Comcast (CMCSA +3.69%) is one of the largest communications and media companies in the U.S., combining a dominant broadband business with NBCUniversal’s film, TV, streaming, and theme parks. That mix makes Comcast a rare hybrid: part infrastructure provider, part entertainment powerhouse.

If you’re looking for an investment that offers steady cash flow from broadband along with long-term upside from streaming and content, Comcast deserves a closer look. Here’s how the company works, how to buy its stock, and what to consider before investing.

About Comcast

Comcast began in 1963 as a small cable provider and steadily expanded through acquisitions and new network build-outs. The company went public in 1972, and over the decades it grew from a regional cable operator into a national broadband provider and global media company.

Today, Comcast’s operations fall into two broad segments:

Connectivity & Platforms (Comcast Cable)

- High-speed broadband

- Wireless services (Xfinity Mobile)

- Traditional pay TV (declining but still meaningful)

Broadband is Comcast’s engine today, delivering stable, recurring revenue.

Content & Experiences (NBCUniversal)

- NBC network and cable channels

- Universal Pictures

- Peacock streaming service

- Universal theme parks (Orlando, Los Angeles, Osaka, Beijing, with more on the way)

This mix gives Comcast built-in diversification across industries that don’t always move in the same direction.

Comcast has two classes of shares:

- Publicly traded Class A shares (CMCSA)

- Non-traded Class B shares, controlled by CEO Brian Roberts, which carry disproportionate voting power

Only Class A shares are available to everyday investors.

How to buy Comcast stock

Investing in Comcast stock is as simple as buying any other stock on the public market.

- Open your brokerage app: Log in to your brokerage account where you handle your investments. If you don't have one yet, take a look at our favorite brokers and trading platforms to find the right one for you.

- Fund your account: Transfer money so you’re ready to invest.

- Search for Comcast: Enter the ticker "CMCSA" into the search bar to bring up the stock's trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this stock.

- Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.

Should you invest in Comcast?

Evaluating Comcast requires looking at two competitive landscapes at once.

On the media side, Comcast’s NBCUniversal segment competes with major players like Walt Disney (DIS +0.73%), Paramount Global (NASDAQ:PARA), Warner Bros. Discovery (WBD -1.35%), Sony (SONY -0.71%), and Amazon (AMZN -0.49%). Success depends heavily on content quality, streaming performance, and film slates.

On the connectivity side, Comcast faces AT&T (T -0.54%), Charter Communications (CHTR +0.01%), and Verizon (VZ -0.01%). Here, customer retention, network upgrades, and pricing strategy matter most.

Investors often appreciate Comcast’s diversification -- weakness in one division can be offset by strength in the other. However, that same diversification means investors must monitor a broad range of industry trends.

It’s helpful to compare Comcast directly with its rivals. Sometimes the better investment isn’t Comcast at all -- it might be a competitor with stronger growth, a more attractive valuation, or clearer long-term momentum.

NASDAQ: CMCSA

Key Data Points

Is Comcast profitable?

