The greatest investors have long track records of generating market-crushing returns over their investing careers. Their successes, in turn, enrich the investors who entrust them with their money. Their uncanny ability to create wealth is what makes them famous.

Here's a closer look at some of the most well-known investors in the world:

1. Warren Buffett

Warren Buffett might be the most well-known investor. His rise to fame began in 1965, when he acquired struggling textile maker Berkshire Hathaway (BRK.A +1.02%)(BRK.B +0.92%) and used it as a vehicle to build a vast investment empire. Today, Berkshire is a global conglomerate with stakes in iconic companies like GEICO, Dairy Queen, Coca-Cola (KO -0.49%), and Apple (AAPL +1.59%).

Buffett is best known for his disciplined value investing approach, which he learned from Benjamin Graham. He buys strong, well-managed companies at fair prices and holds them for the long term. Buffett's philosophy emphasizes patience, simplicity, and deep fundamental analysis, inspiring generations of investors.

Despite his multibillion-dollar net worth, Buffett is famously humble. He still lives in the modest Omaha home he purchased in 1958 and has pledged to give away 99% of his wealth through efforts like The Giving Pledge.

His legacy? A timeless blueprint for investing wisely -- and living with purpose.

2. Benjamin Graham

Benjamin Graham was an investing pioneer. He invented the concept of value investing in the 1920s -- an approach that prioritizes buying stocks priced below their intrinsic values. Graham wrote two of the most famous books on investing, Securities Analysis with David Dodd and The Intelligent Investor. Graham's legacy is the formative role he played in shaping Warren Buffett's investing strategy and his ascent as a leading value investor.

3. Carl Icahn

Carl Icahn is an activist investor who acquires significant stakes in public companies to force changes that he believes will increase shareholder value. In the late 1970s and early 1980s, Icahn developed a reputation for being a "corporate raider" -- someone who engineers hostile takeovers of companies and then slashes costs and sells assets to boost the value of the shares.

Icahn focuses his activism on companies that he believes are undervalued due to mismanagement, and he often seeks to force changes related to a company's leadership team and its governance. While Icahn's "corporate raider" approach may seem callous, he aims to hold management teams accountable as good stewards of shareholder capital.

4. John Templeton

John Templeton is considered one of the best contrarian investors. During the Great Depression, he famously bought 100 shares of each company listed on the New York Stock Exchange that traded for less than $1. That simple, bold wager made him a very wealthy man. He founded his flagship mutual fund, the Templeton Growth Fund (TEPL.X +1.34%), in 1954 and produced annualized returns exceeding 15% over 38 years. He also pioneered international investing, having established some of the largest and most successful cross-border investment funds. He eventually sold his firm, Templeton Funds, to the Franklin Group, which is now Franklin Resources (BEN +1.61%). His investing approach has demonstrated that being contrarian during periods of severe market turmoil can really pay off over the long term.

5. Peter Lynch

Peter Lynch made a name for himself as an investor by managing the Fidelity Magellan Fund (FMAGX +0.46%), a mutual fund sponsored by Fidelity Investments. Between 1977 and 1990, Lynch increased the fund's assets under management from $20 million to more than $14 billion. The Fidelity Magellan Fund outperformed the S&P 500 in 11 years of his 13-year tenure, producing an average annual return of 29%.

Lynch has authored several classic books on investing, including One Up on Wall Street, Beating the Street, and Learn to Earn (with the latter co-authored with John Rothchild). Lynch's work contains many invaluable investing tips. He has made a lasting impact on investors by showing that anyone can be a good investor by focusing on simple principles.

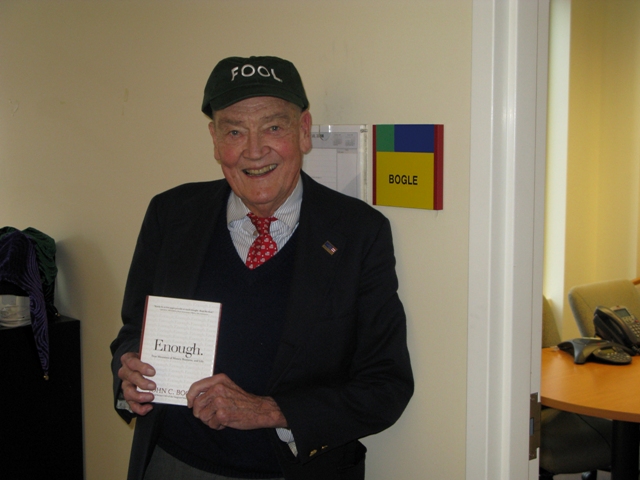

6. John (Jack) Bogle

Jack Bogle founded the Vanguard Group in 1975. He pioneered the no-load mutual fund, which, by eliminating reliance on third-party brokerages, doesn't charge a sales commission. He also created the first low-cost index fund, called the Vanguard 500, which aimed to match the S&P 500's performance in exchange for only a minimal fee. His approach, which has gained popularity with the rise of exchange-traded funds (ETFs), enables investors to capture returns aligned with the broader market without incurring excessive fees. Bogle has left a lasting legacy on the investment sector by significantly lowering costs for the average investor.

