Schwab U.S. Dividend Equity ETF (SCHD -0.07%) empowers anyone to invest in the wealth-creating capabilities of dividend stocks. Over the last 50 years, dividend payers have delivered a higher average annualized total return than the equal-weighted S&P 500 index (9.2% versus 7.7%), with less volatility than the broader market. Companies with a history of increasing their dividends have delivered even higher total returns (10.2% annualized).

NYSEMKT: SCHD

Key Data Points

This exchange-traded fund (ETF) focuses on companies with higher dividend yields and consistent records of dividend growth. The fund is an excellent option for investors seeking to generate passive income while also realizing some stock price appreciation as the underlying companies grow in value.

Exchange-Traded Fund (ETF)

Here's everything you need to know about investing in the Schwab U.S. Dividend Equity ETF.

What is the Schwab U.S. Dividend Equity ETF?

The Schwab U.S. Dividend Equity ETF enables you to invest in 100 of the best dividend-paying stocks through a single fund. The ETF aims to closely track the Dow Jones U.S. Dividend 100 Index. The index measures the performance of high-dividend-yielding stocks that trade in the U.S. These companies consistently pay dividends and have fundamentally stronger financial metrics than their peers.

How to buy the Schwab U.S. Dividend Equity ETF

Anyone with a brokerage account can buy the Schwab U.S. Dividend Equity ETF. The dividend-focused fund trades on a major stock exchange, allowing you to purchase shares even if you don't have an account with Charles Schwab (SCHW +0.04%). Here's a step-by-step guide to show you how to invest in the ETF:

- Open your brokerage app: Log in to your brokerage account where you handle your investments.

- Search for the stock: Enter the ticker or company name into the search bar to bring up the stock's trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this stock.

- Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.

Holdings of the Schwab U.S. Dividend Equity ETF

The Schwab U.S. Dividend Equity ETF is a passively managed fund that mirrors the holdings of the Dow Jones U.S. Dividend 100 Index. The index tracks roughly 100 dividend stocks known for consistently paying dividends backed by high-quality financial profiles. The Schwab U.S. Dividend Equity ETF had 103 holdings in mid-2025, led by:

- ConocoPhillips (COP -0.28%): 4.5% of the fund's holdings.

- Coca-Cola (KO -0.34%): 4.4%.

- Lockheed Martin (LMT -0.56%): 4.3%

- Verizon (VZ +0.40%): 4.2%.

- Altria (MO -0.55%): 4.2%.

The fund's top 10 holdings account for about 40% of its net assets. The ETF offers fairly broad diversification across stock market sectors:

- Energy: 21.1% of the portfolio's value

- Consumer Staples: 19.1%

- Health Care: 15.7%

- Industrials: 12.5%

- Financials: 8.4%

- Information Technology: 7.9%

- Consumer Discretionary: 7.9%

- Communication Services: 4.8%

- Materials: 2.8%

- Utilities: 0.04%

Should I invest in the Schwab U.S. Dividend Equity ETF?

Investing is a very personal venture. Not every stock or fund will be right for your situation. With that in mind, here are some reasons you might want to invest in the Schwab U.S. Dividend Equity ETF:

- You want to collect passive income.

- You'd like to earn a higher income yield than you can get from an S&P 500 index fund.

- You want to invest in a diversified portfolio of high-quality, higher-yielding dividend stocks.

- You don't want to be an active stock picker and manage a portfolio of dividend stocks.

- You're willing to exchange the potential for lower total returns for higher income and less volatility.

On the other hand, here are some reasons the Schwab U.S. Dividend Equity ETF might not be the best ETF to buy for you:

- You're seeking a more growth-focused investment.

- You want a fixed income stream.

- You want an even higher income yield.

- You'd prefer to invest directly in dividend stocks.

- You already own a lot of dividend stocks.

Does the Schwab U.S. Dividend Equity ETF pay a dividend?

The Schwab U.S. Dividend Equity ETF pays a dividend. In mid-2025, the fund had a trailing-12-month dividend yield of 3.7%, more than double the S&P 500's dividend yield of around 1.3%. The higher dividend yield enables investors to collect more dividend income each year, providing them with a higher base return.

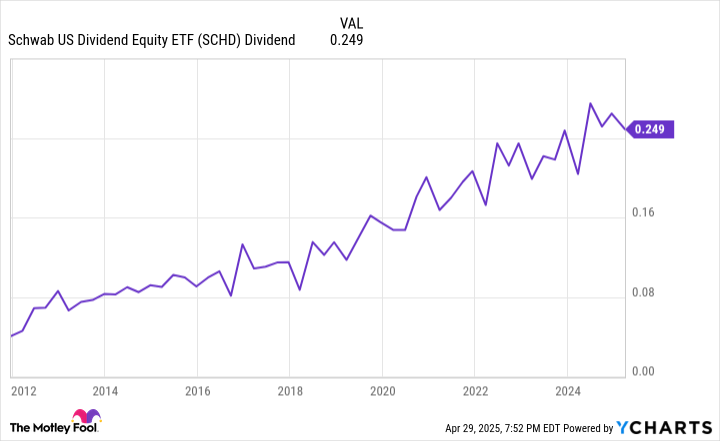

The fund distributes dividend income to investors each quarter. The payments rise and fall based on the dividend income generated by the fund's portfolio, less its expense ratio. While the payments tend to fluctuate from quarter to quarter, they have steadily risen over the years as the companies in the fund have increased their dividends:

What is the Schwab U.S. Dividend Equity ETF's expense ratio?

ETF sponsors like Schwab charge fees known as expense ratios to manage funds on behalf of their investors. The Schwab U.S. Dividend Equity ETF has a 0.06% ETF expense ratio. That's a very low expense ratio for a passively managed ETF; the industry average is about 0.16%.

ETF Expense Ratio

For example, a $10,000 investment in the Schwab U.S. Dividend Equity ETF would incur $6 in management fees each year, about $10 less than other passively managed funds. The fund's lower expense ratio enables investors to keep more of the dividend income generated by the ETF's holdings. Although it might not seem like much at first, it adds up over time.

Historical performance of the Schwab U.S. Dividend Equity ETF

Dividend stocks tend to deliver solid returns over the long term. That has certainly been the case for the Schwab U.S. Dividend Equity ETF over the years:

Fund | 1-Year | 3-Year | 5-Year | 10-Year |

|---|---|---|---|---|

Schwab U.S. Dividend

Equity ETF | 8.04% | 5.90% | 17.32% | 11.44% |

Benchmark

(Large-Cap Value) | 6.62% | 6.86% | 16.55% | 8.91% |

As the table shows, the fund has outperformed its benchmark over the past five- and 10-year periods. However, while it has outperformed its benchmark, the fund has underperformed compared to the S&P 500 during the past decade (12.1%).

Even though the fund has lagged behind the broader market, it provides investors with more income and lower-volatility returns. Those features can make it a solid option for investors seeking an income-focused fund that can still put up good total returns.

Related investing topics

The bottom line on Schwab U.S. Dividend Equity ETF

The Schwab U.S. Dividend Equity ETF makes investing in high-quality dividend stocks easy. The fund owns shares of 100 companies known for their ability to pay above-average and steadily rising dividends. It can provide an instantly diversified portfolio of high-quality dividend stocks that can be a core holding of any investment portfolio.