As one of the world's top software companies, Adobe (ADBE +0.16%) offers a range of products for commercial and personal use, including web design tools, audio and video editing software, animation software, document management software, and photo editing tools. Adobe is known for solutions such as Adobe Creative Cloud, which includes tools like Illustrator and Photoshop.

NASDAQ: ADBE

Key Data Points

If you're interested in scooping up a few shares of Adobe yourself, you've come to the right place. If you want to know how to buy Adobe stock, whether the stock might be a good use of your investment capital, whether the company is profitable, and much more, read on.

Stock

How to buy Adobe stock

Adobe is publicly traded, so the process of buying its stock is much like it would be for any other company trading on a U.S. stock exchange. Here is a step-by-step guide on how to buy Adobe stock.

- Open your brokerage app: Log in to your brokerage account where you handle your investments.

- Search for the stock: Enter the ticker or company name into the search bar to bring up the stock's trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this stock.

- Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.

Should I invest in Adobe?

Whether you should invest in Adobe or not will depend on your investing style. If you favor growth-oriented software businesses, Adobe could be a good addition to your portfolio. If you're looking for a less volatile business or prefer value-oriented or income stocks, you might want to consider a modest position or look elsewhere.

For investors considering a position in Adobe, there's a lot to like about this storied business and where it's going. The company has capitalized on the AI boom by rapidly integrating generative AI into its various media-centric tools, like Photoshop and Premiere Pro.

Adobe has long been at the forefront of innovation in its industry. It was one of the first to adopt the subscription-based software-as-a-service model rather than charging customers one-time fees for software usage.

Subscriptions make up the bulk of the company's overall revenue. Subscription revenue is derived mostly from recurring fees that individual and enterprise customers pay to access solutions such as Document Cloud, Adobe Experience Cloud, and Creative Cloud.

The small remainder of Adobe's revenue is derived from products revenue, as well as services and other revenue. Products revenue includes sources such as licensing fees for software, while services and other revenue include fees for solutions, including training, maintenance, support, and consulting offered to Adobe customers.

If you want to buy Adobe stock, you should know that the software company has a robust balance sheet with a steady history of revenue growth and positive cash flows. In Adobe's fiscal year 2024, the company demonstrated strong financial performance with record revenue and positive growth across its key business segments.

Adobe's revenue reached $21.51 billion, an 11% year-over-year increase, and the company generated $8.06 billion in operating cash flow in the 12-month period.

Is Adobe profitable?

Throughout its history, Adobe has experienced fluctuating profitability according to generally accepted accounting principles (GAAP), but it's consistently delivered on the bottom line in recent financial reports. In fiscal 2024, Adobe's diluted earnings per share were $12.36 (GAAP) and $18.42 (non-GAAP). GAAP net income was $5.56 billion.

Does Adobe pay a dividend?

Adobe does not pay a dividend, and management has not indicated any plans to initiate one. The company paid a dividend starting in 1989 but discontinued it in 2005.

Many tech stocks, such as Microsoft (MSFT +0.24%) and Apple, pay dividends, although yields are quite low compared to the average stock trading on the S&P 500. Often, investors seek returns from growth-oriented software stocks primarily through share price appreciation and share buybacks, and Adobe is no exception.

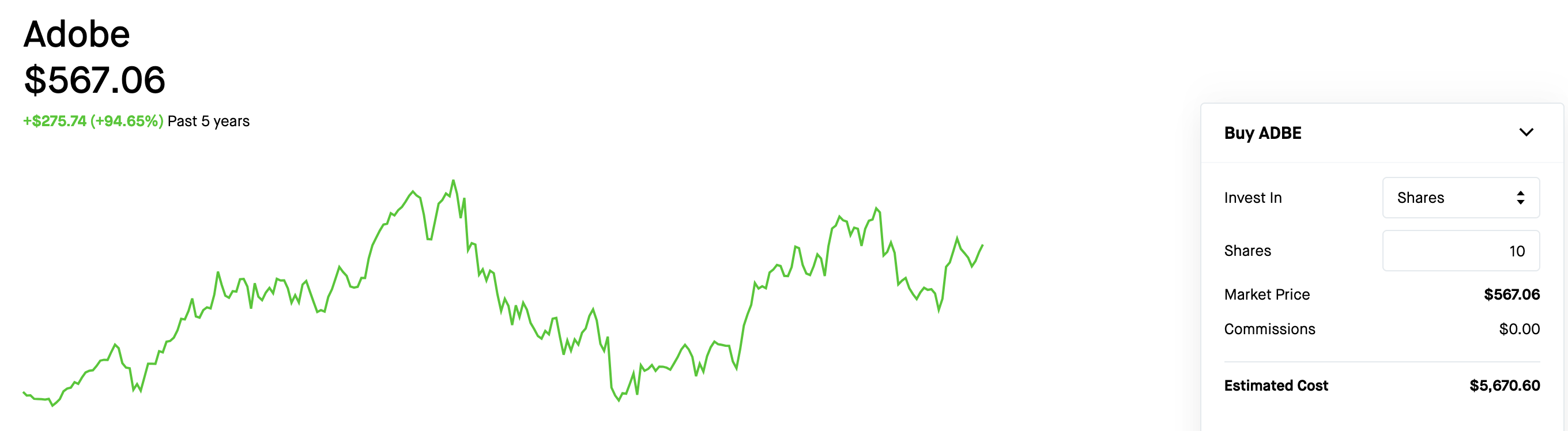

In addition to Adobe's solid share price performance over the last several years despite persistent volatility, the company regularly repurchases shares from investors. In March 2024, management authorized a $25 billion stock repurchase program, which is scheduled to continue until 2028.

Buybacks not only achieve a near-term share price increase but also decrease the number of outstanding shares. Share buybacks also enable a tax-favorable means of bolstering investor returns while also boosting a company's earnings per share.

ETFs with exposure to Adobe

Instead of buying Adobe shares directly, you can also opt to purchase shares through an exchange-traded fund (ETF). By investing in an ETF, you can gain exposure to a wide variety of companies, including Adobe, which provides instant diversification to your portfolio.

A few examples include the SPDR S&P 500 ETF Trust (SPY +0.37%), the iShares Core S&P 500 ETF (IVV +0.35%), and the Invesco QQQ Trust, Series 1 ETF (QQQ +0.29%).

Index funds, which seek to track the performance of a particular index, can also be a great way to invest in a basket of companies simultaneously. Index funds with exposure to Adobe include the Vanguard Total Stock Market Index Fund (VTI +0.34%), the Vanguard S&P 500 Index Fund (VOO +0.33%), and the Fidelity Concord Street Trust - Fidelity 500 Index Fund (FXAIX +0.65%).

Will Adobe stock split?

Adobe has split six times in its company history. All were 2-for-1 stock splits. The first five splits occurred in March 1987, November 1988, August 1993, October 1999, and October 2000. Adobe's most recent split occurred in May 2005.

Related investing topics

The bottom line on Adobe

Adobe has plenty of attractive qualities that one hopes to see in a software stock. The company is growing its revenue steadily, with most of its revenue being recurring, and the business is consistently profitable. Its cash position is also shored up, and its broad global footprint in a competitive industry signals well for future growth.

While growth-oriented businesses like Adobe can be more vulnerable to changing spending patterns among larger enterprise customers when macro conditions tighten, the company still looks well positioned over the next five to 10 years.

Investors may find that this company looks like an attractive option for betting on the future of AI in software-as-a-service stocks, as well as for becoming part-owner of a trailblazing software business that has been around for more than 40 years and counting.