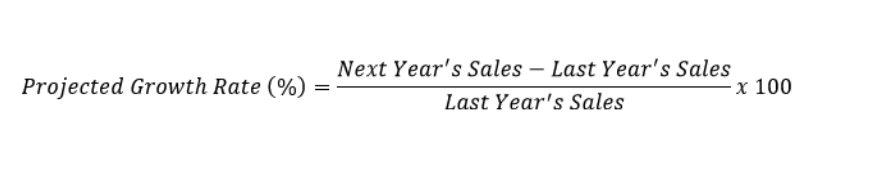

Understanding how fast a company is growing its sales is a critical component of any company analysis. To analyze this metric accurately, you should consider both the projected change in real dollars as well as the percentage change from years prior. We can do both with one simple formula.

How to use the projected growth rate formula

With last year's sales provided in a company's financial statements, there are three variables to consider. The prior year's sales numbers will always be available in the company's financial statements, so we can focus our energy on either the actual dollar change in revenue or the percentage growth rate.

For example, if a company with $1 billion in revenue last year projects its top line to grow at an 8% rate next year, we can plug that figure into the formula and solve for the actual revenue number being projected. In this case, that works out to $1.08 billion in next year's revenue.

If you have more information about the company's plans, this formula can still be even more powerful. (Sometimes, you can get more info from your broker.) Let's assume this company has introduced a new product, and management predicts this product will bring in 10 new accounts next year, with each account worth $20 million in new revenue.

Assuming its existing customers continue buying products at the same rate as last year, those 10 new accounts should generate an additional $200 million in revenue ($20 million each times 10 accounts). Add that $200 million in new revenue to the existing $1 billion in annual revenue from last year, and we can project total revenue for next year at $1.2 billion.

Plugging that number into our formula, we can quickly calculate that this growth represents a 20% projected growth rate. With that number in hand, we can analyze the company's organic growth rates, we can compare this product launch to product launches in the past, and we can even understand how each new product is driving the company's growth over time. We can also review that growth in terms of the rest of the financial statements to understand the impact on cash flow, on inventory needs, or on increased operating expenses.

All of these more advanced analysis techniques start with understanding the projected growth rate. Instead of simply accepting that the new product will increase sales positively, now we can analyze the impact of that change objectively and understand the likelihood of continued success in a much deeper way.

Keep this in mind, however

At the end of the day, any projection is just a best guess. No matter how confident a company's management may be, the reality is that any projection has the very real possibility of being wrong. The assumptions you make about sales growth rates, new customers, and potential dollar amounts are all just best guesses. Any inaccuracy in those guesses will create an inaccurate projection.

Keep that in mind as you work through these analyses. Projections are powerful tools, but they should always be taken with a grain of salt.

This article is part of The Motley Fool's Knowledge Center, which was created based on the collected wisdom of a fantastic community of investors. We'd love to hear your questions, thoughts, and opinions on the Knowledge Center in general or this page in particular. Your input will help us help the world invest better! Email us at [email protected]. Thanks -- and Fool on!