7. Israel "Izzy" Englander

Israel "Izzy" Englander is the founder, chairman, and CEO of New York-based hedge fund Millennium Management. The fund is a very active trader and employs many advanced strategies, such as merger arbitrage, convertible arbitrage, and long-short investing. Englander's investing approach is to make small bets that diversify risk so that no single investment can significantly affect returns. His strategy has been very successful, with Millennium averaging a 14% annual return since its founding in 1989. Englander's strategy is a good reminder to investors of the importance of diversification for reducing risk.

8. George Soros

George Soros founded the hedge fund company Soros Fund Management in 1973, which later became the Quantum Fund. He's an aggressive and highly successful hedge fund manager who consistently generates annual portfolio returns of more than 30%, with the gains for two of those years exceeding 100%. Soros nets spectacular gains by making massive directional short-term bets on currencies and securities, including stocks and bonds.

9. Ken Griffin

Ken Griffin is the founder and CEO of hedge fund Citadel. He also owns Citadel Securities, one of the country's largest market makers. Griffin has helped build Citadel into one of the world's most profitable hedge funds, making Griffin a very wealthy man. Griffin has been using his vast wealth to transform lives by donating more than $2 billion toward education, opportunity, and health science causes.

10. Stanley Druckenmiller

Stanley Druckenmiller is the founder of Duquesne Capital, a hedge fund he ran from its founding in 1981 until its closure in 2010. He was also the lead portfolio manager for George Soros' Quantum Fund from 1988 through 2000. Druckenmiller is a top-down investor, focusing first on the macroeconomic environment to identify sectors to invest in before identifying individual stocks to buy. That strategy led to some very successful bets for Druckenmiller at Duquesne and the Quantum Fund, including one that made $1 billion on a trade to short the British pound sterling in 1992.

11. Cathie Wood

Cathie Wood is the founder, CEO, and chief investment officer of Ark Invest, an investment management company that establishes and actively manages a portfolio of ETFs. One of the firm's top ETFs, the ARK Innovation ETF (ARKK +4.69%), has produced a 275% gain since its inception (13% annualized). Investing in innovation is at the heart of Ark's strategy. Wood is always looking to find "the next big thing" because companies delivering disruptive innovation have the potential to produce the highest returns over the long term.

12. David and Tom Gardner

We would be remiss if we did not give an honorable mention to David Gardner and Tom Gardner, who cofounded the multimedia financial services company The Motley Fool in 1993 to help people achieve financial freedom. Since launching their flagship Stock Advisor service in February 2002, the Gardner brothers have delivered a 1,067% total return to their subscribers through September 10, 2025 -- vastly outperforming the S&P 500's 186% gain during that time period. The Gardner brothers recommend stocks to subscribers and invest in those same stocks themselves. They founded The Motley Fool to help anyone build wealth through the stock market.

Other famous investors

The above list is not exhaustive. Many other investors have earned name recognition for their ability to deliver market-beating returns year after year. For example, while Warren Buffett and John Templeton are some of the most famous value or contrarian investors, Jim Rogers, Marc Faber, and others have also earned reputations for their value investing success. Several investors, including Thomas Rowe Price Jr. and Phillip Fisher, have made names for themselves by successfully investing in growth stocks, and both are considered "fathers" of growth investing.

Not all famous investors earned their public image by creating wealth via the stock market. Billionaire real estate investors Sam Zell and Stephen Ross are famous for their ability to profit from real estate investments. Meanwhile, Bill Gross -- dubbed the "King of Bonds" -- eschewed the stock market in favor of bond investing.

Related investing articles

What do most famous investors have in common?

As this list shows, anyone can be a highly successful investor. However, one of the keys to success for the most famous investors is that they have a long-term mindset. Anyone can have a down year, which has been the case for many famous investors in the past. However, the key to being successful is to press through the challenging times.

It’s during challenging times that the best investors are buying so that they don’t miss the eventual recovery. Many made their best returns by investing through a turbulent period.

Another characteristic that famous investors share is their focus on and mastery of one specific approach to investing. Whether it's identifying value stocks, growth stocks, or pushing for change as an influential activist, these famous investors earn outsized returns by leveraging their deep investment knowledge and staying focused on the strategies that delivered consistent profitability.