have adverse effects in the near future. On the other hand, GE's diversified portfolio, proven competencies in the energy sector, and expansion through numerous acquisitions help hedge investment risks. You might disagree, and if so, you're encouraged to share your viewpoint in the comments below. No dividend is completely perfect, but some are bound to produce better results than others. Keep your eyes open -- you never know where you might find the next great dividend stock!