Exchange-traded funds (ETFs) are an easy way to begin investing. They are fairly simple to understand and can generate impressive returns with minimal expense and effort. They are also easy to buy and sell. Here's what you should know about ETFs, how they work, and how to invest in them.

What is an ETF?

An ETF allows investors to purchase a diversified portfolio of stocks or bonds at once. People buy shares of ETFs, and the money is invested according to a certain objective. For example, if you buy an S&P 500 ETF, your money will be invested in the 500 companies in the S&P 500 index. As a result, your investment's performance should roughly match that of the index over time.

ETFs versus mutual funds

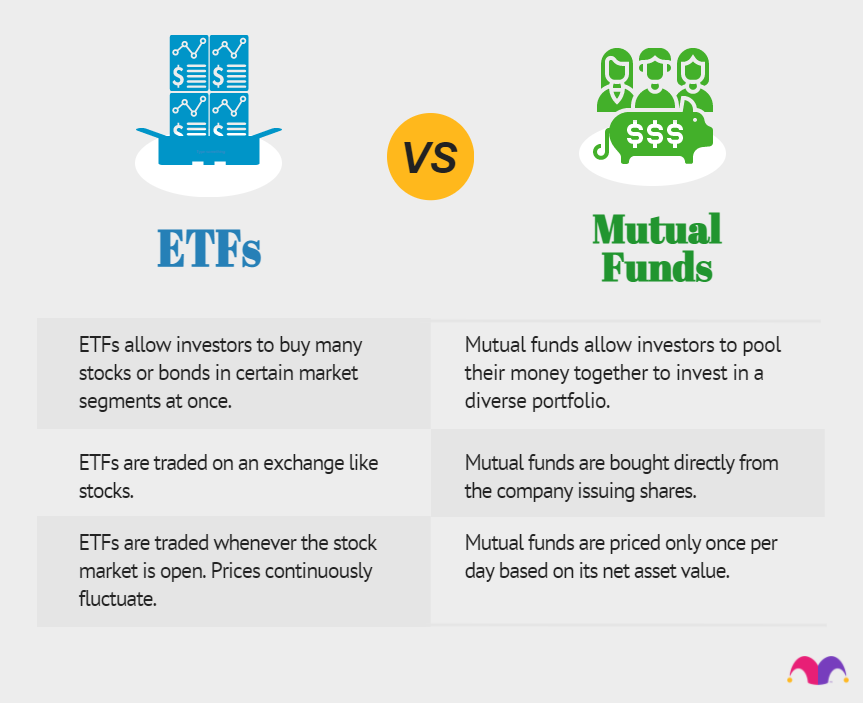

One common question is how ETFs differ from mutual funds since the basic principle is the same. The key differences between these two types of investment vehicles have to do with how you buy and sell them.

- Mutual funds are priced once per day, and you typically invest a set dollar amount, such as $1,000.

- Mutual funds can be purchased through a brokerage or directly from the issuer.

- ETFs trade just like stocks on major exchanges such as the New York Stock Exchange (NYSE) or the Nasdaq Stock Exchange.

- Instead of investing a specific dollar amount in an ETF, you simply buy shares of the ETF like you would buy shares of any stock.

- ETF share prices continuously fluctuate throughout the trading day.

Understanding ETF basics

Before we proceed, there are a few key concepts to understand before purchasing your first ETFs.

- Passive versus active ETFs: There are two basic types of ETFs. Passive ETFs (also known as index funds) simply track a stock market index, such as the S&P 500. Alternatively, active ETFs employ portfolio managers to manage their investments. The key takeaway: Passive ETFs aim to match an index's performance, while active ETFs want to beat it.

- Expense ratios: ETFs charge fees, known as the expense ratio. You'll see the expense ratio listed as a percentage. For instance, a 1% expense ratio means you'll pay $10 in annual investment fees for every $1,000 you invest. To be clear, an ETF expense ratio isn't a fee you have to pay -- it is simply reflected in the ETF's performance over time.

- Dividends and DRIPs: Many ETFs pay dividends. For example, an S&P 500 ETF receives dividends from many of the 500 stocks it holds and then distributes those to its investors. You can choose to have your dividends paid as cash or automatically reinvested in additional shares of the same ETF through a dividend reinvestment plan (DRIP).

How ETFs work

Think of ETFs as having some features of stocks and some features of mutual funds.

ETFs trade just like stocks on major exchanges such as the NYSE and the Nasdaq. They have a share price that fluctuates throughout the trading day, and investors buy a certain number of shares.

Like mutual funds, ETFs are designed to pool investors' money to invest for a common purpose. For example, an S&P 500 ETF would allocate the fund's money proportionally to the 500 companies that make up the popular benchmark index.

How to start investing in ETFs

- Open your brokerage app: Log in to your brokerage account where you handle your investments.

- Search for the ETF: Enter the ticker or ETF name into the search bar to bring up the ETF's trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this ETF.

- Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.

10 of the best ETFs for beginners

Related investing topics

Let your ETFs do the hard work for you

It's important to keep in mind that ETFs are generally designed to be maintenance-free investments. Newer investors often have a tendency to check their portfolios excessively and make emotional, knee-jerk reactions to major market movements. In fact, the average fund investor significantly underperforms the market over time, and overtrading is the main reason.

So, once you buy shares of some great ETFs, the best plan is to leave them alone and let them do what they're intended to do: produce excellent investment growth over long periods of time.