You can gain exposure to Bitcoin (BTC +2.49%) right from a regular brokerage account-- no need for a cryptocurrency exchange or self-custody.

How? Through Bitcoin exchange-traded funds (ETFs), with one of the most notable examples being the ProShares Bitcoin Futures ETF (BITO -6.91%).

In this guide, we'll explain what BITO is, how it works, provide a step-by-step guide for buying the ETF, and weigh its pros and cons.

NYSEMKT: BITO

Key Data Points

What is BITO?

BITO is an open-ended investment fund that trades on an exchange under its own ticker symbol, allowing you to buy shares just like you would any other stock.

When you invest in BITO, your money goes into a portfolio made up of two main assets:

1. CME Bitcoin futures

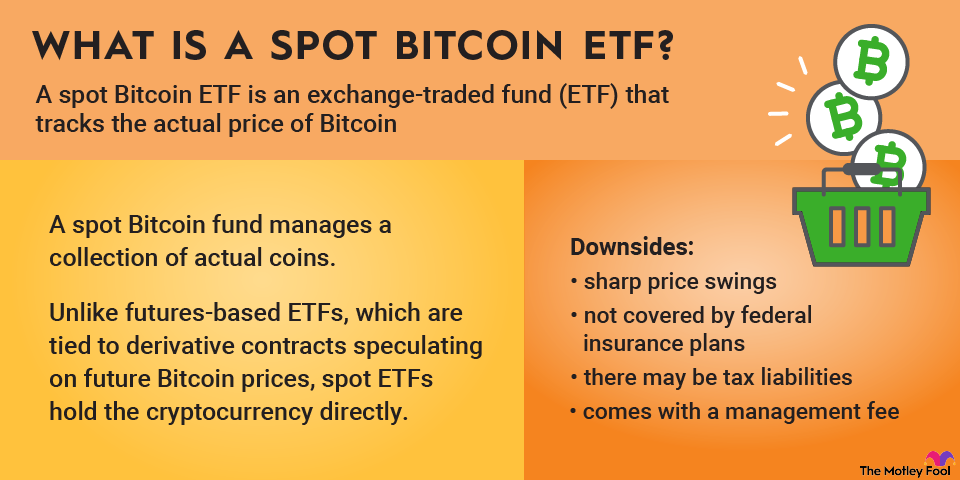

These are derivatives contracts that allow investors to speculate on or hedge against Bitcoin's future price movements. Instead of owning Bitcoin directly, BITO holds these futures contracts, which are used to mirror Bitcoin's performance as closely as possible.

2. Treasury bills

These short-term government securities are held as collateral to support the futures contracts. They provide a stable asset to back the fund's investments in more volatile Bitcoin futures.

The goal of BITO is to give you exposure to the risks and returns of Bitcoin futures, which aim to perform similarly to the spot Bitcoin price, though there may be slight differences.

Additionally, unlike holding Bitcoin directly, BITO pays a monthly distribution, primarily from the profits it earns managing Bitcoin futures contracts, but also the interest earned by its collateral.

This is because all exchange-traded funds (ETFs) and mutual funds registered under the Investment Company Act of 1940 are required to distribute most of their taxable income, including dividends and capital gains, by the end of each calendar year to avoid excise taxes.

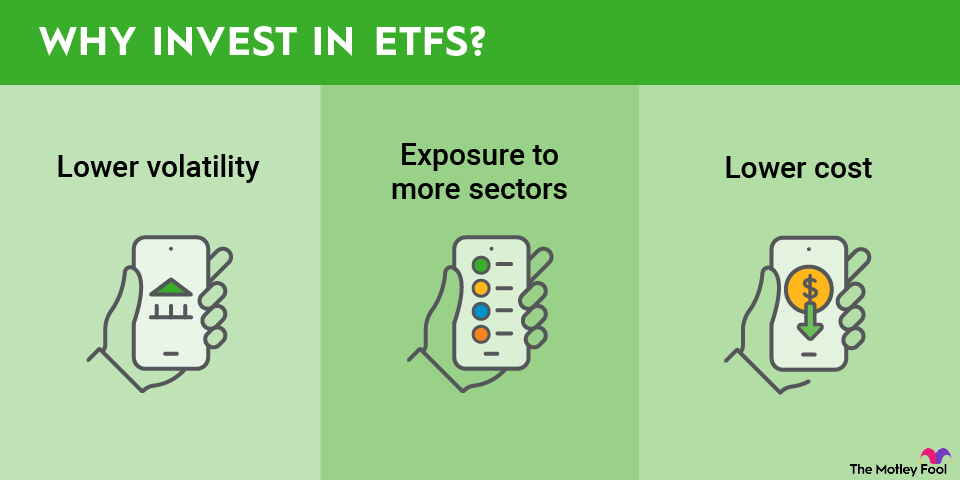

Exchange-Traded Fund (ETF)

Key facts about BITO

The ProShares Bitcoin Strategy ETF was the first Bitcoin-linked exchange-traded fund to debut in the U.S., launching on October 18, 2021, well before the approval of any spot Bitcoin ETFs.