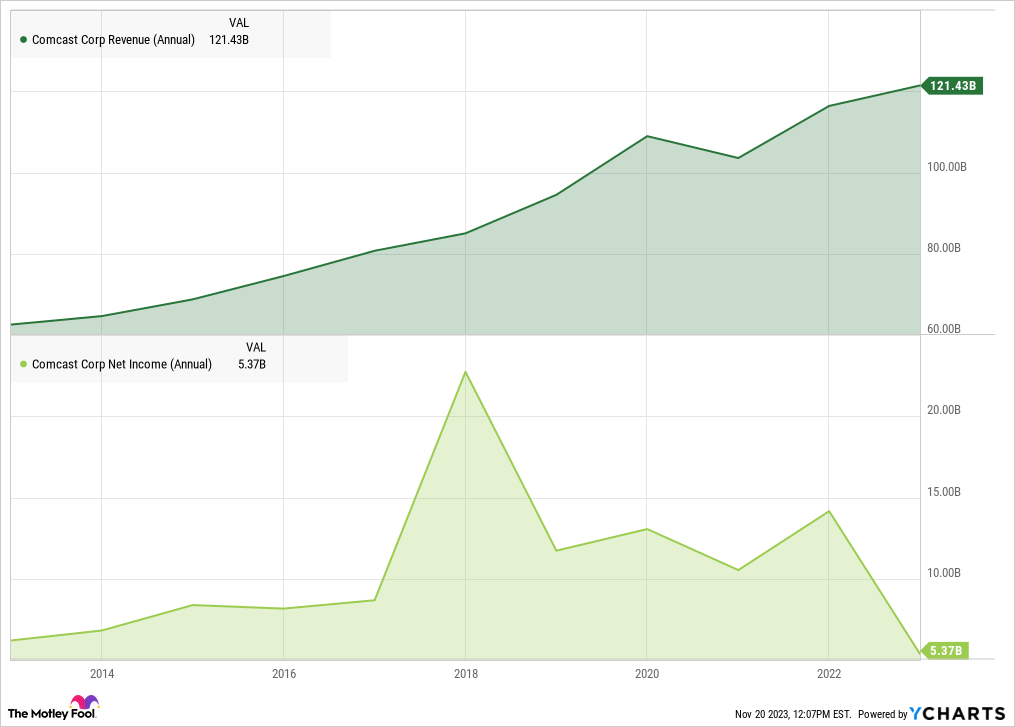

Comcast's financial track record has been robust over time, and the company is an effective cash machine. In fiscal year 2024, the company reported revenue of $121.9 billion, generating $15.9 billion in net income and $13.9 billion in free cash flow.

These cash flows support ongoing investments in network upgrades, streaming expansion, theme park development, and shareholder returns.

Does Comcast pay a dividend?

Comcast is a consistent dividend payer. In 2024, it returned $5.1 billion in dividends to shareholders, with yields often landing in the 3–3.5% range depending on the stock price.

The company also buys back its own shares at a meaningful pace. Share repurchases totaled $9.1 billion in 2024, and Comcast has increased its annual dividend every year since 2009.

How to invest in Comcast through ETFs

As a market-leading U.S. company, Comcast is an active component of many stock market indexes, including the broad market-tracking S&P 500 (^GSPC -0.75%) index.

This stock's impact on the value and overall performance of these funds varies with its weighting in each fund, and Comcast's performance makes a larger difference to the returns of smaller ETFs with an outsize Comcast investment.

Here are a few ETFs where Comcast stock accounted for a significant ownership stake in June 2025, either by dollar amounts or in terms of Comcast's weighting of the fund's total assets:

Exchange-Traded Fund | Number of Comcast Shares | ETF Net Asset Value | % of NVA in Comcast Stock |

|---|---|---|---|

Invesco QQQ TRUST (NYSEMKT:QQQ) | 77.7 million | $334 billion | 0.8% |

SPDR S&P 500 ETF TRUST (NYSEMKT:SPY) | 45.5 million | $604 billion | 0.3% |

Communication Services Select Sector SPDR Fund (NYSEMKT:XLC) | 26.1 million | $21.9 billion | 4.0% |

iShares U.S. Telecommunications ETF (NYSEMKT:IYZ) | 0.46 million | $0.38 billion | 4.2% |

Will Comcast's stock split?

Comcast has split its stock multiple times since the 1980s, but its most recent split was in 2017.

Given that CMCSA has traded mostly in the $30–$50 range for several years, another split seems unlikely unless the stock appreciates significantly.

The bottom line

This stock's investment potential depends on its leading role in the media and communications markets. The Peacock service needs a steady flow of high-quality exclusive content, and these stories also provide fodder for future theme park additions.

So, great content forms the foundation of Comcast's NBCUniversal operations. On the connectivity side, Comcast seeks a perfect balance between consumer-pleasing products and services, affordable network upgrades, and appropriate pricing levels.

Both divisions face fierce competition and regulatory challenges. A reasonable hurdle for Comcast may be more than smaller or younger companies can handle. A harsh market presents both problems and opportunities for a market sector leader like Comcast.

The theme parks under development and the burgeoning Peacock service are key to Comcast's near-term growth. The old-school cable network is transitioning to a fiber-optic infrastructure, which adds heavy capital expenses but also prepares Comcast for next-generation internet services.