BITO trades on the NYSE Arca exchange under the ticker symbol BITO and currently manages $2.43 billion in assets.

Unlike index-tracking funds, BITO is actively managed. This means its portfolio managers make discretionary decisions about how to roll over and manage Bitcoin futures contracts, rather than simply following a pre-set benchmark.

The ETF is highly liquid, with a 30-day median bid-ask spread of just 0.05%, making it easy to trade. It also has an active options market, offering investors the ability to buy and sell calls and puts on the fund.

How to buy BITO

For the most part, buying shares of BITO is similar to investing in most ETFs. Here's how to do it:

- Open a brokerage account. Make sure to choose a broker that offers ETF trading, and double-check to make sure they support cryptocurrency ETFs; not all brokers do.

- Figure out your investment. Based on your risk tolerance and financial objectives, determine how much you want to invest in BITO.

- Find the ETF. Search for "BITO" using the ticker symbol. Make sure you're selecting "shares" rather than "options."

- Enter your order. Specify the number of shares you want to buy and the price if you're placing a limit order.

Once your order is completed, your account will be debited the cash amount, and you'll be credited with shares of BITO.

Remember, to receive BITO's monthly distribution, you must hold shares of the ETF before and on the ex-dividend date, which is typically the first calendar day of each month.

Holdings of BITO

BITO's holdings are primarily composed of three types of assets:

1. Bitcoin futures

You might see an entry like " CME BITCOIN FUT DIGITAL ASSETS 25/JUL/2025 BTCN5 CURNCY." This refers to a futures contract tied to Bitcoin's price, set to expire on July 25, 2025. Futures contracts allow BITO to gain exposure to Bitcoin's price without directly holding the cryptocurrency.

2. Index swaps

An entry like "S&P CME BITCOIN FUTURES DAILY ROLL INDEX SWAP W/SG SOCIETE GENERALE" refers to a swap agreement where BITO exchanges returns based on the S&P CME Bitcoin Futures Daily Roll Index. This allows the fund to further replicate Bitcoin's price performance using derivative contracts with institutions like Société Générale.

3. Treasury bills

These are short-term government bonds used as collateral for the futures and swap positions. Treasury bills provide a stable, low-risk asset in the portfolio.

On the fund's webpage, you can find a daily updated table showing these holdings, including their percentage weights in the portfolio, the number of shares or contracts held, and their current notional value.

Should I invest in BITO?

BITO is best suited for an investor who:

- Wants exposure to Bitcoin futures prices.

- Prefers to avoid self-custody and cryptocurrency exchanges.

- Wants to invest using a regular brokerage account.

- Is comfortable with high volatility and complex derivatives.

- Seeks a crypto-linked product that pays monthly income.

If you meet most of these criteria, BITO could be a suitable investment for your portfolio.

Does BITO pay a dividend?

Yes, BITO pays a monthly distribution, typically with an ex-distribution date on the first trading day of the month, and the payment usually follows the next week.

For tax purposes, this distribution is generally categorized as a dividend, but it may also include capital gains. The payments come from the net income generated by its futures, swaps, and Treasury bills.

Due to the nature of BITO's holdings, its yield can fluctuate and is not consistent, varying from month to month. Historically, the yield has been high, averaging around 30% to 50%, but it's important to note that past performance may not indicate future results.

What is BITO's expense ratio?

BITO charges an expense ratio of 0.95%. For a $10,000 investment, this works out to around $95 in annual fees.

This fee covers the costs of managing the ETF, including the active management and the use of derivatives like futures and swaps.

You don't pay this fee directly; instead, it's deducted from the ETF's gross returns over time.

While 0.95% is considered high for an ETF, it's reasonable for BITO given its active management and complex strategy.

Expense Ratio

Historical performance of BITO

Here's a look at BITO's total returns over various time frames. However, because this ETF is relatively new with an inception date of Oct. 18, 2021, five- and 10-year performance data is unavailable.

Fund | 3 Month | 6 Month | 1 Year | 3 Year |

BITO (Market Price) | 22.33% | 3.74% | 44.97% | 41.34% |

BITO (NAV) | 22.24% | 3.60% | 44.67% | 41.20% |

Related investing topics

The bottom line on BITO

BITO offers an alternative way to gain exposure to Bitcoin without the need for self-custody or a cryptocurrency exchange. It primarily holds Bitcoin futures along with Treasury bills as collateral and pays a monthly dividend, often with a high yield.

However, it comes with high volatility due to its exposure to Bitcoin prices and a relatively high expense ratio. For investors seeking Bitcoin exposure within a traditional brokerage account and who are comfortable with these risks, BITO can be a suitable option.